As October ushered in the start of the new federal fiscal year, it also brought a government shutdown beginning on October 1, 2025.” FY25 has been a period of considerable transition under the new administration, which took office in January 2025. A series of executive actions has reshaped the landscape, creating the Department of Government Efficiency, revising the FAR, promoting innovative contracting vehicles, realigning funding priorities, and culminating in the recent government shutdown.

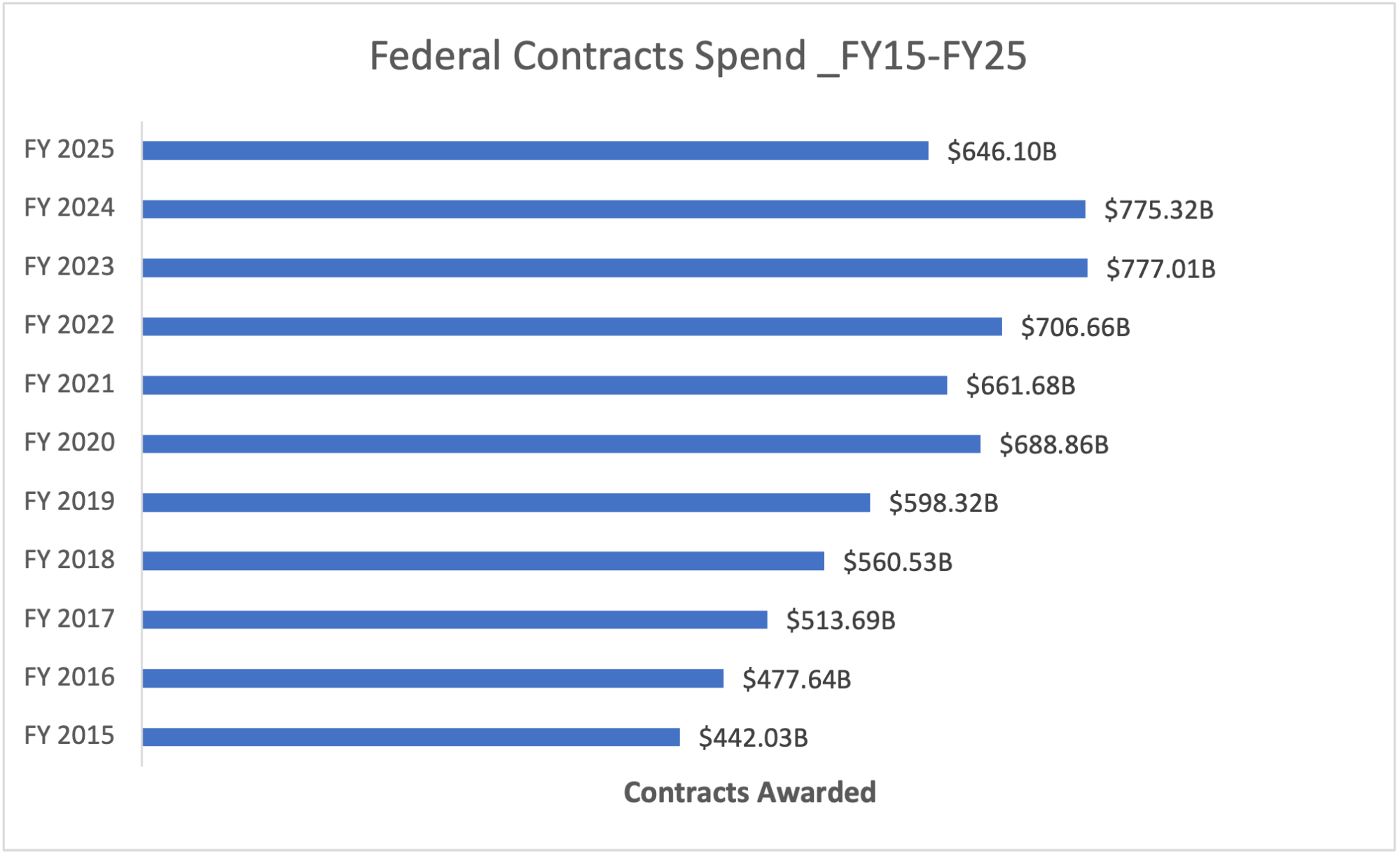

So, how much did the federal government actually spend in FY25? As of 10/25/25, the federal government has awarded $646.1B to 101,251 companies. In comparison, $775B was spent by the government in FY24 on federal contracts. With the FY25 numbers expected to increase, once all Department of Defense data is made public in FPDS.gov, I feel confident that the spend in FY25 will cross $730B.

Federal contracting spend has grown from $442B in FY15 to $646B YTD in FY25 – representing an annualized growth rate of approximately 4% and closely tracking the average inflation rate of 3.3%. Notably, spending surged in FY20 in response to COVID-19, and while pandemic-related obligations have tapered off, federal spending did not return to pre-Covid levels.

FY25 YTD Contract Spend Highlights:

While a comprehensive analysis of FY25 spend will be done in January(once all DoD data is made public), an analysis based on the FY25 data YTD reveals notable trends:

- Total small business contract awards account for 21.7% of the awards

- 101,251 companies won awards, down from previous years (i.e., in FY24, more than 108k companies won contracts)

