Were you aware that in FY 23, a substantial $6.23B, accounting for 8% of total federal contracts, was allocated to Small Business Innovation Research (SBIRs) and Small Business Technology Transfers (STTRs), benefiting 3,230 businesses? Noteworthy companies like Qualcomm, Symantec, Sonicare, and Biogen have all been recipients of SBIR funding in the past Intrigued to delve deeper into these innovative programs?

So what are SBIRs and STTRs?

The SBIR program is a highly competitive program that propels domestic small businesses into federal research and development ventures with promising commercialization potential. The programs aim to stimulate high-tech innovation, foster entrepreneurial spirit, and address specific research and development requirements.

The STTR program, on the other hand, requires a partnership between small businesses and nonprofit research institutes, serving as a bridge between the performance of basic science and the successful commercialization of resulting innovations.

Both programs are focused on meeting their stated mission, namely to:

- Stimulate innovation

- Meet federal research and development needs

- Foster participation in innovation and entrepreneurship by women and other socially disadvantaged businesses

- Increase private sector commercialization of innovation derived from federal R&D

Additionally, the STTR program aims to foster technology transfer through cooperative R&D between small businesses and research institutions.

Established in 1982 the program has been reauthorized and extended multiple times. The last extension in FY 22 extended the program through September 30th, 2025, and showcased the federal government’s enduring commitment to fostering innovation and entrepreneurial advancement. The US Small Business Administration (US SBA) directs the implementation of the program and reports annually to Congress on its operation.

Participating Agencies

It’s worth noting that participating agencies are mandated to allocate 3.2% to the SBIR program if their extramural research and development budgets exceed $100M. Moreover, agencies with an extramural R&D budget surpassing $1 billion must reserve 0.45% for the STTR program. Each agency independently manages its program, contributing to a diverse landscape of R&D and innovation initiatives.

The Three Phases of SBIR/STTR

The Programs are structured in three phases, with Phase I being the exploratory phase and Phase III being the commercialization phase.

For more information on SBIRs visit sbir.gov

Contracts Awarded Under SBIRs/STTRs

Let’s delve into the contracts awarded through these programs. It’s important to note that SBIRs can also be awarded through grants. For this blog, I will be focusing on contracts awarded by funding agencies rather than contracting agencies.

