It is January 2024, a time for resolutions, and creating and implementing strategies both professionally and personally. I look forward to the first week of January as contract data includes the Defense contracts that are subjected to the 90-day delay before they are made public on FPDS.gov.

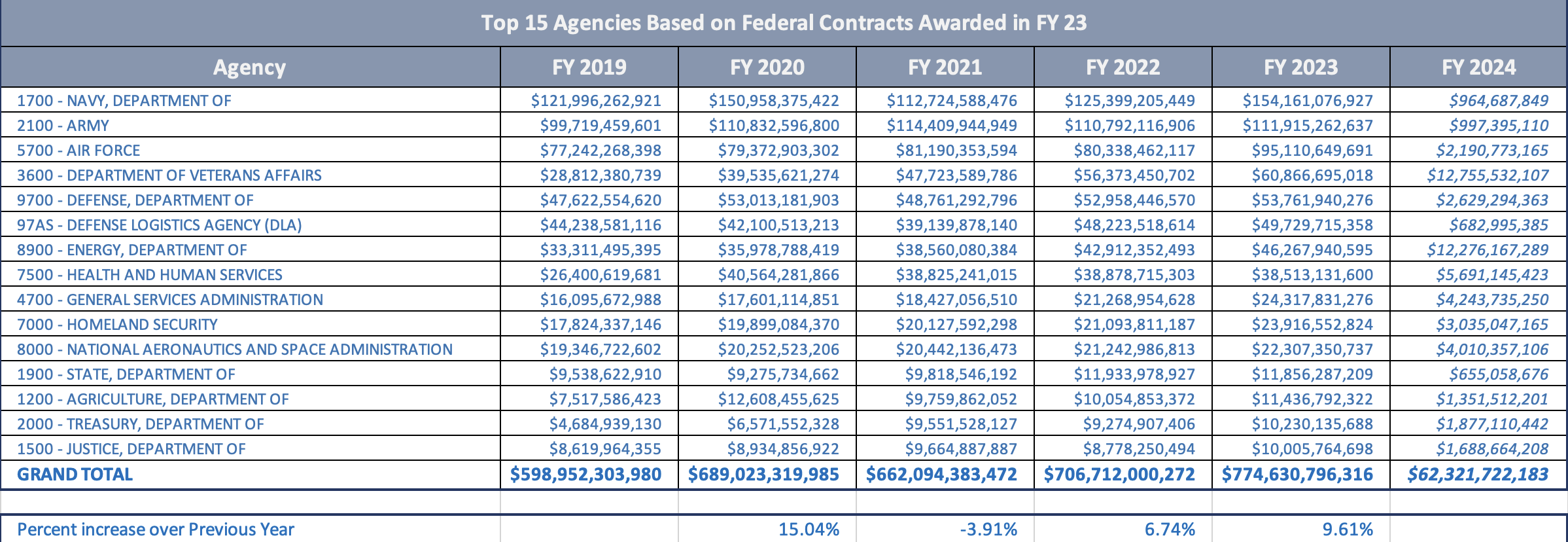

According to the Congressional Budget Office (CBO), the fiscal year 2023 witnessed a decrease of 2% in total federal outlays compared to the previous fiscal year, settling at $6.1 trillion. However, federal contracts reached an unprecedented milestone, reaching $774.6 billion in FY 23. While it comes as no surprise that defense agencies dominate the list of top spenders, it’s worth noting that the Department of Veterans Affairs, Energy, Health and Human Services, and Homeland Security also secure spots among the top ten agencies for FY 23.

Fedmine’s analysis of FPDS data as of 1/8/24

Top Companies include Lockheed, Optum, ElectricBoat, McKesson, and Raytheon. For the full report on the FY 23 spending click here. In terms of set-asides:

- $46.5B was awarded as small business set-aside

- $21.5B was awarded as set-asides as 8(a) sole source and competed

- $13.2B was awarded as set-asides to service-disabled veteran-owned businesses

- $1.54B was awarded as HUBZone set-asides

- $1.5B was awarded as WOSB set-asides

Personally, I would love to see the set-asides for HUBZone and WOSB increase! Delving deeper into the spending, 61% of the total federal contracts for FY 23 were awarded by defense agencies – i.e. $471.6B was awarded to 48, 503 companies.

Federal Contracting in FY 23

Small Businesses

It is crucial to delve into the insights provided by federal contract awards, particularly concerning small businesses, as well as the allocation of contracts and numerous other factors that shape the federal contract landscape.

