In its first two months, the Trump administration issued two executive orders with the potential to significantly alter the landscape of the Federal Emergency Management Agency (FEMA): “Achieving Efficiency Through State and Local Preparedness” and “Council to Assess the Federal Emergency Management Agency.” While change is a constant across federal agencies, the nature of these directives suggests that companies working with FEMA may have a clearer path to understanding and mitigating potential business disruptions.

How these reviews and councils will impact FEMA’s budget—$33B is the President’s Request for FY25—moving forward will be tricky. However, the administration may focus particular attention on the $1.57B designated for Operations and Support. Within this amount, specific areas including Preparedness and Protection ($326M), Mitigation ($73M), Regional Operations ($228M), and Mission Support ($655M) could be targeted as the administration prepares for a shift in responsibility and preparedness towards state and local governments.

Each executive order provides multiple timeframes to review existing policies and establish any new strategies, so the full impact of these executive orders on FEMA operations may not be known for up to one year. This uncertainty can significantly affect both long-term and short-term business development for FEMA contractors. However, companies can take proactive steps now to prepare for potential changes.

Why Federal Contractors Can’t Afford to Wait

The disaster response landscape is poised for a significant shift as the administration signals an intention to empower local jurisdictions, potentially reshaping FEMA’s role. For contractors already embedded in state and local emergency management networks, alongside their work with FEMA, now is the time to proactively assess how a risk-informed approach will reshape their operational strategies.

Those not currently partnering with state and local governments should urgently evaluate their service offerings and business strategies to determine if this evolving procurement landscape presents new opportunities or potential challenges to their existing models.

Underscoring State and Local Preparedness

Firms accustomed to working primarily within FEMA must expand their market to include state and local governments. Understanding the risks to local infrastructure that have already been established and existing mitigation strategies already developed can help firms understand if there is a market for their solution. While monitoring current and past bids offers a baseline, truly proactive companies will delve deeper.

This means actively tracking discussions and identifying needs emerging from town halls, city council meetings, and local emergency management agencies. With the level of future FEMA funding uncertain, gaining insight into local priorities and concerns becomes paramount for tailoring relevant solutions and positioning your company for success.

Where to Look: Identifying Emerging Opportunities at the State and Local Level

With the GovSpend platform, contractors can track federal, state, and local markets and go beyond posted RFPs by searching across multiple data sets—including open bids, existing contracts, and public meeting transcripts—to uncover early indicators of local needs and procurement trends.

By using targeted keyword searches such as emergency operations, emergency communication, emergency preparedness, emergency planning, emergency response, crisis management, disaster recovery, preparedness plans, and risk assessment, contractors can:

- Identify open solicitations that match their offerings

- Analyze historical contracts to understand pricing and competition

- Surface meeting mentions where emergency preparedness needs are being discussed—before RFPs are released

Tracking Discussions and Solicitations Across the U.S.