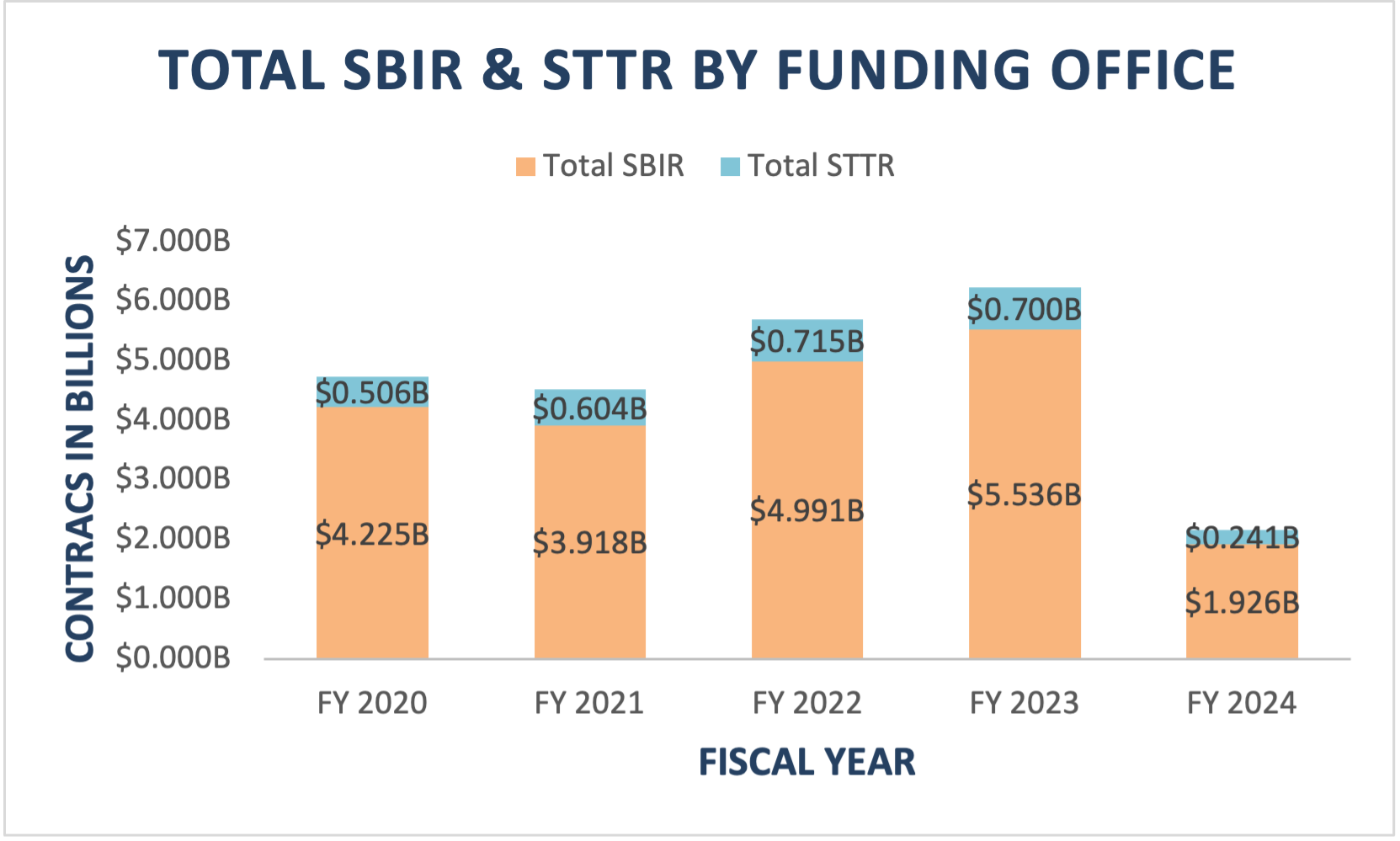

Over the years, we’ve witnessed a 31% increase in spending on SBIRs & STTRs, rising from $4.7B in FY 20 to $6.3B in FY 23. STTR funding has consistently accounted for an average of 12% of the total SBIR/STTR expenditure during this period.

| FY 2020 | FY 2021 | FY 2022 | FY 2023 | FY 2024 | |

|---|---|---|---|---|---|

| Total SBIR & STTR | $4,731,141,770.47 | $4,521,650,478.15 | $5,705,785,758.71 | $6,235,909,563.14 | $2,167,075,873.80 |