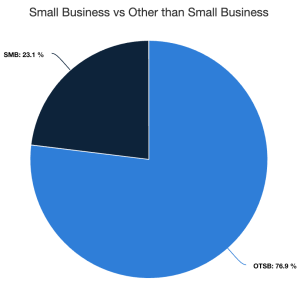

In the fiscal year 2023, $171.48 billion was awarded to 79,046 companies as Small Business Contracts, accounting for an impressive 23.1% of the total awards. Top Agencies include defense agencies such as the Army, DLA, Navy, Air Force, and DoD. We also see the VA, Health & Human Services as also the Dept. of Agriculture and Homeland Security.

Top companies winning contracts as small businesses are Atlantic Diving and Noble Supply & Logistics. It is also important to note that FCN, a Women-Owned Business makes the list of top small businesses as do the following veteran-owned businesses Thundercat Technology, MinBurn Technology, Four Points Technology, and V3Gate LLC. The full report on contracts awarded as small businesses can be found here.

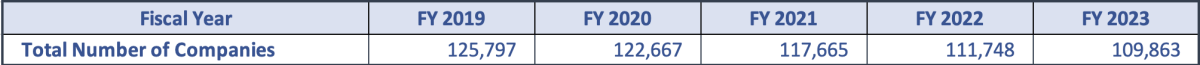

While the contracts awarded have increased, the number of companies that are winning the contracts continues its downward trend. FY 23 saw the number of companies at 109,863 – a drop of more than 12% from FY 19.

First Timers

The number of companies winning contracts for the First Timers has shown a promising increase in FY 23, with 11,822 companies securing contracts compared to 10,955 companies in FY 22. This upward trend raises the question: will this positive momentum continue in the future?

Product Categories

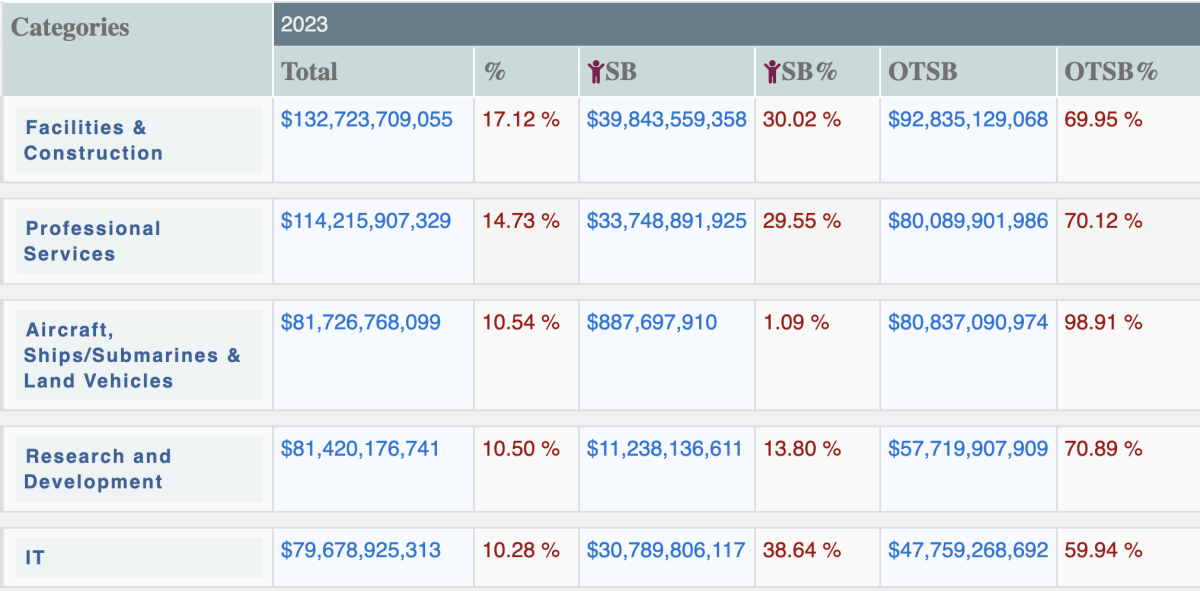

In terms of the product categories no surprise to see Facilities & Construction and Professional Services in the top categories.

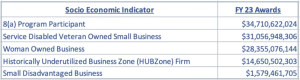

Socio-Economic Categories

Small businesses play a crucial role in our economy, so it’s important to take a closer look at the contracts they receive specifically based on the socio-economic categories. It’s always encouraging to see awards going to veteran-owned and women-owned businesses. However, when we consider these numbers as a percentage of the total, they appear quite small in comparison.

