Did you know that in FY 24, more than $18.3B dollars were awarded as Other Transaction Agreements? That is more than 2% of the total federal contract spend, which topped $774B!

So what are OTAs or OTs? While OTAs are not grants, FAR-based contracts, or cooperative agreements, they are a legal agreements subject to specific requirements and can be protested! (Refer to Oracle’s protest for the cloud contract under OTA).

Originally introduced in the National Aeronautics and Space Act of 1958, it allowed NASA to enter into other transactions as may be necessary in the conduct of its work. This authority has been expanded over the past several decades to include other agencies including Dept of Defense, Dept of Homeland Security, Energy, Health & Human Services, and Dept of Transportation. While each agency seems to interpret and use the vehicle with slight variations, the primary use is to, “provide the Government with access to state-of-the-art technology solutions from traditional and Non-Traditional Defense Contractors, through a multitude of potential teaming arrangements tailored to the particular project and the needs of the participants.”

With the passage of Section 815 of the National Defense Authorization Act (NDAA) for Fiscal Year 2016, Congress amended the OT authority of the Department of Defense (DOD) for prototype projects, which has now been permanently codified at Title10, Section 2371b, of the U.S. Code.

In addition to Defense Agencies, OTAs are used by some civilian agencies, namely Homeland Security, Dept of Energy, and Health & Human Services.

From a data perspective:

- The award data is made public and is in FPDS

- These awards typically have no NAICS code, but do have a PSC code assigned

- There are no set-sides or no contracting officer size determination of small or other than small

