It’s been more than 4 months since the Department of Government Efficiency (DOGE) began its sweeping review of federal spending, resulting in a wave of stop work orders and contract terminations. Companies subject to these terminations are facing the turmoil and legal challenges that come with these actions, and the industry itself is in a state of disruption and uncertainty.

As part of our ongoing series analyzing DOGE-related activity, I’ve looked at the latest data for contracts terminated for convenience from 1/20/25 through 5/30/25 (as reported in FPDS.gov.)

My key takeaways from this analysis were:

- The terminations and stop work orders remain concentrated in non-defense agencies

- Contract savings are modest, as seen with current de-obligations at $1.26B —a fraction (0.2%) of the overall $774B in federal contracts awarded in FY 24

- Less than $3.2B is the de-obligated amount of “base and exercised option value”

- Less than $21B is de-obligated for “base and all option value,” which is the agreed upon total contract or order value including all options, if any (per FPDS.gov)

Agency Analysis: Number of Actions and Dollars De-obligated

Looking at the number of contract actions, GSA leads the agencies with 9,508 actions, followed by HHS at 2,188 and Dept of Defense (which includes Navy, Air Force, DLA) at 1,138 actions.

| Contracting Agency | Sum of Number of Actions | Sum of Obligated Amount | Sum of Base and Exercised Options Value | Sum of Base and All Options Value |

| 4700 – GENERAL SERVICES ADMINISTRATION | 9587 | -$118.43M | -$107.22M | -$140.93M |

| 7500 – HEALTH AND HUMAN SERVICES | 2145 | -$263.17M | -$2,233.85M | -$7,737.36M |

| 9700 – DEPT OF DEFENSE | 1153 | -$102.97M | -$236.18M | -$2,567.56M |

| 7200 – USAID | 1015 | -$148.52M | -$3.01M | -$6.76M |

| 1200 – AGRICULTURE, DEPARTMENT OF | 936 | -$36.53M | -$35.33M | -$117.80M |

| 3600 – DEPARTMENT OF VETERANS AFFAIRS | 617 | -$88.74M | -$88.94M | -$622.96M |

| 2000 – TREASURY, DEPARTMENT OF | 582 | -$33.55M | -$27.32M | -$510.32M |

| 1400 – INTERIOR, DEPARTMENT OF | 521 | -$23.28M | -$75.64M | -$391.56M |

| 7000 – HOMELAND SECURITY | 381 | -$157.93M | -$117.42M | -$4,665.33M |

| 9568 – United States Agency For Global Media, BBG | 337 | -$0.03M | -$0.03M | -$0.31M |

| 1900 – STATE, DEPARTMENT OF | 302 | -$6.16M | -$11.92M | -$52.25M |

| 1300 – COMMERCE, DEPARTMENT OF | 261 | -$13.38M | -$13.85M | -$58.84M |

| 6900 – TRANSPORTATION | 250 | -$18.44M | -$19.83M | -$624.56M |

| 9100 – EDUCATION, DEPARTMENT OF | 246 | -$100.87M | -$20.07M | -$121.41M |

| 8600 – HOUSING AND URBAN DEVELOPMENT | 154 | -$113.58M | -$113.92M | -$180.93M |

| Other Agencies | 1117 | -$38.12M | -$95.03M | -$3,120.32M |

| Grand Total | 19604 | -$1,263.69M | -$3,199.56M | -$20,919.19M |

However, when we shift focus to de-obligated dollars, a different picture emerges. The Dept of Health and Human Services leads with over $263M de-obligated, followed by Homeland Security and USAID.

| Contracting Agency | Sum of Number of Actions | Sum of Obligated Amount | Sum of Base and Exercised Options Value | Sum of Base and All Options Value |

