Delving into data is a passion of mine. Whether analyzing financials, customer KPIs, marketing data, or federal spending, I rely on data for not just monitoring the performance of our business and our government, but for making informed decisions with real-time information.

For small businesses maneuvering through the complexities of procurement, leveraging data can be the key to thriving. But how exactly can data play a role in procurement decisions for small businesses?

Data-Driven Decisions for Small Business

At the recent Small Business National Training Conference, hosted by the U.S. Department of Health and Human Services (HHS) Office of Small and Disadvantaged Business Utilization (OSDBU) in Atlanta, GA, I had the pleasure of co-presenting on this very topic with Wayne Berry, a Senior Procurement Analyst at the HHS OSDBU.

During the session, titled “Data-Driven Decisions for Small Business,” we highlighted how small businesses can use facts, metrics, and data to guide strategic decisions that align with their public sector growth goals. In this post, I will summarize our recommendations, particularly when it comes to growing your federal contract business: market research, anticipating future opportunities, devising effective pricing strategies, and implementing targeted marketing efforts.

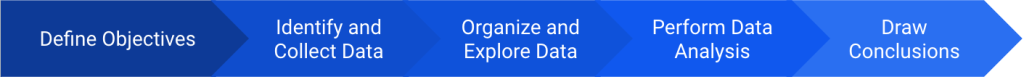

Data-driven decision-making, or DDDM, is most effective when approached formulaically by following these steps:

#1 – Define Objectives

Establishing clear objectives is crucial to drawing insightful conclusions. The most common objectives in procurement may vary but commonly include:

- Understand Your Market: Contracting data can uncover valuable insights into the federal market landscape, including identifying the agencies procuring your solution (or product), key vendors, emerging trends, and competitive dynamics. Experiment with different search criteria, such as keywords versus industry codes, to see if the results yield varying perspectives.

- Understand Your Client: Strong knowledge of your potential client or prospect can be the difference between winning and losing. Pay attention to how the agency purchases, including the utilization of NAICS & PSC codes, whether awards are on IDIQs/GSA, the set-aside status, and who your competitors are within that specific agency.

- Understand Your Competitor: Competitive intel is a key input into a smart and efficient strategy. With a competitor’s award history, current customer list, pricing, use of GSA schedule and various GWACs/IDIQs, expiring contracts and so much more, you can define the right components to winning more bids.

- Identify Opportunities: Data-based pipeline growth is essential to selling into your ideal customer base. Using expiring or upcoming contract data along with possible recompetes enables you to uncover areas for growth and expansion within your specific market.

- Understand Awards: Historical transactional data offers valuable insights into the award details, including end dates, funding sources, contracting offices, pricing information, set-asides, and more. This data serves as a crucial source of competitive intelligence, especially when assessing the incumbent’s position in the market.

#2 – Identify and Collect Data

The federal government is required to disclose its spending and procurement data, largely due to the passing of these acts:

- Federal Funding Accountability and Transparency Act (FFATA): Enacted in 2006, FFATA requires the disclosure of all entities receiving federal funds through contracts, grants, loans, and other forms of assistance.

- Digital Accountability and Transparency (DATA) Act: Signed into law in 2014, the DATA Act builds upon FFATA by mandating standardized reporting of federal spending data.

- Open, Public, Electronic, and Necessary (OPEN) Government Data Act: Passed as part of the Foundations for Evidence-Based Policymaking Act in 2019, the OPEN Government Data Act requires federal agencies to publish their information as open data, using machine-readable formats and following open data principles.

Key sources of data for federal contracts include the Federal Procurement Data System (FPDS); SAM.gov for opportunities and entity details; and USASpending.gov for additional spending information.

#3 – Organize and Explore Data

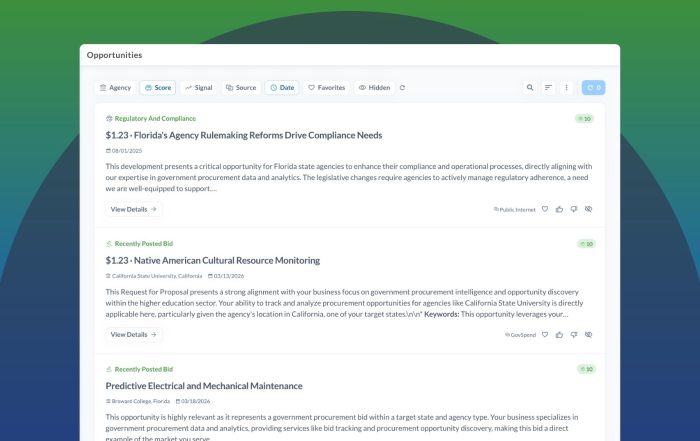

Companies looking for federal contract information can visit the individual sources mentioned above and manually aggregate the data for complete insights. However, mature public sector sales teams can leverage the data more efficiently and effectively when they use an integrated data platform like Fedmine, which integrates 19 federal data and pairs it with tailor-made workflow tool for federal contracting.

That said, a company should follow these steps when successfully exploring relevant data:

- Acquisition: Obtain pertinent datasets from designated sources, guaranteeing they are complete and precise. Ensure that the data is accurate and updated regularly.

- Aggregation: Receive, aggregate, and standardize the data before converting it into a database consumable format.

- Process: Establish systematic procedures for searching and retrieving data to streamline future analysis and access. Build searches that generate alerts so you can stay ahead of new opportunities.

#4 – Perform Data Analysis

Based on your objectives and the data available to you, it’s important to establish which metrics and insights will be most valuable in aiding your procure-related decision-making. For example, if your goal is to set competitive pricing, it will be most important to look at recent contracts awarded by your target agencies in your industry or market. Some important data analysis techniques include:

- Visualization: Create visual representations of procurement data using charts, graphs, maps, and dashboards to enhance your understanding of the data and easily present your key findings. Visualizations can also help identify patterns, trends, outliers, and relationships within the data.

- Trend Analysis: Analyze procurement data over time to identify trends, patterns, and fluctuations in procurement activities.

#5 – Draw Conclusions

When the preceding steps are done correctly and thoroughly, this step should be the most straightforward. Based on your objectives, your analysis should naturally present the insights you need to shape your initiatives and inform your decisions. This may include:

- New market insights that help you better understand your market, including trends that can help you anticipate the future of the products or services you sell.

- Deeper client insights that help you create a strategic agency plan for expanding relationships or building new ones.

- Smarter vendor insights that help you navigate the competitive landscape and price-to-win strategies, or identify new teaming partners.

And Finally, Create Opportunities

Companies that leverage federal procurement data to build a healthy pipeline of new opportunities are better equipped to propel their businesses forward. For example, companies can monitor sam.gov for open opportunities, pre-solicitation and sources sought notices; analyze award data to anticipate recompetes; track expiring task orders on IDIQs/GWACs/GSA Schedules; and stay informed on forecasts, Exhibit 53s, and agency budgets.

In conclusion, by following these DDDM steps—from defining clear objectives to drawing meaningful conclusions—small businesses leverage procurement data to inform their strategy decisions, and ultimately drive growth and enhance their competitiveness in their respective markets.