Spending Trends

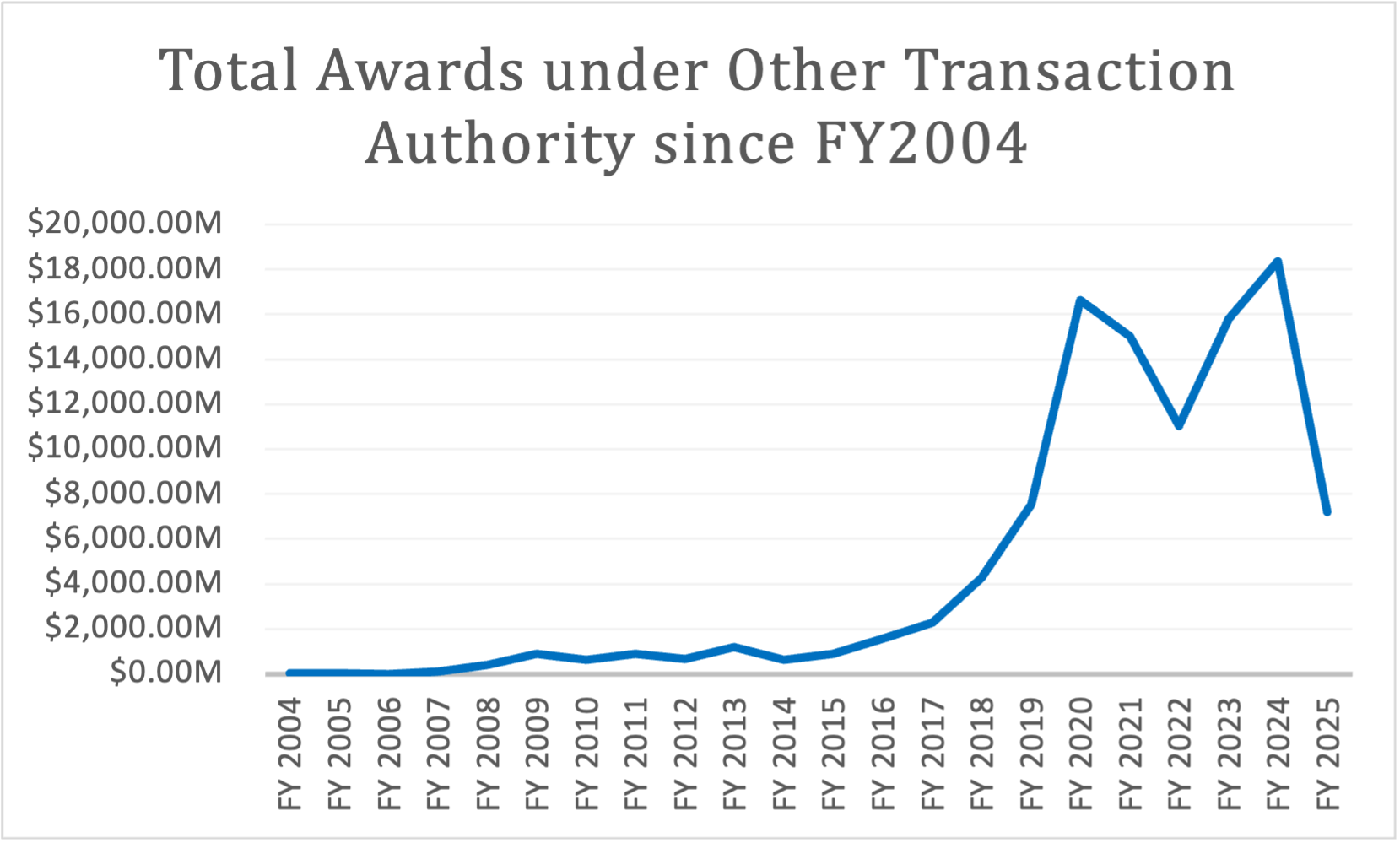

OTAs have grown from $2M in awards in FY 04 to $18.36B in FY 24, with the first OTA in the system to United Airlines, awarded by Homeland Security!

We see a marked increase in the use of OTAs from FY 16, correlating with the passage of Section 815 of the NDAA of FY 2016. The growth in OTAs over the past 8 years has been exponential, growing from $1.56B in FY 16 to $18.36B in FY 24. It is also interesting to note that while OTAs were predominantly used by Homeland Security initially, OTAs are now used predominantly by defense agencies, especially since they can now be used for prototype projects.

| FY 16 | FY 17 | FY 18 | FY 19 | FY 20 | FY 21 | FY 22 | FY 23 | FY 24 | FY 25 – YTD | |

| Civilian Agencies | $0.13B | $0.17B | $0.25B | $0.18B | $0.22B | $0.31B | $0.05B | $0.06B | $0.24B | $0.09B |

| Defense Agencies | $1.43B | $2.12B | $4.00B | $7.37B | $16.43B | $14.71B | $11.00B | $15.75B | $18.12B | $7.12B |

| Total OTA Awards | $1.57B | $2.28B | $4.25B | $7.55B | $16.65B | $15.02B | $11.05B | $15.81B | $18.36B | $7.21B |

Civilian Agency Usage

Over the years we have seen a change in use by the various agencies. Dept of Homeland Security, once a prolific user of OTAs, has significantly reduced its use of OTAs, whereas the Dept of Health & Human Services has increased the use of OTAs.

| FY16 | FY17 | FY18 | FY19 | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 | |

| 7000 – HOMELAND SECURITY | $131.96M | $168.14M | $249.38M | $183.70M | $217.35M | $307.60M | $24.83M | $10.57M | $14.25M | $0.00M |

| 7500 – HEALTH AND HUMAN SERVICES | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M | $18.98M | $28.51M | $223.22M | $91.19M |

| 8900 – ENERGY, DEPARTMENT OF | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M | $4.20M | $17.00M | $0.00M | $0.00M |

| Total Civil Agencies | $131.96M | $168.14M | $249.38M | $183.70M | $217.35M | $307.60M | $48.01M | $56.07M | $237.47M | $91.19M |

Note: Above spend is based on Funding Offices

The Dept of Homeland Security was one of the first agencies to use OTA, specifically the Transportation Security Administration (TSA). Awards were made to various cities and airports for infrastructure and other related expenses, reaching a high of $298M in FY 21 before falling sharply to $14.6M in FY 22.