| 7500 – HEALTH AND HUMAN SERVICES | 2145 | -$263.17M | -$2,233.85M | -$7,737.36M |

| 7000 – HOMELAND SECURITY | 381 | -$157.93M | -$117.42M | -$4,665.33M |

| 7200 – AGENCY FOR INTERNATIONAL DEVELOPMENT | 1015 | -$148.52M | -$3.01M | -$6.76M |

| 4700 – GENERAL SERVICES ADMINISTRATION | 9587 | -$118.43M | -$107.22M | -$140.93M |

| 8600 – HOUSING AND URBAN DEVELOPMENT | 154 | -$113.58M | -$113.92M | -$180.93M |

| 9700 – DEPT OF DEFENSE | 1153 | -$102.97M | -$236.18M | -$2,567.56M |

| 9100 – EDUCATION, DEPARTMENT OF | 246 | -$100.87M | -$20.07M | -$121.41M |

| 3600 – DEPARTMENT OF VETERANS AFFAIRS | 617 | -$88.74M | -$88.94M | -$622.96M |

| 1200 – AGRICULTURE, DEPARTMENT OF | 936 | -$36.53M | -$35.33M | -$117.80M |

| 2000 – TREASURY, DEPARTMENT OF | 582 | -$33.55M | -$27.32M | -$510.32M |

| 1400 – INTERIOR, DEPARTMENT OF | 521 | -$23.28M | -$75.64M | -$391.56M |

| 6900 – TRANSPORTATION | 250 | -$18.44M | -$19.83M | -$624.56M |

| 9543 – Millennium Challenge Corporation | 65 | -$15.50M | -$37.70M | -$182.23M |

| 0000 – THE LEGISLATIVE BRANCH | 2 | -$14.49M | -$14.49M | -$14.55M |

| 1300 – COMMERCE, DEPARTMENT OF | 261 | -$13.38M | -$13.85M | -$58.84M |

When we look at the overall agency numbers, it is also important to look at the de-obligations within an agency by bureau or contracting office, which can be done in the Fedmine platform. Understanding spending—or in this case, de-obligations by bureau—will provide us with a deeper comprehension of the administration’s priorities.

Inside HHS: Disproportionate Cuts

Digging deeper into HHS, two bureaus—Centers for Disease Control (CDC) and Administration for Children and Families (ACF)—account for a staggering 90.5% of all terminations by dollar value to date.

| Contracting Agency/Bureau | Sum of Obligated Amount | Sum of Base and Exercised Options Value | Sum of Base and All Options Value |

| 7523 – Centers for Disease Control and Prevention | -$161.67M | -$2,131.41M | -$5,260.93M |

| 7590 – Administration for Children and Families | -$76.46M | -$76.46M | -$2,072.88M |

| 7529 – National Institutes of Health | -$13.15M | -$13.81M | -$258.10M |

| 7527 – Indian Health Service | -$4.95M | -$4.95M | -$8.62M |

| 7524 – Food and Drug Administration | -$4.10M | -$5.24M | -$40.62M |

| 7570 – Office of the Assistant Secretary For Administration (ASA) | -$1.29M | -$1.29M | -$25.40M |

| 7530 – Centers For Medicare and Medicaid Services | -$0.81M | -$0.10M | -$2.60M |

| 7522 – Substance Abuse and Mental Health Services Administration | -$0.48M | -$0.48M | -$0.48M |

| 7526 – Health Resources and Services Administration | -$0.23M | -$0.10M | -$67.72M |

| 7505 – Office of Assistant Secretary For Preparedness and Response | $0.00M | $0.00M | $0.00M |

| 7528 – Agency For Healthcare Research and Quality | $0.00M | $0.00M | $0.00M |

| 7500 – HEALTH AND HUMAN SERVICES | -$263.17M | -$2,233.85M | -$7,737.36M |

Surprisingly, FDA and NIH, which I anticipated would see proportionate reductions, experienced relatively modest cuts. The data is a window into how the terminations are reshaping agency priorities, policies, and federal market dynamics.

Department of Defense: Fewer Cuts Than Expected (So Far)

Given the Defense agencies’ historic share of federal spending, I expected to see higher termination totals. To date, the de-obligations equal less than $103M across 1,153 actions.