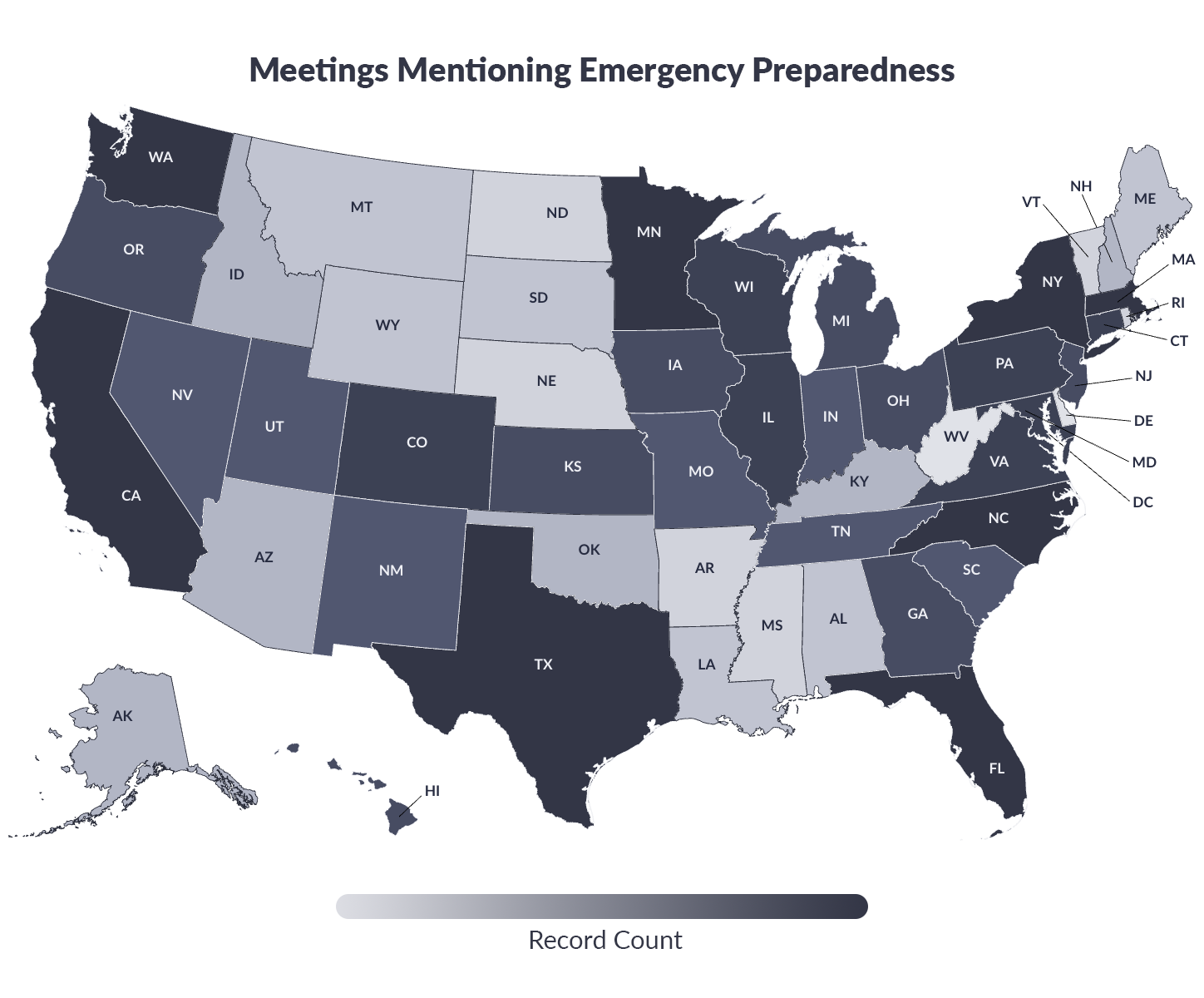

Looking at GovSpend’s Meeting Intelligence database, there were roughly 10,700 meetings in the last 90 days with discussions related to emergency preparedness. The heat map below shows the distribution of those meeting mentions across the US.