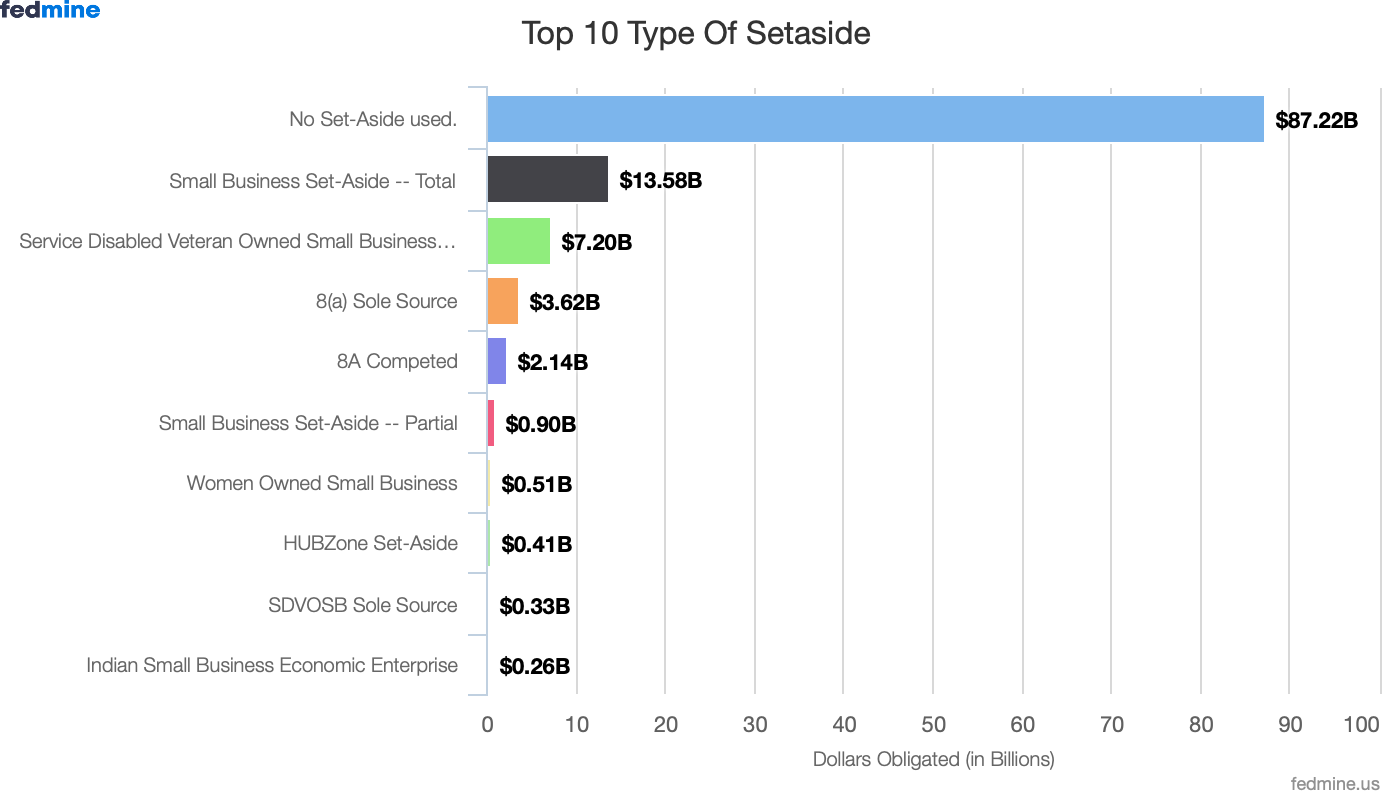

- Less than 8% ($48.9B) of the total dollars were awarded as set-aside contracts, with more than $27B awarded as small business set-asides.