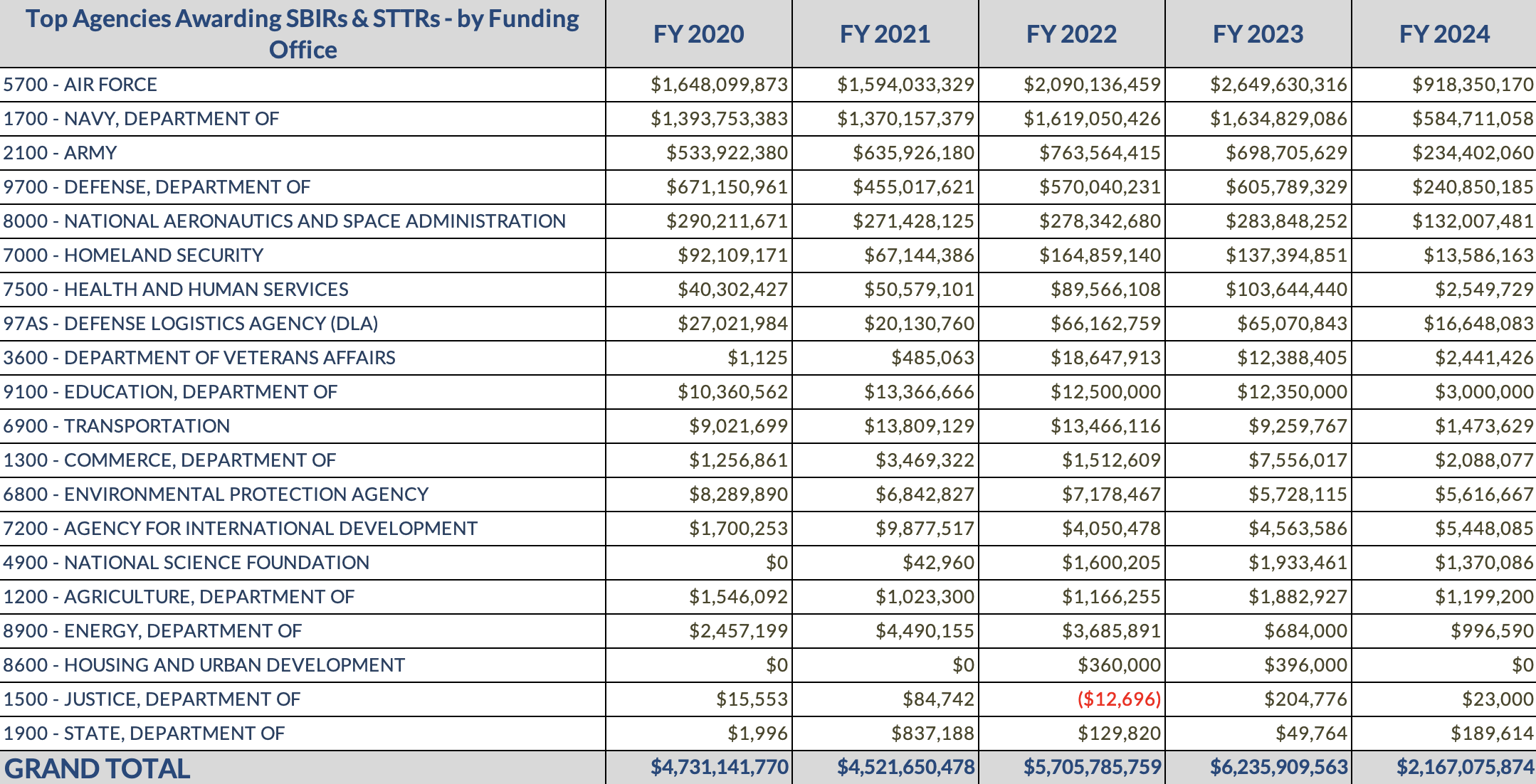

When analyzing agency expenditures, the Department of Defense (DoD) and other defense agencies make up $5.6B, or 91% of the total spending. However, agencies like NASA, Homeland Security (DHS), and Health & Human Services (HHS) have consistently utilized these programs over the years. Interestingly, DHS and HHS have experienced a notable increase in their utilization of these programs.

Fedmine analysis of FPDS spend as on 6/17/24

SBIR Spend

Given the three distinct phases of the SBIR program, it seemed beneficial to delve into spending patterns across these stages. To my surprise, Phase I spend was within the 4-5% range, while Phase II garnered 35-40% of the awards, and Phase III encompassed the majority, ranging between 55-60%.

| FY 2020 | FY 2021 | FY 2022 | FY 2023 | FY 2024 | |

|---|---|---|---|---|---|

| SBBIR Phase I | $293,139,194.97 | $253,641,239.59 | $248.732,362.42 | $244,694,78.75 | $77,335,808.27 |

| SBIR Phase II | $1,626,086,039.46 | $1,459,720,382.08 | $1,986,415,563.70 | $1,979,386,655.18 | $649,517,978.47 |

| SBIR Phase III | $2,305,721,494.53 | $2,204,291,595.15 | $2,755,646,106.42 | $3,311,583,093.42 | $1,199,379,693.54 |

| Total SBIR | $4,224,946,728.96 | $3,917,653,216.86 | $4,990,794,032.54 | $5,535,664,533.35 | $1,926,233,480.28 |