| Contracting Agency | Sum of Number of Actions | Sum of Obligated Amount | Sum of Base and Exercised Options Value | Sum of Base and All Options Value |

| 97AS – DEFENSE LOGISTICS AGENCY (DLA) | 798 | -$38.60M | -$38.60M | -$38.67M |

| 5700 – AIR FORCE | 52 | -$29.50M | -$170.61M | -$170.54M |

| 2100 – ARMY | 76 | -$24.04M | -$25.79M | -$39.73M |

| 1700 – NAVY, DEPARTMENT OF | 133 | -$5.77M | $8.79M | -$2,261.04M |

| 97DH – Defense Health Agency (DHA) | 22 | -$1.87M | -$3.57M | -$11.62M |

| 97AK – Defense Information Systems Agency (DISA) | 50 | -$1.59M | -$1.59M | -$24.08M |

| 97F2 – Dept of Defense Education Activity (DODEA) | 5 | -$1.27M | -$1.27M | -$1.27M |

| 9748 – Defense Human Resources Activity | 3 | -$0.23M | -$0.23M | -$0.66M |

| 97F5 – Washington Headquarters Services (WHS) | 4 | -$0.05M | -$0.05M | -$0.05M |

| 97ZS – U.S. Special Operations Command (USSOCOM) | 3 | -$0.05M | -$3.28M | -$19.84M |

| 9761 – Defense Threat Reduction Agency (DTRA) | 2 | $0.00M | $0.00M | -$0.01M |

| 9763 – Defense Contract Management Agency (DCMA) | 4 | $0.00M | $0.00M | $0.00M |

| 97AV – Defense Counterintelligence and Security Agency | 1 | $0.00M | $0.00M | -$0.03M |

| 9700 – DEPT OF DEFENSE | 1153 | -$102.97M | -$236.18M | -$2,567.56M |

It’s important to note that defense spending data typically has a 90-day delay before making it into FPDS, so we may see these numbers increase in the future.

Exploring the Extent of Contract Competition

More than 75% of the contracts that were terminated went through the “full and open competition” process, while less than 7% of the contracts were not available for competition or were not competed.

| Extent of Competition | Sum of Number of Actions | Sum of Obligated Amount |

| A – Full and Open Competition | 9614 | $ (932,324,065.68) |

| D – Full and Open Competition after exclusion of sources | 2088 | $ (139,867,611.65) |

| F – Competed under SAP | 3978 | $ (80,613,821.12) |

| B – Not Available for Competition | 1321 | $ (53,767,938.70) |

| C – Not Competed | 694 | $ (35,038,430.13) |

| G – Not Competed under SAP | 1909 | $ (20,577,717.93) |

| H – Competed | $ (1,500,000.00) | |

| Grand Total | 19604 | $ (1,263,689,585.21) |

Set-Asides and Terminations

Of the $1.26B de-obligated to date, $190M, or 15%, of dollars de-obligated came from contracts that were initially set-asides. Of these terminations:

- 32.5% were small business set-asides

- 31.6% were SDVOSB set-aside awards

- 28.4% were 8(a) sole source awards

| Type of Set-Aside | Sum of Number of Actions | Sum of Obligated Amount | Sum of Base and Exercised Options Value | Sum of Base and All Options Value |

| SBA – Small Business Set-Aside — Total | 1896 | $ (61,766,472.93) | $ (53,649,567.77) | $ (786,688,715.81) |

| SDVOSBC – Service Disabled Veteran Owned Small Business Set-Aside | 291 | $ (60,058,705.11) | $ (60,433,982.34) | $ (555,252,192.82) |

| 8AN – 8(a) Sole Source | 573 | $ (54,011,553.44) | $ (51,006,281.34) | $ (209,874,299.12) |

| 8A – 8A Competed | 52 | $ (7,312,158.39) | $ (9,858,355.57) | $ (2,117,824,957.55) |

| WOSB – Women-Owned Small Business | 99 | $ (2,940,141.20) | $ (11,504,667.96) | $ (45,356,959.71) |

| HZC – HUBZone Set-Aside | 25 | $ (1,300,687.43) | $ (1,300,687.43) | $ (2,922,987.37) |

| SBP – Small Business Set-Aside — Partial | 7 | $ (968,722.40) | $ (968,722.40) | $ (169,903,442.44) |

| EDWOSB – Economically Disadvantaged Women-Owned Small Business | 7 | $ (575,607.10) | $ (575,607.10) | $ (2,078,441.48) |

| SDVOSBS – SDVOSB Sole Source | 36 | $ (436,708.82) | $ (436,708.82) | $ (805,856.47) |

| VSA – Veteran-Owned Set-Aside | 2 | $ (316,726.34) | $ (316,726.34) | $ (316,726.34) |

