As we begin the second quarter of the federal Fiscal Year 2025 (FY25), we find ourselves amidst changes that will impact federal contracting in numerous ways. However, this is also the time to review and analyze the federal government’s contract awards for the previous fiscal year (FY24), which ended on September 30, 2024. Why does it take time to access the prior year’s spending data? The answer is straightforward—the data is sourced from the Federal Procurement Data System (fpds.gov), and there is typically a 90-day delay for Department of Defense contract data to become public.

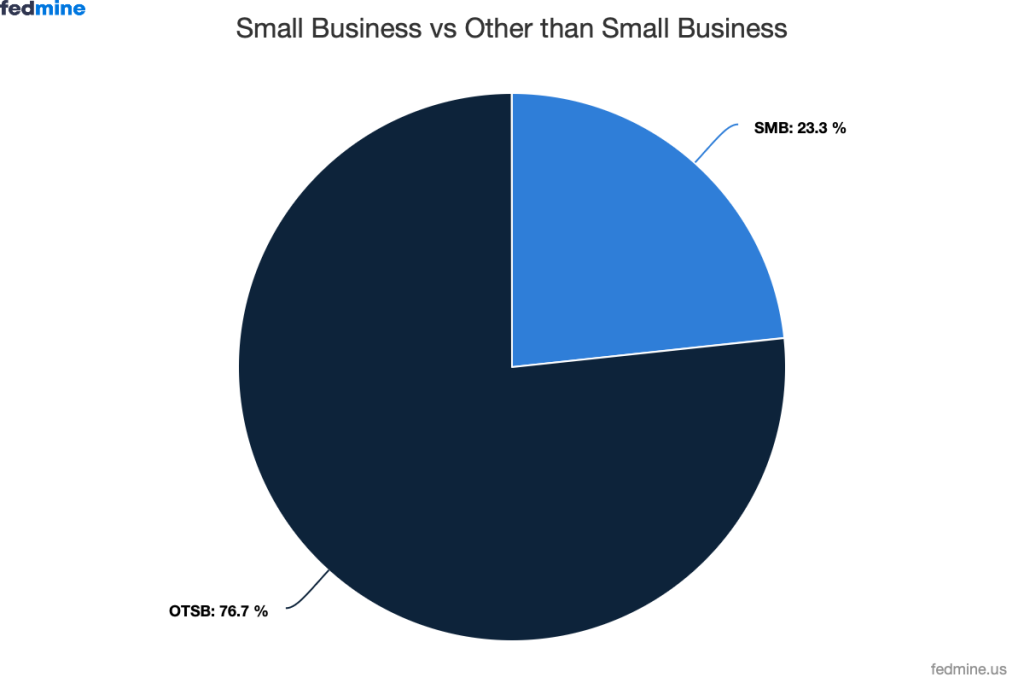

In FY24, the federal government awarded $773.68 billion to 108,899 companies (including de-obligations). Of this total, 76.7% ($579.23 billion) was awarded as Other Than Small Business (OTSB) contracts to 40,856 companies, while $176.11 billion (23.3%) was awarded as small business contracts to 78,677 companies.

The 80/20 principle continues to align with patterns observed in federal procurement spending.

Although the total value of awarded contracts decreased by $3.3 billion (less than 0.5%), it is noteworthy that the number of companies receiving contracts also declined from 109,866 in FY23 to 108,899 in FY24 (refer to the blog for FY23 analysis).

Federal Contract Awards Over the Years

| Fiscal Year | Total Federal Contract Awards (Including De-obligations) | Increase/Decrease Over Previous Year (Billion $) | Percentage Change Over Previous Year |

| FY 2019 | $598.32B | $37.78B | 6.74% |

| FY 2020 | $688.86B | $90.55B | 15.13% |

| FY 2021 | $661.68B | -$27.18B | -3.95% |

| FY 2022 | $706.66B | $44.98B | 6.80% |

| FY 2023 | $777.01B | $70.35B | 9.95% |

| FY 2024 | $773.68B | -$3.33B | -0.43% |

Since FY19, federal contracts have increased from $598 billion to $774 billion in FY24, with only minor decreases in FY21 and FY24. Notably, spending under the COVID-19 National Interest Action Code amounted to less than $90 billion from FY20 to FY22, contributing only a small portion to the overall rise in federal spending.