| HOMELAND SECURITY | FY16 | FY17 | FY18 | FY19 | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| 7040 – Under Secretary for Science and Technology | $4.45M | $15.94M | $26.72M | $18.52M | $39.44M | $10.01M | $10.23M | $10.57M | $7.54M | $0.00M |

| 7061 – Cybersecurity and Infrastructure Security Agency | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M | $6.72M | $0.00M |

| 7013 – Transportation Security Administration | $126.98M | $152.21M | $222.66M | $165.18M | $177.91M | $298.07M | $14.59M | $0.00M | $0.00M | $0.00M |

| 7062 – Countering Weapons of Mass Destruction | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M | -$0.48M | $0.00M | $0.00M | $0.00M | $0.00M |

| 7001 – Office of Procurement Operations | $0.52M | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M |

| Homeland Security Total | $131.96M | $168.14M | $249.38M | $183.70M | $217.35M | $307.60M | $24.83M | $10.57M | $14.25M | $0.00M |

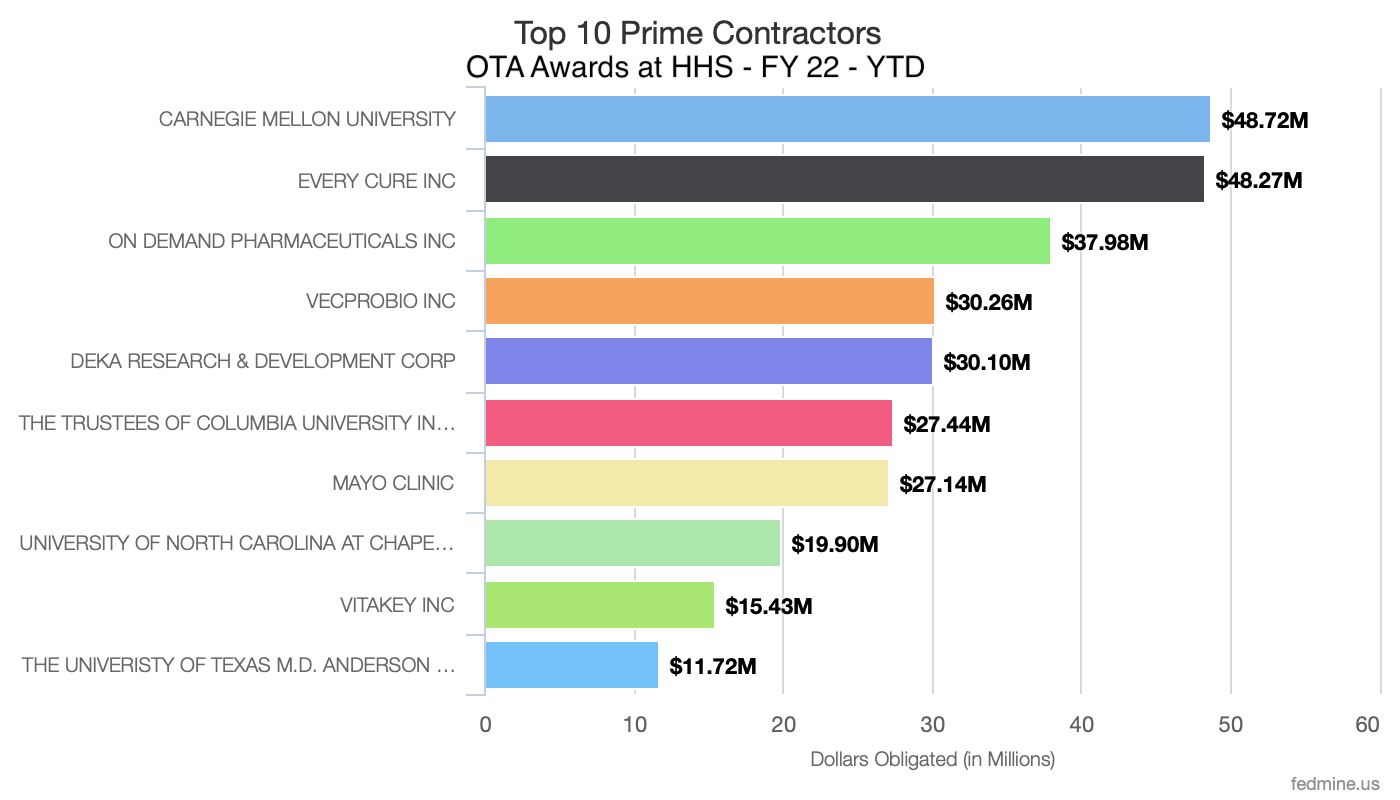

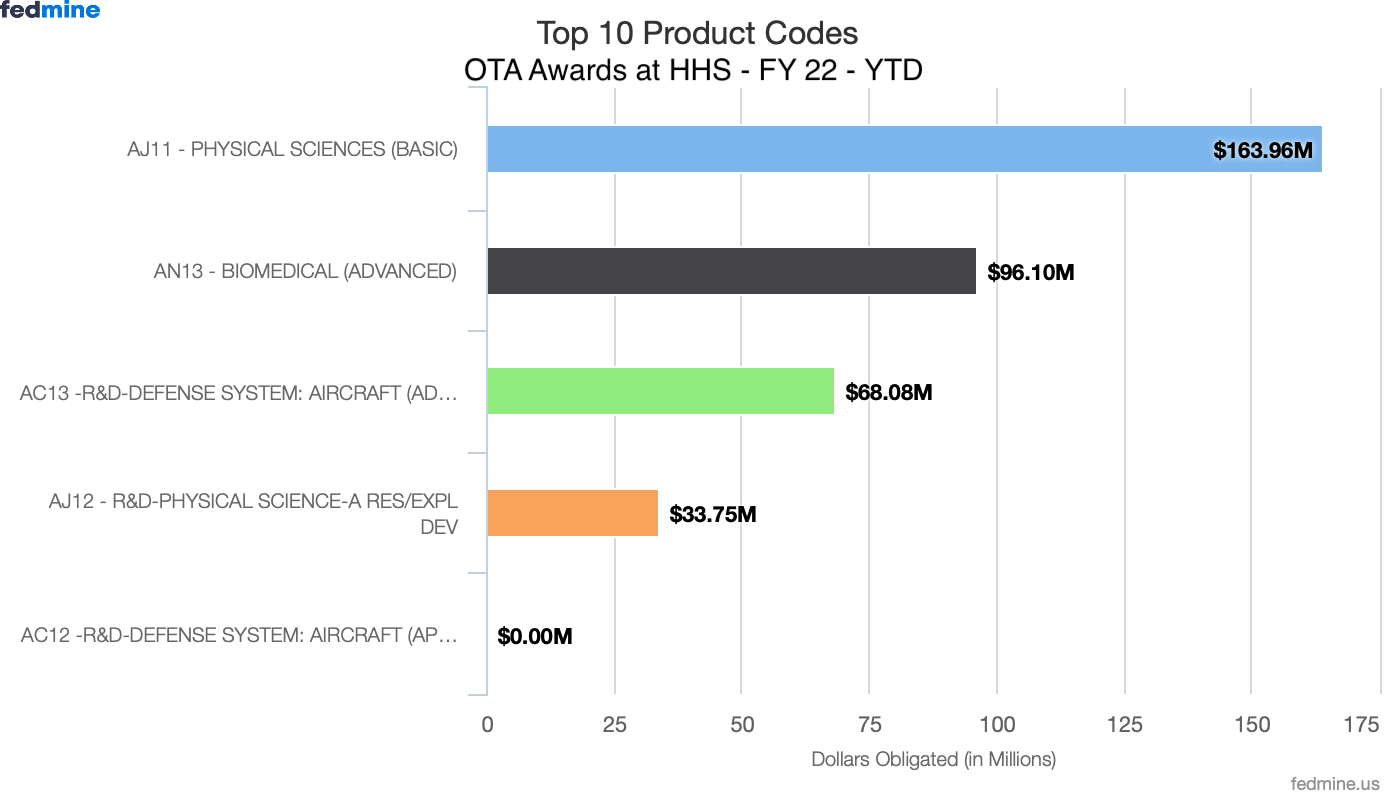

CISA and the Under Secretary for Science & Technology have also started using OTAs. The Dept of Health & Human Services (HHS) has emerged as a notable OTA user from FY 22 and has awarded over $362M on OTAs primarily through National Institute of Health (NIH) and the Office of Assistant Secretary For Preparedness & Response(ASPR).