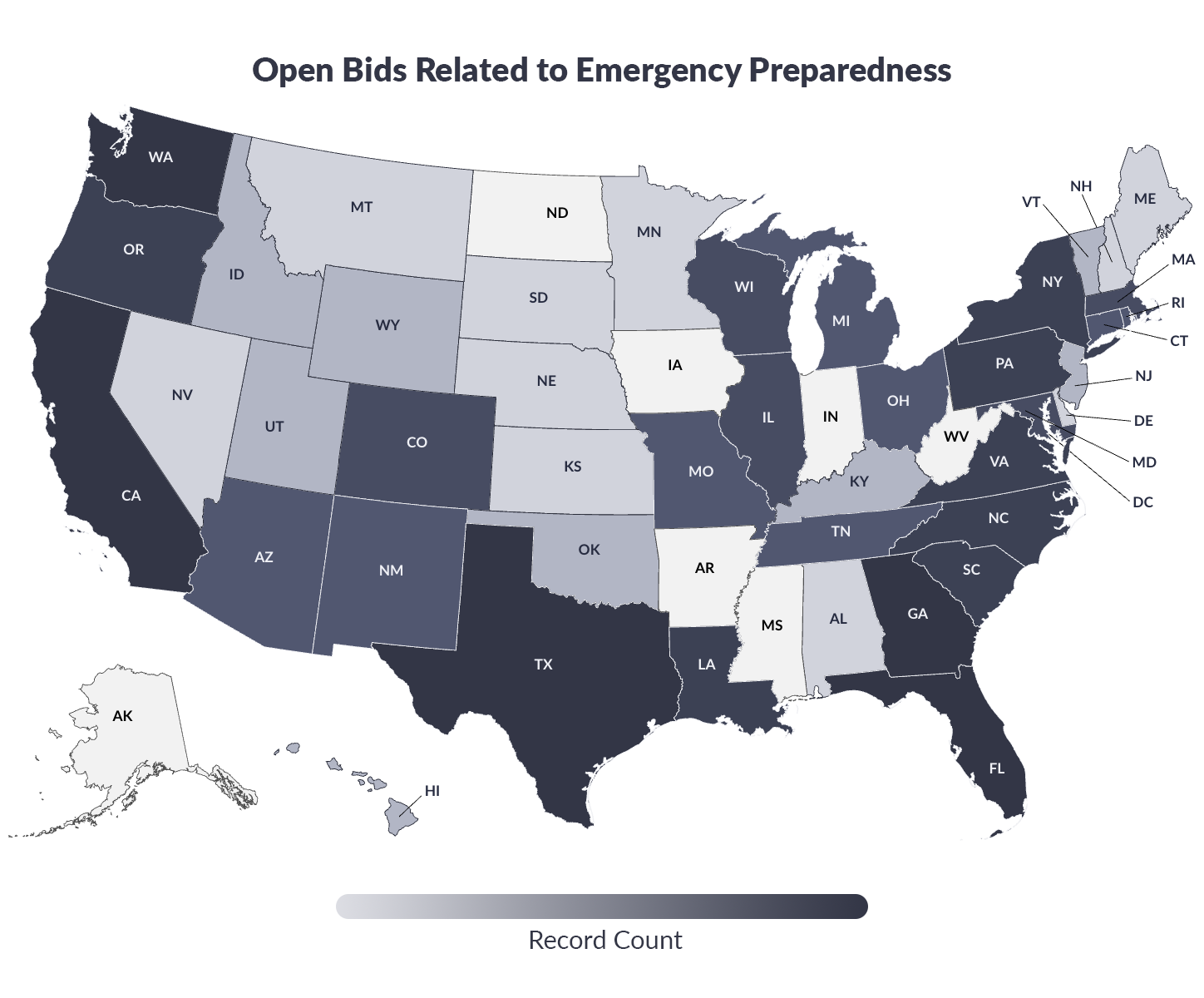

Similarly, reviewing GovSpend’s database of open bids and RFPs, there are roughly 5,300 open solicitations across the United States, with a fairly similar distribution pattern:

Top States for Emergency Preparedness Activity

Further analyzing the data, we’re able to show the top 10 states in terms of both meeting mentions and open bids related to emergency preparedness:

| Top 10 States | Meetings (last 90 days) | Open Bids | Total Meetings & Open Bids |

|---|---|---|---|

| California | 2,193 | 730 | 2,923 |

| Florida | 814 | 580 | 1,394 |

| Texas | 605 | 727 | 1,332 |

| Massachusetts | 446 | 228 | 674 |

| New York | 380 | 185 | 565 |

| Pennsylvania | 270 | 209 | 479 |

| Virginia | 332 | 127 | 459 |

| Illinois | 247 | 210 | 457 |

| Washington | 349 | 99 | 448 |

| North Carolina | 266 | 161 | 427 |

| Grand Total | 5,902 | 3,256 | 9,158 |

Tracking this level of detail enables contractors to align business development efforts with actual local demand, better forecast upcoming opportunities, and stay ahead of the curve.

Final Thoughts: Proactive Moves Contractors Should Make Now

FEMA’s role is evolving, and contractors who stay focused solely on federal opportunities risk missing a broader shift toward local preparedness initiatives.

Now is the time to:

- Assess (or develop) your current footprint in state and local markets

- Adjust your intelligence-gathering strategy to include local meeting data

- Monitor policy developments and emerging needs at every level of government

With the right data and a forward-looking strategy, contractors can stay competitive no matter how FEMA’s future takes shape.

Interested in learning more about how the GovSpend platform’s comprehensive data can help shape your public sector strategy? Connect with a GovSpend team member.