| BI – Buy Indian | 4 | $ (179,877.63) | $ (179,877.63) | $ (1,871,635.98) |

| WOSBSS – Women Owned Small Business Sole Source | 8 | $ (148,628.55) | $ (972,375.56) | $ (760,953.61) |

| ISBEE – Indian Small Business Economic Enterprise | 6 | $ (44,356.48) | $ (44,356.48) | $ (492,834.48) |

| EDWOSBSS – Economically Disadvantaged Women Owned Small Business Sole Source | 1 | $ – | $ (1,480,488.00) | $ (1,480,488.00) |

| HZS – HUBZone Sole Source | 2 | $ – | $ – | $ (2,047,742.29) |

| VSS – Veteran Owned Sole Source | 2 | $ – | $ – | $ – |

| Total Set-Aside Awards | $ (190,060,345.82) | $ (192,728,404.74) | $ (3,897,678,233.47) |

These terminations are a reminder that even awards under our small business program can be cancelled.

GSA Schedules and IDVs

Approximately $84M of the contracts terminated were awarded on a GSA MAS schedule and were spread across 1,796 actions. In terms of the various GWACs & IDVs, $25.9B of the contracts terminated were awarded on VETS2, followed by $14.5M in terminations of awards on CIO-SP3.

| IDV/GWAC | Sum of Number Of Actions | Sum of Obligated Amount |

| VETS2 | 9 | $ (25,928,247.33) |

| CIO-SP3 | 10 | $ (14,565,679.70) |

| NASA SEWP V | 235 | $ (4,768,016.60) |

| OASIS Unrestricted POOL 2 | 14 | $ (4,640,424.15) |

| VECTOR | 30 | $ (4,166,275.40) |

| DHA MQS | 34 | $ (3,125,385.93) |

| Alliant 2 | 19 | $ (1,829,975.40) |

| OASIS SB POOL 1 | 33 | $ (1,215,836.00) |

| VHA Healthcare Furniture Region 2 | 1 | $ (1,146,337.68) |

| 8(a) Stars III | 16 | $ (1,141,419.97) |

| PSC-Large | 9 | $ (847,418.94) |

| OASIS 8(a) SUB POOL 1 | 10 | $ (573,596.85) |

| OASIS Unrestricted POOL 1 | 32 | $ (331,450.57) |

| VHA Healthcare Furniture Region 4 | 1 | $ (157,316.89) |

| ProTech Oceans | 3 | $ (49,668.63) |

NASA SEWP V, which saw the most number of terminations, accounted for less than $5M in de-obligations!

Closing Thoughts

As we cross the four-month mark of DOGE’s aggressive actions, the data paints a complex picture. The total savings, while material in absolute terms, represent a modest fraction of total federal obligations—and notably, defense-related cuts have been fewer than expected, at least so far.

While agencies like HHS, Homeland Security, and USAID have absorbed the brunt of de-obligations, it is important to delve into data elements such as the bureau level, set-aside type, and competition side that provide insights into shifting agency priorities and policy directions.

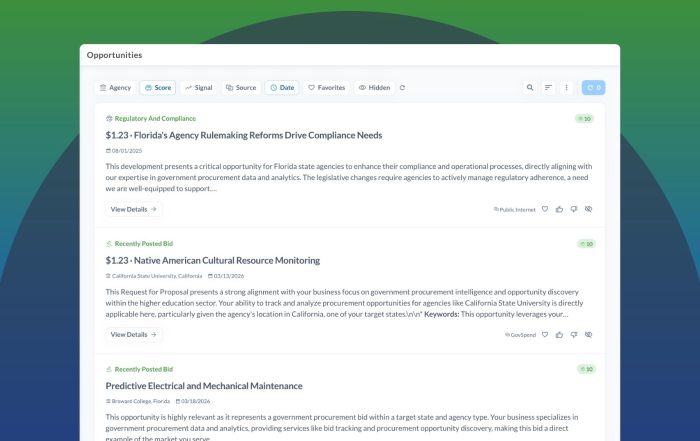

Maintaining real-time awareness of where dollars are being pulled back—and where they aren’t—will be vital for business development as we prepare for Q4 of FY25. Using data from Fedmine, GovSpend’s federal solution, makes it easy to analyze these trends and uncover the best opportunities to steer your sales strategy.

Stay tuned as we continue to track and report on these developments in the months ahead.