| HEALTH AND HUMAN SERVICES | FY22 | FY23 | FY24 | FY25 |

| 7505 – Office of Assistant Secretary For Preparedness & Response (ASPR) | $0.00M | $0.00M | $202.63M | $91.19M |

| 7529 – National Institutes of Health | $18.98M | $28.51M | $20.60M | $0.00M |

| HHS Total | $18.98M | $28.51M | $223.22M | $91.19M |

Top awardees include educational institutions such as Carnegie Mellon, Columbia, and the University of North Carolina.

Top PSC codes include those for R&D, reflecting the focus on advanced research.

The Dept of Energy has funded less than $22M under OTAs, which was awarded to Advanced Technology International.

| FY22 | FY23 | FY24 | FY25 | |

| 8900 – ENERGY, DEPARTMENT OF | $4.20M | $17.00M | $0.00M | $0.00M |

Defense Agency Analysis

The use of Other Transaction Agreements (OTAs) has expanded dramatically within Defense agencies, with the U.S. Army emerging as one of the earliest and most significant adopters of this acquisition method. Following closely behind are the U.S. Air Force and the broader Department of Defense (DoD), each steadily increasing their use of OTAs over the past decade.

| Defense Agencies | FY16 | FY17 | FY18 | FY19 | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 – YTD |

| 2100 – ARMY | $0.806B | $1.417B | $2.645B | $4.744B | $12.933B | $9.988B | $5.558B | $6.542B | $5.985B | $2.345B |

| 5700 – AIR FORCE | $0.283B | $0.223B | $0.593B | $1.489B | $1.535B | $2.088B | $1.611B | $3.545B | $5.754B | $2.179B |

| 9700 – DEFENSE, DEPARTMENT OF | $0.323B | $0.467B | $0.709B | $0.974B | $1.335B | $1.871B | $2.744B | $4.110B | $3.928B | $1.913B |

| 1700 – NAVY, DEPARTMENT OF | $0.022B | $0.008B | $0.051B | $0.160B | $0.631B | $0.760B | $1.083B | $1.556B | $2.451B | $0.681B |

| 97AS – DEFENSE LOGISTICS AGENCY (DLA) | $0.000B | $0.000B | $0.000B | $0.001B | $0.001B | $0.001B | $0.002B | $0.000B | $0.006B | $0.001B |

| 96CE – US ARMY CORPS OF ENGINEERS – Civil programs | $0.000B | $0.000B | $0.000B | $0.000B | $0.000B | $0.000B | $0.000B | $0.000B | $0.000B | $0.003B |

| Sector Totals | $1.433B | $2.115B | $3.998B | $7.367B | $16.435B | $14.708B | $10.998B | $15.753B | $18.124B | $7.122B |

Interestingly, USACE has used OTAs, though minimally, at less than $3M over the past 5 years.