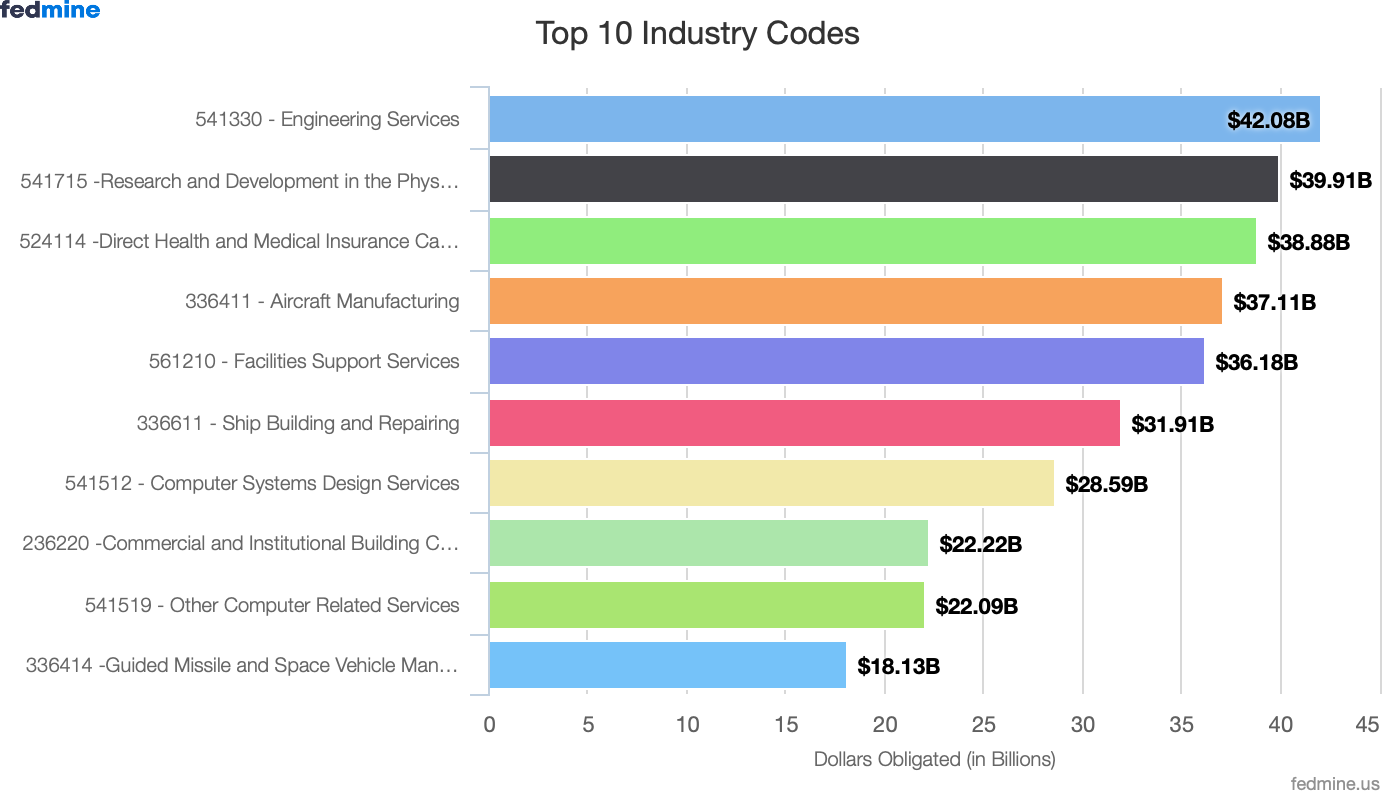

- In terms of top NAICS codes, overall, engineering services, aircraft manufacturing, R&D, and health make up the top industries.

- Top companies include Electric Boat, Lockheed, Optum, Triwest, and Raytheon

Spending by Category

It is important to understand the various spend categories for federal government contracts, and also understand whether the contracts are awarded as small-business or other than small-business (OTSB).

Facilities & Construction leads, followed by Professional Services, Medical, IT, and Aircrafts. Of course, the category will determine how the awards are made, hence we see higher OTSB spend in the medical and aircraft categories.

Defense versus Civilian/Non-Defense Agency Spending

Total spend across the Defense agencies since FY20 has consistently crossed $400B and typically averages around 61% of the total federal contracts awarded.

| FY 2020 | FY 2021 | FY 2022 | FY 2023 | FY 2024 | FY 2025 | |

| Total Defense Agencies | $438.74B | $401.62B | $425.24B | $472.25B | $463.64B | $352.32B |

| Total – Civilian, Independent, Legislative Agencies | $250.12B | $260.06B | $281.42B | $304.75B | $311.68B | $293.78B |

| Total Federal Awards | $688.86B | $661.68B | $706.66B | $777.01B | $775.32B | $646.10B |

FY25 marks the first decline in non-defense agency spend, down by $17.9B, which is less than 6% of non-defense spend and approximately 2.3% of the total FY24 spend. Navy, Air Force, and Army typically account for more than 70% of Defense spending and 40% of total federal spending.