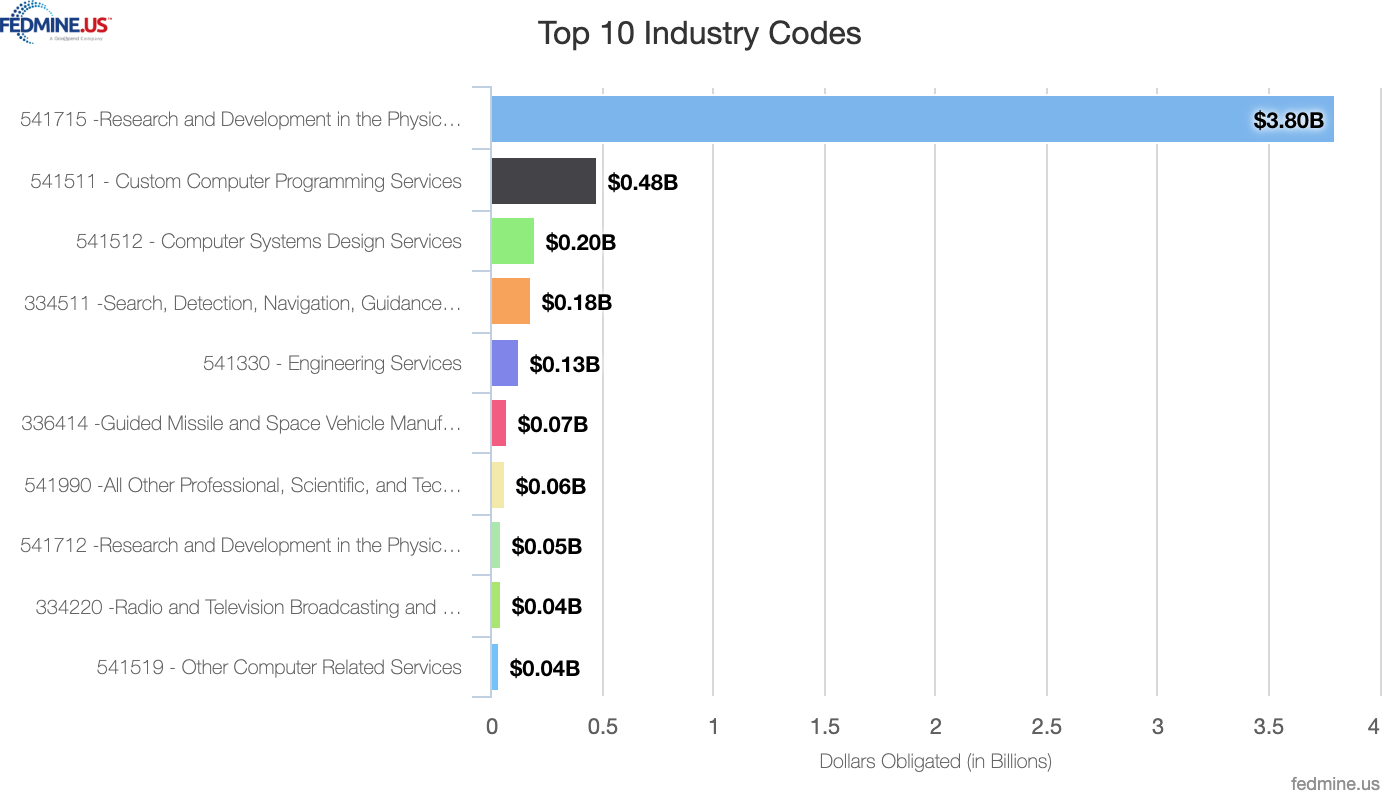

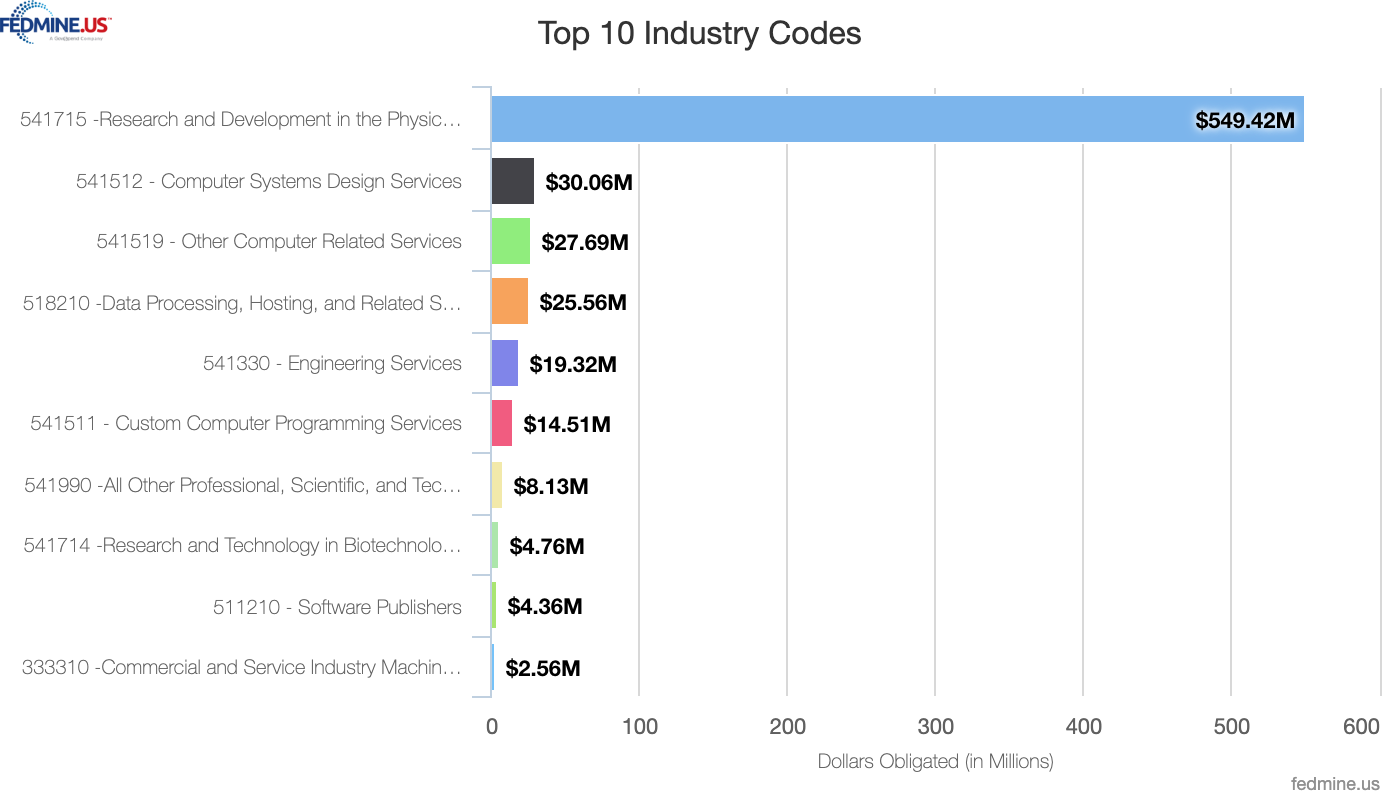

During FY 23, a total of 2,895 businesses received SBIR contracts, with 10% of the contracts being awarded as other than small business. Upon analyzing the NAICS codes, it was evident that the majority of the contracts were awarded under the R&D NAICS.

Top companies winning SBIRs include Linquest Corp, Technology Service Corp, Anduril Industries, Progeny Systems, and Cosmic Advanced Engineered Solutions. To see the full report of the SBIRs awarded, click here.

STTR Spend

While the spend under STTR is approximately 12% of the total SBIR/STTR spend, it is important to remember that this program is focused on technology transfer for R&D with research institutions. As we see below, STTR Phase I funding ranges between 10-13% of the total amount spent on STTRs.

| FY 2020 | FY 2021 | FY 2022 | FY 2023 | FY 2024 | |

|---|---|---|---|---|---|

| STTR Phase I | $49,913,751 | $88,130,012 | $93,890,886 | $56,210,911 | $31,027,437 |

| STTR Phase II | $229,563,665 | $246,857,644 | $328,743,551 | $273,863,067 | $119,007,726 |

| STTR Phase III | $226,717,625 | $269,009,606 | $292,357,289 | $370,171,052 | $90,807,231 |

| Total STTR | $506,195,042 | $603,997,261 | $714,991,726 | $700,245,030 | $240,842,394 |

In FY 23, 877 companies won STTR contract awards totaling $700.3M. We see 10% of the contracts awarded as Other than Small Business contracts. It is no surprise that the largest NAICS category is that of R&D.

Top companies winning STTR contracts include Parsons, Assured Information Security, Monkton, Sierra Space, and Dark Wolf Solutions.

Looking for SBIRs & STTRs opportunities?

While a few may be posted on sam.gov, be sure to check out the SBIR website for a comprehensive list of available opportunities.

Constantly encountering challenges in various fields such as cybersecurity, technology, and healthcare, our commitment to investing in cutting-edge technology ensures that we stay at the forefront of innovation. The SBIR/STTR program plays a crucial role in supporting small businesses’ research and development efforts, making it a must-consider initiative for any company focused on advancing in the realm of R&D.

Note: The above analysis is based on FPDS data on the Fedmine platform as of 6/17/24 and 6/18/24 based on funding contracting offices.