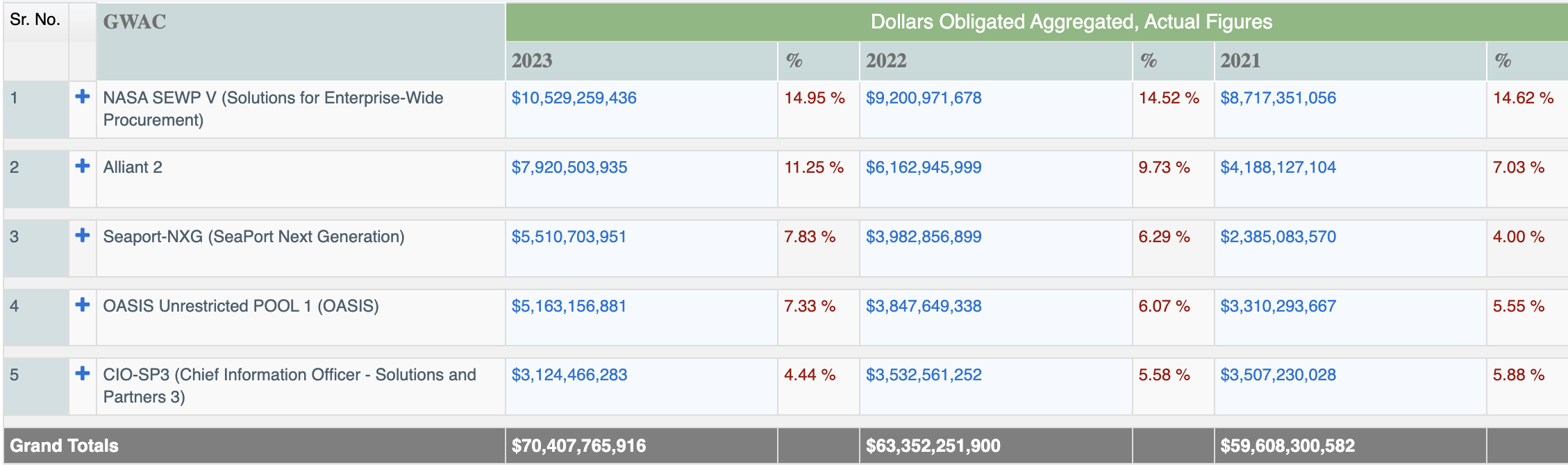

IDIQ and GWACs

I also think it is important for us to understand the contracts awarded on IDIQs and GWACs. In FY 23 approx. 9% of the total contracts were awarded on these vehicles, an increase of 10% over FY 22 awards.

No surprise that SEWP V and CIO SP3 are in the top five vehicles. (Note that these vehicles are in various stages of recompete and award)

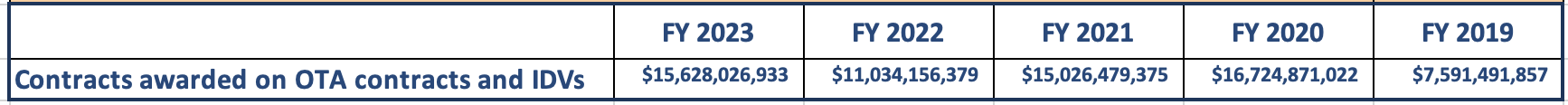

Other Transaction Authorities

Over the past years, we have increasingly seen the use of innovative contract vehicles, one of which is Other Transaction Authority or OTAs as they are commonly referred to. Typically used for certain prototypes, research, and production projects they provide the agencies the flexibility to work with companies on innovative transactions. In FY 23 $15.6B in awards were done as OTAs, i.e. 2% of the total contract awards.

We also need to consider the awards that are done as Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR). These programs provide funding to small businesses for innovative technologies. In FY 23 $6.09B was awarded as SBIRs/STTRs, an increase of 8.5% over the FY 22 spending of $5.6B. A couple of months ago we were able to identify the contracts that were awarded under the Infrastructure Investment and Jobs Act (IIJA). In FY 23 $32B of the contracts were funded under the IIJA.

So what will FY 24 bring us? Will we reach the contracts awarded in FY 23? We are currently on a continuing resolution which ends on January 19th, 2024. However, Congress is reaching an agreement for funding for FY 24 and it will be interesting to see how various agencies and projects are funded.

The federal government is placing a strong emphasis on Artificial Intelligence (AI), recognizing its significance in today’s world. In October 2023, the White House issued an executive order and unveiled a groundbreaking AI Bill of Rights. As technology continues to advance rapidly, the government is actively exploring commercially available technologies. Furthermore, the National Defense Authorization Act (NDAA) for Fiscal Year 24 introduces pivotal changes that will impact federal contracting, specifically regarding technology. I do see an increase in OTAs and SBIRs/STTRs.

In terms of dollars awarded to small businesses, the goal for SDVOSBs is increased to 5%, which is a welcome change. It is encouraging to see the number of first-timers increase and I hope that this trend continues. With a lot of changes and initiatives specifically for small and disadvantaged businesses, I hope to see an increase in small business dollars and us meeting our socio-economic goals.

As always, if you have any questions feel free to reach out directly to me – at amehan@govspend.com