| Agency | FY 2020 | FY 2021 | FY 2022 | FY 2023 | FY 2024 | FY 2025 |

| 1700 – NAVY, DEPARTMENT OF | $150.97B | $112.77B | $125.41B | $154.46B | $137.93B | $123.96B |

| 5700 – AIR FORCE | $79.37B | $81.24B | $80.23B | $95.32B | $105.16B | $75.59B |

| 2100 – ARMY | $110.65B | $114.33B | $110.63B | $111.60B | $102.18B | $65.42B |

| 9700 – DEFENSE, DEPARTMENT OF | $52.98B | $48.56B | $52.98B | $53.82B | $57.15B | $44.81B |

| 97AS – DEFENSE LOGISTICS AGENCY (DLA) | $42.12B | $39.03B | $48.25B | $50.50B | $53.10B | $39.26B |

| 96CE – US ARMY CORPS OF ENGINEERS – Civil programs | $2.66B | $5.69B | $7.74B | $6.55B | $8.12B | $3.28B |

| Total Defense Agencies | $438.74B | $401.62B | $425.24B | $472.25B | $463.64B | $352.32B |

Note: FY25 numbers will change once all defense contract data is made public, which typically occurs about 90 days post-contract issue

Civilian/Independent Agencies Analysis

While non-defense agencies have seen their numbers fall (by less than 8%) to $293.7B in FY25, some agencies, including the Department of Veterans Affairs, Department of Energy, and Homeland Security have seen an increase in spending and are amongst the top non-defense agencies.

- Homeland Security, Transportation, NASA, Energy, and Veterans Affairs have all seen an increase in FY25.

