As of April 16th, 2025, significant changes are continuing to occur in the realm of government contracting. Not only are the contracts currently awarded being impacted, but also the future methods of awarding contracts, workforce reductions, and the ongoing termination of contracts.

FPDS is the authoritative source of federal procurement data, including new contracts and contract terminations. Although we can look at the terminated contract listing on doge.gov, it is important to remember that fpds.gov is the ultimate authority for federal procurement data, and not all of the contracts listed on doge.gov are terminated in fpds.gov.

It has been almost 3 months since the Department of Government Efficiency was established on January 20th, 2025 via an executive order, and a clear understanding of the actual savings from these terminations, if any, will take time. Nonetheless, these terminations are impacting businesses, the government, and the economy.

To gain a better understanding of the current situation since I last wrote about tracking DOGE terminations, let’s delve into the contract termination data. As of 4/16/25, 6,335 contracts have been impacted, involving 2,518 companies and 12,218 actions. The overall de-obligated amount stands at $588.8B, however, the majority of terminations currently have a $0 value, and this amount is anticipated to rise over time. I have excluded any stop-work orders in this analysis as they go through the process of either being reinstated (rescinded) or terminated.

Of the companies with terminated contracts, 1,036 have a de-obligated amount. Listed below are the top companies based on de-obligations.

| Company Name | Sum of Obligated Amount |

| KIND INC | $ (73,287,785.02) |

| ACTIVE DEPLOYMENT SYSTEMS, LLC | $ (69,339,610.70) |

| 24 ASSET MANAGEMENT CORP | $ (51,045,736.00) |

| AMERESCO, INC. | $ (38,337,514.00) |

| JGM PROPERTY GROUP, INC. | $ (32,056,966.00) |

| GWWH A JOINT VENTURE | $ (30,908,772.00) |

| ROYAL DISTRIBUTORS LLC | $ (19,215,000.00) |

| SPECTRUM SOLUTIONS ACQUISITIONS, LLC | $ (18,704,183.00) |

| T47 INTERNATIONAL, INC. | $ (12,326,700.70) |

| TETRA TECH ES, INC. | $ (9,034,627.00) |

| NISH | $ (8,711,972.30) |

| TANDEM SERVICES LLC | $ (8,676,029.09) |

| DELOITTE CONSULTING LLP | $ (8,027,789.33) |

| PYRAMID SYSTEMS, INC. | $ (7,336,810.70) |

| PORTER NOVELLI PUBLIC SERVICES INC. | $ (7,131,129.82) |

Agency Analysis

The leading agencies in terms of total dollars de-obligated are the Department of Homeland Security, followed by the Department of Housing & Urban Development, and Department of Health & Human Services.

| Agency | Obligated Amount |

| 7000 – HOMELAND SECURITY | -$154.21M |

| 8600 – HOUSING AND URBAN DEVELOPMENT | -$127.23M |

| 7500 – HEALTH AND HUMAN SERVICES | -$98.43M |

| 4700 – GENERAL SERVICES ADMINISTRATION | -$75.56M |

| 3600 – DEPARTMENT OF VETERANS AFFAIRS | -$35.31M |

| 1200 – AGRICULTURE, DEPARTMENT OF | -$19.96M |

| 1400 – INTERIOR, DEPARTMENT OF | -$13.66M |

| 1300 – COMMERCE, DEPARTMENT OF | -$12.28M |

| 6900 – TRANSPORTATION | -$12.04M |

| 2000 – TREASURY, DEPARTMENT OF | -$11.72M |

| 7200 – AGENCY FOR INTERNATIONAL DEVELOPMENT | -$9.77M |

| 1500 – JUSTICE, DEPARTMENT OF | -$5.24M |

| 1900 – STATE, DEPARTMENT OF | -$3.09M |

| 9100 – EDUCATION, DEPARTMENT OF | -$2.72M |

| 8000 – NATIONAL AERONAUTICS AND SPACE ADMINISTRATION | -$2.28M |

In terms of the number of actions, the General Services Administration leads with 6,656 actions, followed by the Department of Health & Human Services and the Department of Agriculture.

| Agency | Number of Actions |

| 4700 – GENERAL SERVICES ADMINISTRATION | 6656 |

| 7500 – HEALTH AND HUMAN SERVICES | 981 |

| 1200 – AGRICULTURE, DEPARTMENT OF | 718 |

| 7200 – AGENCY FOR INTERNATIONAL DEVELOPMENT | 518 |

| 3600 – DEPARTMENT OF VETERANS AFFAIRS | 516 |

| 7000 – HOMELAND SECURITY | 298 |

| 1400 – INTERIOR, DEPARTMENT OF | 250 |

| 2000 – TREASURY, DEPARTMENT OF | 220 |

| 1300 – COMMERCE, DEPARTMENT OF | 187 |

| 6900 – TRANSPORTATION | 183 |

As more contracts are terminated, the de-obligations across various agencies will shift. However, it raises the question of whether we have reached the conclusion of terminations in some of the smaller agencies.

Remember that there is a delay of up to 90 days before defense data is released on fpds.gov. It will be intriguing to observe the termination data for defense agencies, especially since defense spending accounts for almost 60% of the total contract awards.

Contracting Officer Size Determination

A key data element in FPDS is the “Contracting Officer’s Determination of Business Size,” which can be either small or other than small. FPDS defines this field as “The Contracting Officer’s determination of whether the selected contractor meets the small business size standard for award to a small business for the NAICS code that is applicable to the contract”.

By examining this data, we gain a better understanding of how many of these terminations were awarded as small business contracts.

