A look at which LMS are gaining, which are losing steam, and which school districts are pumping the brakes

Return of in-person learning continues brisk pace of LMS purchases

Public schools loaded up on learning management systems during the pandemic, and now competition between the vendors could intensify as some schools seek to consolidate their software applications.

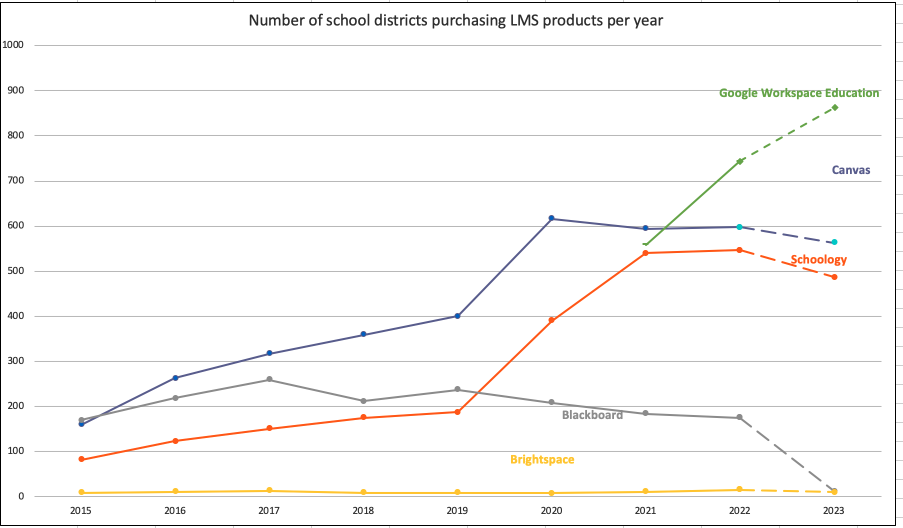

School building closures spurred a large increase in the number of districts purchasing subscriptions to learning management software, with Google, Canvas and Blackboard as the leading players, GovSpend data shows. Though the worst of the pandemic has passed, the number of school districts buying the leading platforms each year has remained steady since 2020.

“K-12 markets continue to be resilient as stimulus funding is available this buying season,” Instructure CEO Stave Daly said during the company’s conference call to discuss fourth-quarter earnings. Instructure is the publicly traded company that makes Canvas LMS. Daly stated during the call that while the company is seeing a “slowdown” in higher ed, the company feels good about K-12 markets.

GovSpend’s meeting module adds real-life anecdotes to the numbers

However, some school districts are falling out of love with their LMS solutions, a perusal of GovSpend’s Meeting Intelligence module, which transcribes and archives public meetings including school board meetings, shows.

In one example, the board of Grand Island Public Schools in Nebraska discussed a proposal to replace Canvas and Turnitin with Google. Given projected cost savings of 15%, the board passed the proposal during the March 14 meeting, referring to it as a “consolidation of third-party apps.”

GovSpend purchase order data shows that Grand Island Public Schools in late 2023 paid $8,397 to renew Canvas for the ‘23 to ‘24 school year. Previously it had paid $12,900 for each the ‘22-’23 year and the ‘21-’22 year.

During a recent school board meeting in Wisconsin, a regular technology update noted how much time it took to manage the school’s tech needs. “Software management is becoming overwhelming,” said a staff member to the board of the Mosinee School District on March 19. “We have more and more software products every year.” Materials posted with the meeting show that the school district uses Canvas, Seesaw, Learning Ally, Snap & Read, and Math Resources among others.

In a more contentious example, a teacher spoke at the Connellsville Area School District board meeting in Pennsylvania on Feb. 28, urging the board not to renew its Schoology contract. “The brick and mortar students should not have to be subjected to using Schoology when it’s not friendly for them, it’s not impacting them in a positive way, and it’s burdensome on a lot of us,” the teacher said. The teacher asked the district to consider only using Google products.

The changing LMS landscape

Google Workspace for Education has surged in sales since its rebranding in 2020. Google also offers a basic free LMS tool called Google Classroom, but schools can upgrade to the paid version.

Canvas has also seen an increase in purchase order activity among K-12 schools, while Blackboard’s learning management system has declined in sales to schools, according to procurement data obtained by GovSpend.

Blackboard has gone through changes in recent years, merging in 2021 with Anthology, an EdTech provider to higher education institutions. The combined company subsequently sold its K-12 community engagement division to FinalSite in 2022, but retained its K-12 LMS product Blackboard Learn.

Open source LMS products such as Moodle are free to use without buying, so usage can’t be measured with purchase orders alone, but purchase orders show that some school districts do buy cloud hosting services from these providers to better utilize the systems.

A caveat to looking at the data is that school districts don’t always buy directly from the education tech companies. Sometimes a central agency purchases the LMS, distributes the LMS to the school district and bills the school district. For example, school districts in Pennsylvania may buy LMS systems from one of the state’s 29 intermediate units. School districts in New York often purchase software subscriptions from one of the state’s 37 boards of cooperative education services. These are reflected in GovSpend’s database with the unit being listed as the company and the school district listed as the purchasing agency.