- USAID saw a 44% drop in awards, a decrease of $3.3B from FY24

- The Department of Health & Human Services saw contract awards drop by $10B, or 27%.

| Agency | FY 2020 | FY 2021 | FY 2022 | FY 2023 | FY 2024 | FY 2025 |

| 3600 – DEPARTMENT OF VETERANS AFFAIRS | $39.54B | $47.69B | $56.38B | $61.69B | $66.89B | $69.43B |

| 8900 – ENERGY, DEPARTMENT OF | $35.98B | $38.56B | $42.90B | $46.27B | $47.67B | $50.26B |

| 7000 – HOMELAND SECURITY | $19.86B | $20.12B | $21.12B | $24.08B | $23.64B | $28.40B |

| 7500 – HEALTH AND HUMAN SERVICES | $40.57B | $38.83B | $38.89B | $38.51B | $36.76B | $26.76B |

| 4700 – GENERAL SERVICES ADMINISTRATION | $17.65B | $18.27B | $21.28B | $24.54B | $26.93B | $24.68B |

| 8000 – NASA | $20.04B | $20.39B | $21.23B | $22.23B | $21.35B | $22.70B |

| 6900 – TRANSPORTATION | $7.78B | $7.86B | $8.68B | $9.46B | $9.28B | $9.88B |

| 1900 – STATE, DEPARTMENT OF | $9.28B | $9.82B | $11.97B | $11.87B | $11.89B | $9.54B |

| 1200 – AGRICULTURE, DEPARTMENT OF | $12.65B | $9.85B | $10.06B | $11.47B | $11.61B | $9.54B |

| 1500 – JUSTICE, DEPARTMENT OF | $8.93B | $9.70B | $8.88B | $10.30B | $9.56B | $8.69B |

| 2000 – TREASURY, DEPARTMENT OF | $6.57B | $9.55B | $9.27B | $10.24B | $9.26B | $8.43B |

| 1400 – INTERIOR, DEPARTMENT OF | $4.62B | $5.13B | $6.55B | $7.67B | $8.33B | $6.83B |

| 7200 – AGENCY FOR INTERNATIONAL DEVELOPMENT | $6.15B | $5.57B | $6.02B | $6.69B | $7.48B | $4.16B |

| 1300 – COMMERCE, DEPARTMENT OF | $5.82B | $4.50B | $4.09B | $5.03B | $5.19B | $4.16B |

| 9100 – EDUCATION, DEPARTMENT OF | $2.98B | $2.68B | $2.44B | $2.45B | $2.72B | $2.50B |

| 1600 – LABOR, DEPARTMENT OF | $2.55B | $2.74B | $2.59B | $2.82B | $2.50B | $2.05B |

| 2800 – SOCIAL SECURITY ADMINISTRATION | $2.13B | $1.83B | $2.00B | $2.02B | $1.95B | $1.81B |

| 6800 – ENVIRONMENTAL PROTECTION AGENCY | $1.16B | $1.20B | $1.59B | $1.88B | $2.22B | $1.71B |

| 4900 – NATIONAL SCIENCE FOUNDATION | $0.50B | $0.50B | $0.58B | $0.63B | $0.78B | $0.71B |

| 5000 – Securities and Exchange Commission | $0.52B | $0.55B | $0.56B | $0.70B | $0.55B | $0.50B |