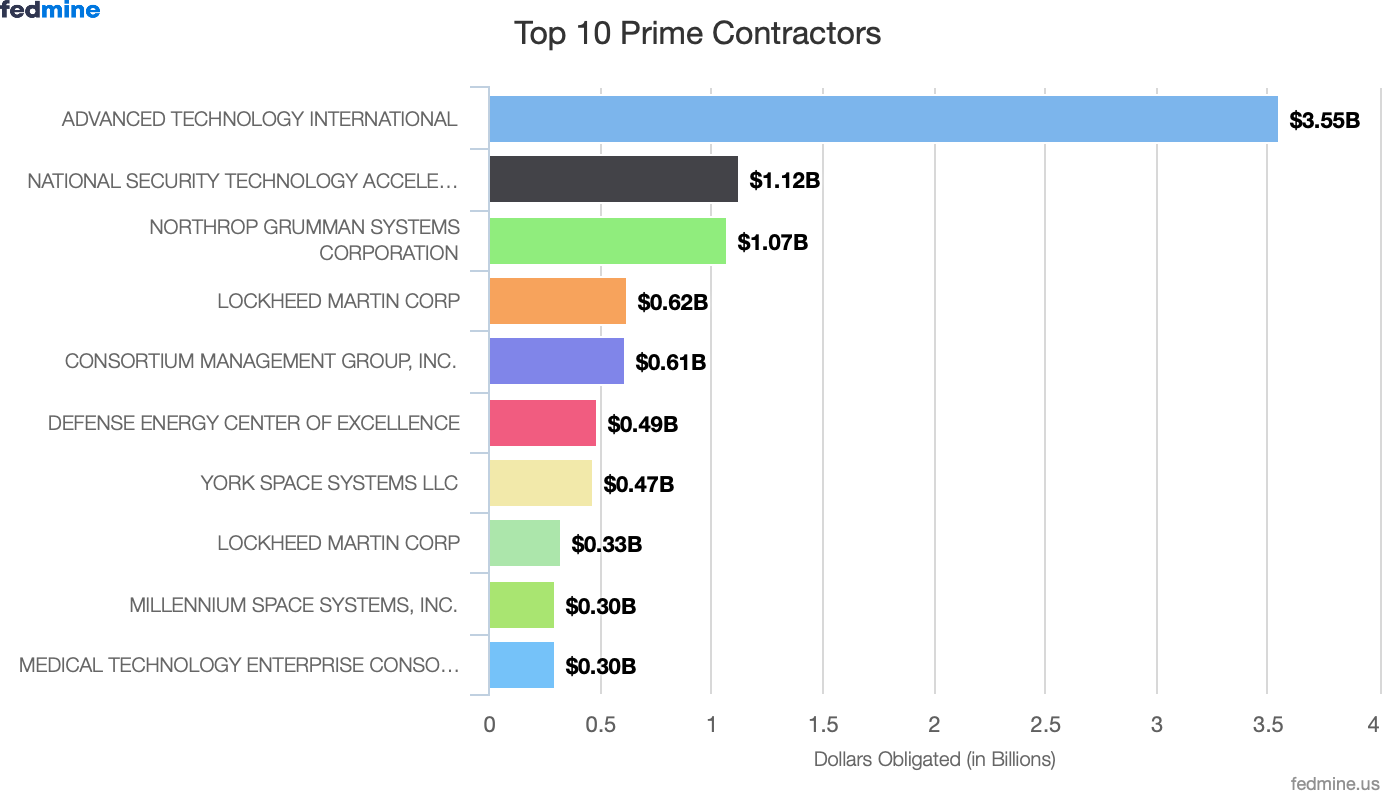

In terms of companies winning these awards, we see a mix of large primes such as Northrop Grumman and Lockheed Martin, along with consortiums such as ATI, National Security Technology Accelerator, and the Consortium Management Group, who help manage the projects.