Based on the number of actions, 61% of terminations were for the contracting officer’s size determination of small business.

| CO Size Determination | No of Actions |

| Small Business | 7204 |

| Other Than Small Business | 4692 |

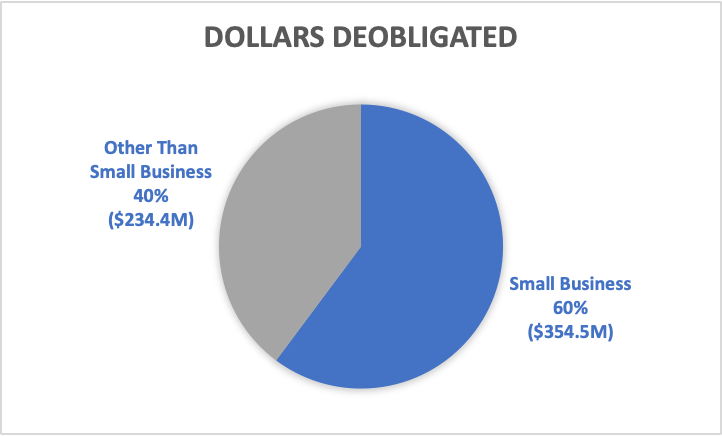

In terms of dollars de-obligated, $354.4M was terminated where the CO’s size determination was small.

It is clear that small businesses are affected more by these terminations, from both the number of actions and the dollars de-obligated. Data shows 61% of terminated contracts were initially awarded to small businesses, highlighting the sector’s disproportionate impact. Keep in mind that in FY 24, small business awards accounted for 24% of the total awards. Additionally, the $354.4 million de-obligated from these contracts emphasizes the significant economic effect on these businesses, vital for local economies and job creation.

Often we overlook the Solicitation Procedure for contract awards. I did an analysis of contract terminations based on solicitation procedures and was surprised to find that nearly 50% of the terminations were awarded as MAFO (i.e. a Delivery/Task Order) against a multiple award IDV or a Part 8 BPA Call, and almost 30% of the contracts were awarded under the simplified acquisition process.

| Solicitation procedure | Total Number of Actions |

| MAFO – Multiple Award Fair opportunity | 5435 |

| SP1 – Simplified Acquisition | 3512 |

| NP – Negotiated Proposal | 1568 |

| SSS – Only One Source | 1220 |

| TS – Two Step | 75 |

| BR – Basic Research | 33 |

| AE – Architect – Engineer | 21 |

| AS – Alternative Sources | 18 |

| SB – Sealed Bid | 8 |

It is also important to note that almost 80% of the contracts that were terminated were competed, either through the full & open category or the simplified acquisition process.

| Extent Competed | No. of Actions |

| A – Full and Open Competition | 5914 |

| B – Not Available for Competition | 812 |

| C – Not Competed | 408 |

| D – Full and Open Competition after exclusion of sources | 1250 |

| F – Competed under SAP | 2282 |

| G – Not Competed under SAP | 1230 |

Set Asides

Looking at the use of set-asides for the original awards, only 16% of the total terminated contracts were set-aside; however, 60% of all terminations are small business awards.

| Type of Set Aside | Sum of Number Of Actions |

| SBA – Small Business Set-Aside — Total | 1159 |

| 8AN – 8(a) Sole Source | 384 |

| SDVOSBC – Service Disabled Veteran Owned Small Business Set-Aside | 209 |

| WOSB – Women-Owned Small Business | 64 |

| SDVOSBS – SDVOSB Sole Source | 31 |

| 8A – 8A Competed | 29 |

| HZC – HUBZone Set-Aside | 18 |

| EDWOSB – Economically Disadvantaged Women-Owned Small Business | 5 |

| SBP – Small Business Set-Aside — Partial | 5 |

| WOSBSS – Women-Owned Small Business Sole Source | 4 |

| ISBEE – Indian Small Business Economic Enterprise | 4 |

| VSS – Veteran-Owned Sole Source | 2 |

| VSA – Veteran-Owned Set-Aside | 2 |

| HZS – HUBZone Sole Source | 2 |

| EDWOSBSS – Economically Disadvantaged Women-Owned Small Business Sole Source | 1 |

| BI – Buy Indian | 1 |

GWACs & GSA Schedules

Examining terminated task orders under GSA Schedules and GWACs, it’s no surprise to see that awards on MAS schedules lead, followed by NASA SEWP V. I expected to see more awards on schedules and vehicles to be terminated, but the overall termination percentage is in line with the overall use of schedules and vehicles.

| Schedule/GWAC | Total Number of Actions |

| MAS | 1159 |

| NASA SEWP V | 114 |

| VECTOR | 27 |

| OASIS | 21 |

| HCATS SB | 18 |

| 8ASTARS3 | 16 |

| 51 V | 15 |

| OASIS Unrestricted POOL 1 | 15 |

| BPA | 13 |

| OASIS SB | 13 |

Conclusion

I believe that data tells a story, especially federal contracting data. In less than three months we have seen more than 6,000 contracts impacted, with millions of dollars already de-obligated, and more to come. While it’s still too early to see the actual costs and savings of DOGE’s changes, the numbers tell us that small businesses—often considered the engine of innovation and economic diversity in federal contracting—are bearing the brunt of the terminations.

As we move forward, continued tracking and analysis will be critical to understanding the evolving federal contracting landscape. Of course, using Fedmine, which derives its contract data from FPDS, makes it easy to analyze these terminated contracts.

Stay tuned as we continue to monitor these terminations.

Note: The data referenced in this article is based on Fedmine’s analysis of FPDS data as of 4/16/25. The search was done for Contracts terminated for convenience from 1/20/25.