Top Agencies

It is no surprise that defense agencies consistently rank among the top 15 federal agencies. In FY24, they accounted for 59.87% ($464.2 billion) of all federal contracts. Other key agencies include the Department of Veterans Affairs, NASA, the Department of Energy, Health and Human Services, and the General Services Administration.

| Agency | FY 2019 | FY 2020 | FY 2021 | FY 2022 | FY 2023 | FY 2024 |

| Navy, Department of | $121.99B | $150.97B | $112.77B | $125.41B | $154.46B | $137.48B |

| Air Force | $77.24B | $79.37B | $81.24B | $80.23B | $95.32B | $105.18B |

| Army | $99.61B | $110.65B | $114.33B | $110.63B | $111.60B | $102.42B |

| Veterans Affairs, Department of | $28.81B | $39.54B | $47.69B | $56.38B | $61.69B | $66.90B |

| Defense, Department of | $47.58B | $52.98B | $48.56B | $52.98B | $53.82B | $57.01B |

| Defense Logistics Agency (DLA) | $44.23B | $42.12B | $39.03B | $48.25B | $50.50B | $53.00B |

| Energy, Department of | $33.31B | $35.98B | $38.56B | $42.90B | $46.27B | $47.68B |

| Health and Human Services | $26.37B | $40.57B | $38.83B | $38.89B | $38.51B | $36.76B |

| General Services Administration | $16.10B | $17.65B | $18.27B | $21.28B | $24.54B | $26.51B |

While the Navy and Air Force experienced decreases in contract awards compared to FY23, other agencies such as the Department of Veterans Affairs, Defense Logistics Agency, Department of Energy, and General Services Administration saw increases. Observing agency-specific trends and understanding the reasons behind these changes is essential.