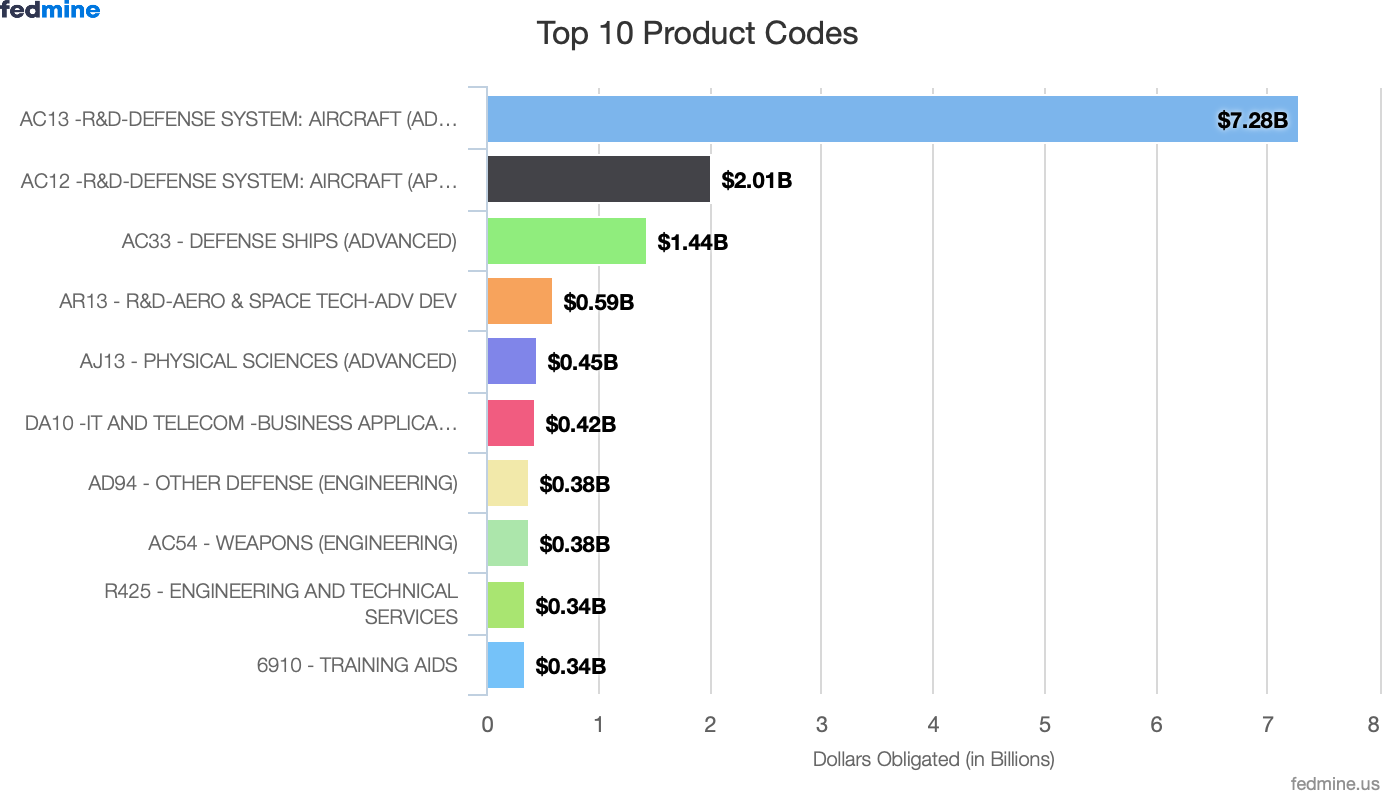

The largest sums of awards are under the R&D, Physical Sciences, and Engineering PSC codes, given that OTAs can be used for prototypes.

Analyzing spend across the various funding offices at the Dept. of Defense also gives us insight into the increasing use of OTAs within the various bureaus, such as the Secretary of Defense, DARPA, DISA, DTRA, and DHA, which saw spending go up in FYs 23 & 24.

| Department of Defense | FY16 | FY17 | FY18 | FY19 | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 – YTD |

| 97AD – Immediate Office of the Secretary of Defense | $12.19M | $40.18M | $242.35M | $360.12M | $451.14M | $353.38M | $453.80M | $1,123.64M | $1,351.37M | $649.21M |

| 97AE – Defense Advanced Research Projects Agency (DARPA) | $219.00M | $379.74M | $377.88M | $426.36M | $346.02M | $347.47M | $333.02M | $489.64M | $734.93M | $514.24M |

| 97F5 – Washington Headquarters Services (WHS) | $25.07M | $35.73M | $68.57M | $112.22M | $251.44M | $600.06M | $534.93M | $762.88M | $673.64M | $235.29M |

| 97AK – Defense Information Systems Agency (DISA) | $0.00M | $0.00M | $2.16M | $26.27M | $63.29M | $50.57M | $182.94M | $150.00M | $259.11M | $156.27M |

| 97DH – Defense Health Agency (DHA) | $0.00M | $0.20M | $0.49M | $0.11M | $2.44M | $8.19M | $11.47M | $126.91M | $257.92M | $83.02M |

| 97ZS – U.S. Special Operations Command (ussocom) | $0.28M | $0.00M | $1.29M | $14.83M | $44.17M | $132.11M | $127.21M | $165.37M | $187.81M | $54.19M |