Other Take-aways

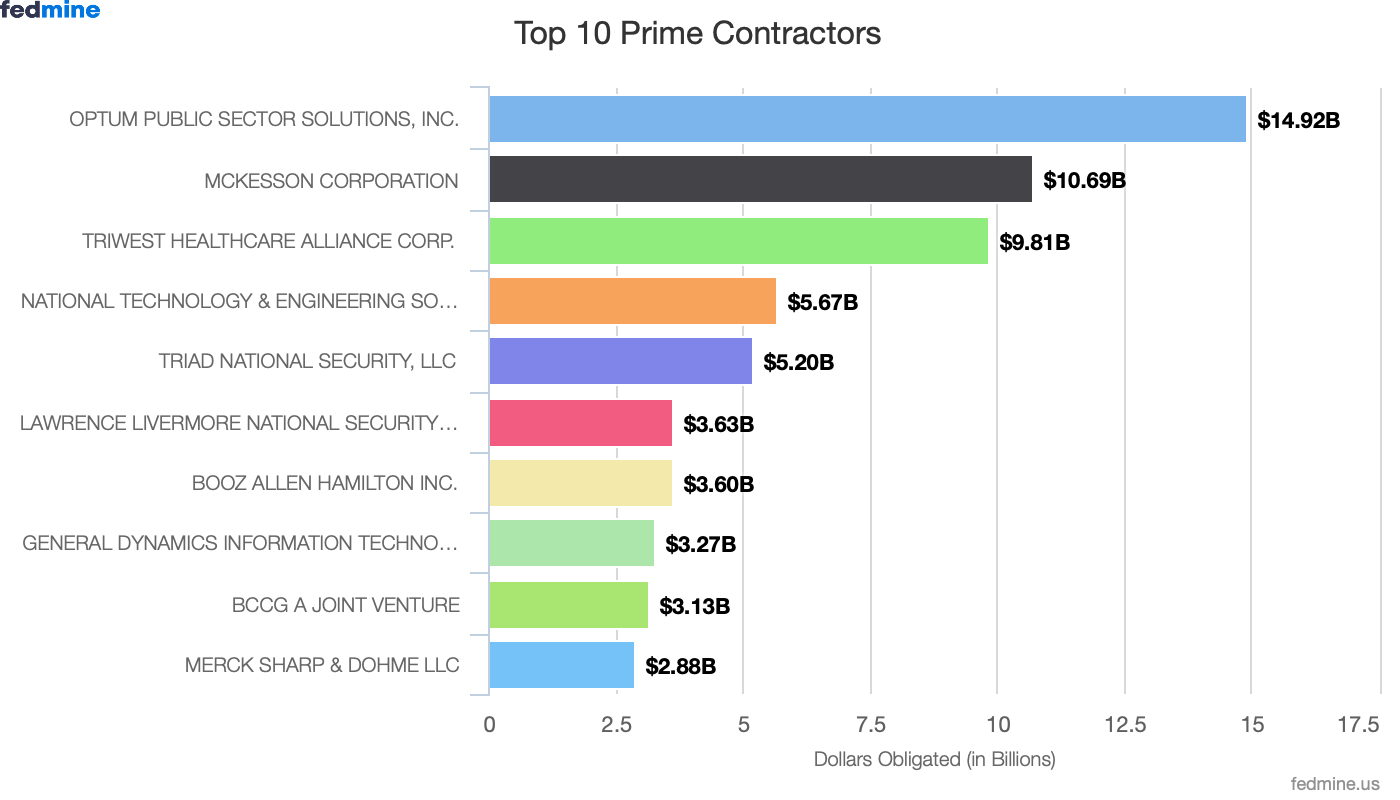

In FY25, $293.8B was awarded to 72,186 companies, of which 24.4% was awarded as small business awards. Top companies include Optum, Mckesson, and Triwest (mainly for work at the Department of Veterans Affairs). BCCG’s work on the border barrier at US Customs and Border Protection has landed them in the top 10 companies for FY25. It’s no surprise that the top 10 companies are working at the top three agencies.