Top Industry Categories

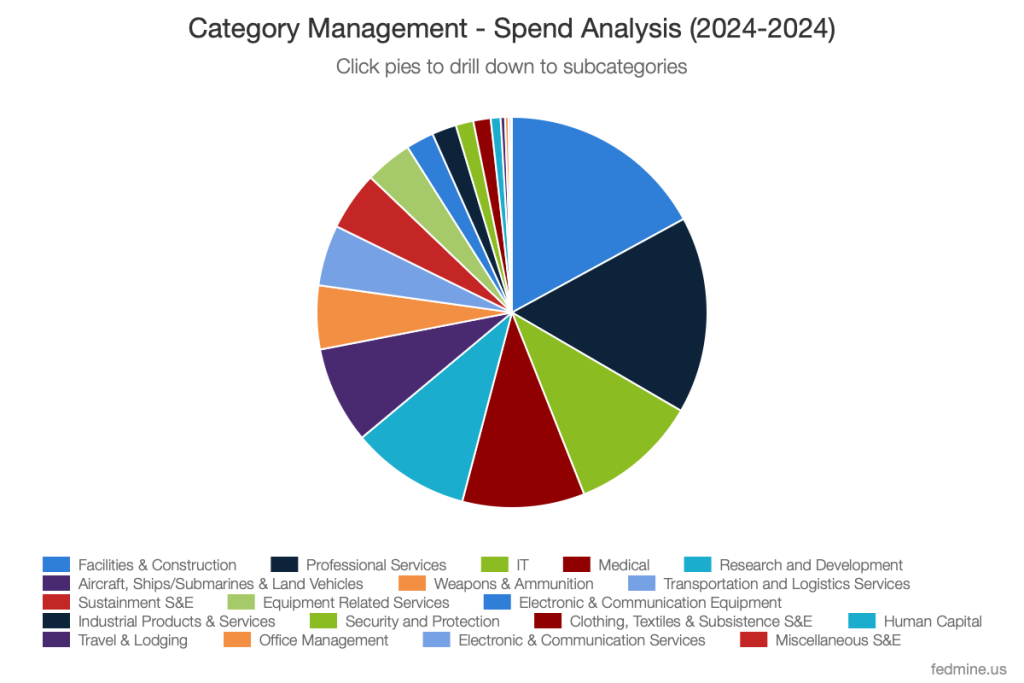

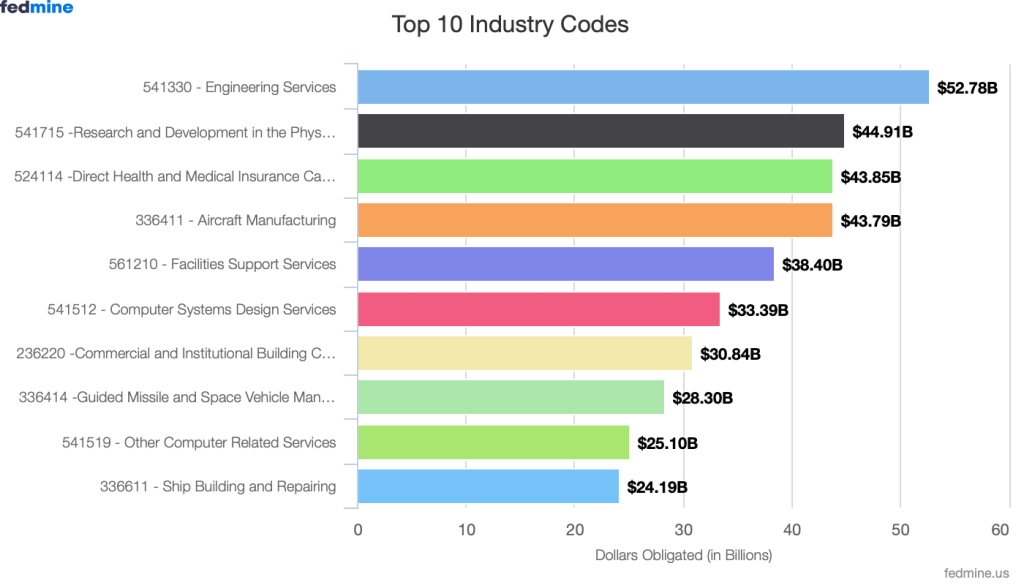

While we can explore the spending under the various NAICS & PSC, it is beneficial to have a broad perspective on the federal spend based on categories. The leading industry categories include Facilities and Construction (17.07% of total contract awards), Professional Services, IT, and Medical. Combined, these four categories account for over 54% of all federal contract awards. The contract awards for small businesses (SB) and Other Than Small Businesses (OTSB) vary depending on the industry category and whether the required work, solution, or product can be procured from a small business.

The top NAICS codes reflect the top categories of Facilities & Construction, Professional Services, IT, Medical, and R&D. Notably, the top NAICS code, 541330 (Engineering Services), is widely used in both the construction/environmental and information technology sectors.

Top Companies

Optum Public Sector Solutions led the list of top companies, securing $20.14 billion in FY24, primarily through contracts with the Department of Veterans Affairs. Other prominent companies include Lockheed Martin, McKesson, and Boeing. (Note: Companies are not consolidated under their parent companies.)

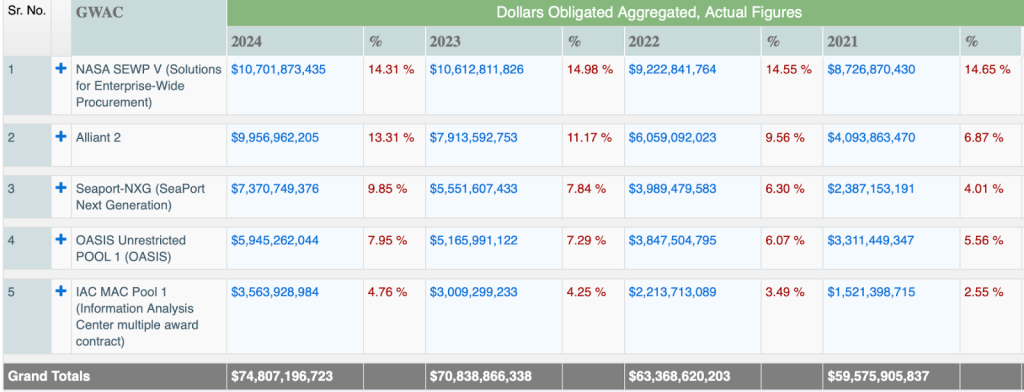

Use of GWACs/IDIQs

The use of Government-Wide Acquisition Contracts (GWACs) and Indefinite Delivery/Indefinite Quantity (IDIQ) contracts, excluding MAS schedules, has been on the rise. In FY24, $74.8 billion was awarded through these vehicles, accounting for more than 9.5% of total federal contract awards. NASA SEWP V, Alliant 2, and SEAPORT NXG were the top three vehicles used across the federal government.