| 97JC – Missile Defense Agency (MDA) | $0.00M | $0.00M | $0.00M | $0.00M | $88.55M | $162.45M | $238.10M | $433.83M | $155.11M | $111.97M |

| 97AV – Defense Counterintelligence and Security Agency | $0.00M | $0.00M | $0.00M | $19.57M | $19.33M | $75.64M | $96.03M | $129.14M | $122.73M | $49.28M |

| 9761 – Defense Threat Reduction Agency (DTRA) | $63.31M | $2.63M | $1.77M | $7.06M | $53.20M | $110.18M | $90.20M | $136.11M | $89.78M | $14.25M |

| 97CY – U.S. CYBER COMMAND | $0.00M | $0.00M | $0.00M | $1.52M | $0.00M | $0.00M | $0.00M | $0.00M | $54.44M | $39.74M |

| 97AT – Defense Security Cooperation Agency | $0.00M | $0.00M | $0.00M | $2.96M | $2.37M | $0.00M | $0.00M | $0.00M | $9.97M | $3.00M |

| 9771 – Defense Microelectronics Activity (DMEA) | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M | $28.50M | $33.25M | $9.64M | $0.00M |

| 97HW – Uniformed Services University of the Health Sciences (USUHS) | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M | $9.56M | $1.51M | $22.35M | $9.03M | $2.03M |

| 97BZ – Defense Finance and Accounting Service (DFAS) | $0.00M | $0.00M | $0.00M | $1.28M | $0.00M | $14.44M | $11.00M | $39.95M | $4.89M | $0.00M |

| 97CG – National Security Agency/Central Security Service | $0.00M | $0.23M | $0.00M | $0.00M | $0.00M | $2.36M | $0.14M | $15.25M | $3.58M | $0.00M |

| 97BJ – Joint Chiefs of Staff, Organization of | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M | $1.90M | $0.92M |

| 97EX – Inspector General, Office Of | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M | $0.73M | $0.00M |

| 97SD – Space Development Agency | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M | $623.62M | $480.07M | $0.72M | $0.00M |

| 9776 – USTRANSCOM | $2.88M | $6.57M | $7.43M | $0.00M | $0.00M | $0.00M | $0.25M | $0.13M | $0.55M | $0.00M |

| 9763 – Defense Contract Management Agency (DCMA) | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M |

| 97DL – Defense Intelligence Agency (Virginia Contracting Agency) | $0.00M | $1.88M | $3.48M | $0.00M | $10.21M | $4.47M | $10.81M | $1.36M | $0.00M | $0.00M |

| 9748 – Defense Human Resources Activity | $0.00M | $0.00M | $0.00M | $0.00M | $0.78M | $0.49M | $0.00M | $0.00M | $0.00M | $0.00M |

| 97AB – National Geospatial-Intelligence Agency (NGA) | $0.00M | $0.23M | $3.60M | $0.58M | $0.33M | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M |

| 97AR – Defense Contract Audit Agency (DCAA) | $0.00M | $0.00M | $0.00M | $0.66M | $1.68M | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M |

| 97F7 – Joint Improvised Explosive Device Defeat Organization (JIEDDO) | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M | $0.00M |

| Agency Totals | $322.73M | $467.40M | $709.01M | $973.55M | $1,334.96M | $1,871.38M | $2,743.52M | $4,109.89M | $3,927.84M | $1,913.41M |

Interestingly, the Space Development Agency used OTAs in FY 23 & FY 24.

In Conclusion:

The rapid rise in the use of Other Transaction Agreements (OTAs) over the past decade highlights the federal government’s growing use of innovative and flexible acquisition tools for R&D, emerging technologies, and prototyping especially. With the current administration’s focus on modernizing acquisitions, I do expect to see an increased use of OTAs.

As the data shows, FY 24 alone saw over $18.3 billion awarded through OTAs — a figure that represents not just 2% of total federal contract obligations, but a strategic increase in using innovative acquisition vehicles.

As federal priorities evolve, especially in areas like AI, technology, cyber, and space, OTAs will continue to play an important role.