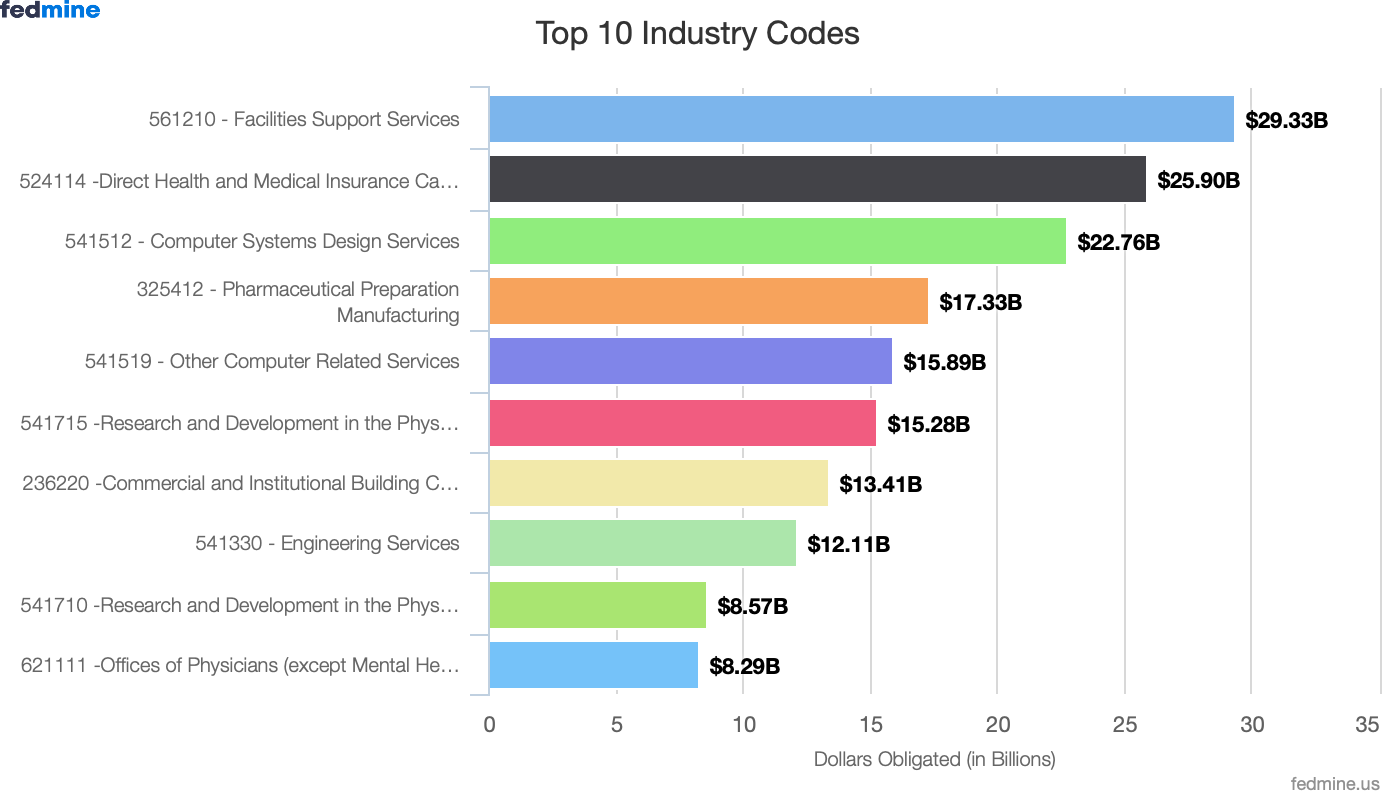

In terms of top 10 NAICS codes, we see a mix of facilities support & construction, computer systems, health, and R&D codes, accounting for $169B, or 57.4%, of the total civilian and non-defense agency spend.

$28.95B of awards at non-defense agencies were set-asides, with small business set-asides accounting for approximately 50% of set-asides. SDVOSB set-asides are the second most used set-aside program.

In FY25 (YTD), 9,112 unique SAM entities won awards for the first time, compared to 11,908 companies in FY24 — a drop of almost 24%.

Final Thoughts

As we analyze FY25 data, it’s clear that while overall spending remains close to FY24 levels, the contractor base continues to shrink. We’re seeing fewer new entrants winning federal awards, and the Small Business and SDVOSB set-aside programs remain the most widely utilized across agencies.

Looking ahead, we can expect greater use of GSA Schedules, agency-specific GWACs and IDIQs, and other innovative acquisition vehicles. At the same time, companies will face rising compliance costs — from pursuing CMMC certification to staying aligned with the ongoing FAR rewrite. As FY26 approaches, staying informed, aligning with evolving acquisition strategies, and remaining agile, while keeping a clear focus on your customer and your strengths, will be essential in navigating an increasingly competitive federal marketplace.