Small Business Contracts

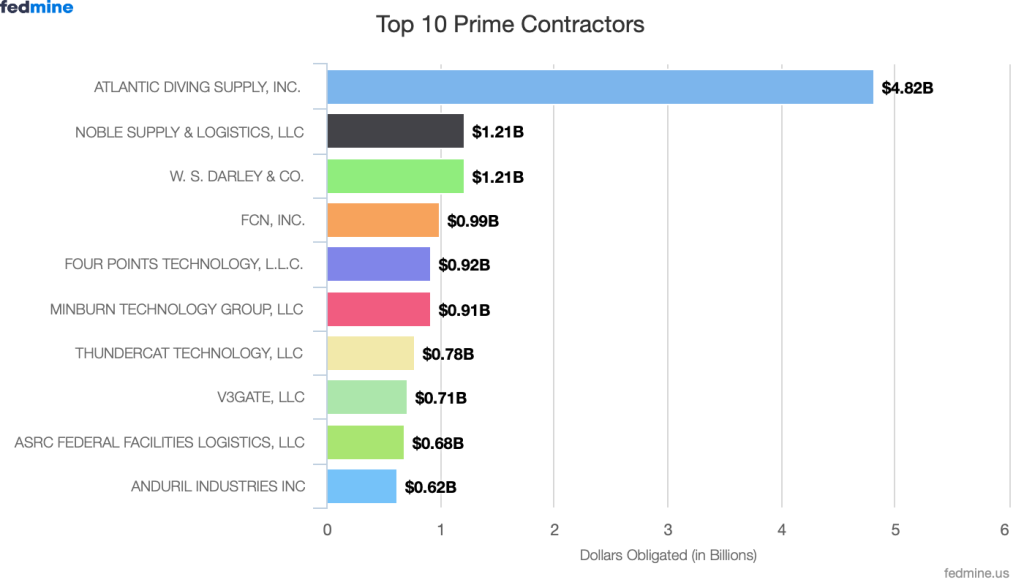

In FY24, $176.1 billion in small business contracts were awarded to 78,677 companies—an increase of nearly $4 billion from FY23. Leading small business contractors included Atlantic Diving Supply, Noble Supply, FCN, and Four Points Technology. New entrants in the top 10 list included ASRC Federal Facilities and Anduril Industries.

Set-Aside Contracts

The federal government mandates that a portion of overall government spending be allocated to small businesses. These targets, established by Congress, are set at 23% for small business contracts. This differs from set-aside contracts, which are specifically reserved for small businesses. The use of set-aside contracts often assists the government in meeting its objectives. In FY24, $33.32 billion in small business set-aside contracts were awarded, representing less than 5% of total federal contracts. In addition to the $33.32 billion that was awarded in small business set-aside contracts, $15.4 billion were awarded as 8(a) sole-source and competed set-asides, $8.5 billion was awarded Service-Disabled Veteran-Owned Small Business (SDVOSB) set-asides, $1.1 billion was awarded as Women-Owned Small Business (WOSB) set-asides, and HUBZone set-asides amounted to less than $1 billion.

Conclusion

An analysis of federal contracting in FY24 reveals that, despite slight declines in overall contract awards, the distribution between small and large businesses remains consistent with historical trends. The defense sector continues to lead in contract awards, driven by key agencies like the Department of Veterans Affairs and the Department of Energy. Industry categories such as Facilities and Construction, Professional Services, and IT dominate contract awards.

Looking ahead, evolving administrative priorities are expected to influence future spending patterns. I anticipate a decrease in overall federal contracts in FY25, coupled with an increase in awards through acquisition vehicles, a reduction in the use of set-asides, a decline in spending within civilian and legislative agencies, and a rise in the adoption of innovative acquisition methods. As we navigate FY25, staying informed and adaptable will be essential for federal contractors seeking success in this dynamic environment.