The creation of the Department of Government Efficiency (DOGE) — aimed at “modernizing Federal technology and software to maximize governmental efficiency and productivity” — at the beginning of the year triggered a wave of unexpected cancellations and terminations of awards across agencies. At the same time, a flurry of executive orders signaled significant changes in procurement policies. These include:

- “Restoring Common Sense to Federal Procurement,” which calls for the rewrite of the FAR (Federal Acquisition Regulation)

- “Eliminating Waste and Saving TaxPayer Dollars by Consolidating Procurement,” which calls for consolidating domestic procurement under the General Services Administration (GSA)

- “Ensuring Commercial, Cost-Effective Solutions in Federal Contracts,” which calls for the procurement of commercially available products and services.

These directives are further echoed in departmental guidance as well. The recent Office of Management Budget (OMB) memo, dated July 18th, 2025, on “consolidating federal procurement activities” calls for OMB and GSA to work closely with agencies, “to significantly increase consolidation efforts in an orderly manner that fully leverages GSA’s expertise and statutory role as the Federal Government’s core buyer for addressing prevalent and repetitive needs”.

While these policy shifts are substantial, they’re not purely theoretical — we’re already seeing the operational impacts. In recent months, major contract vehicles such as the Department of Homeland Security’s PACTS III have been cancelled, and DHS has also announced that it will not proceed with the FirstSource III vehicle.

While this is definitely news worthy, those who have been paying attention to trends would have noticed a relatively quiet shift over the years to an increased use of GSA schedules and GWACs/IDIQs.

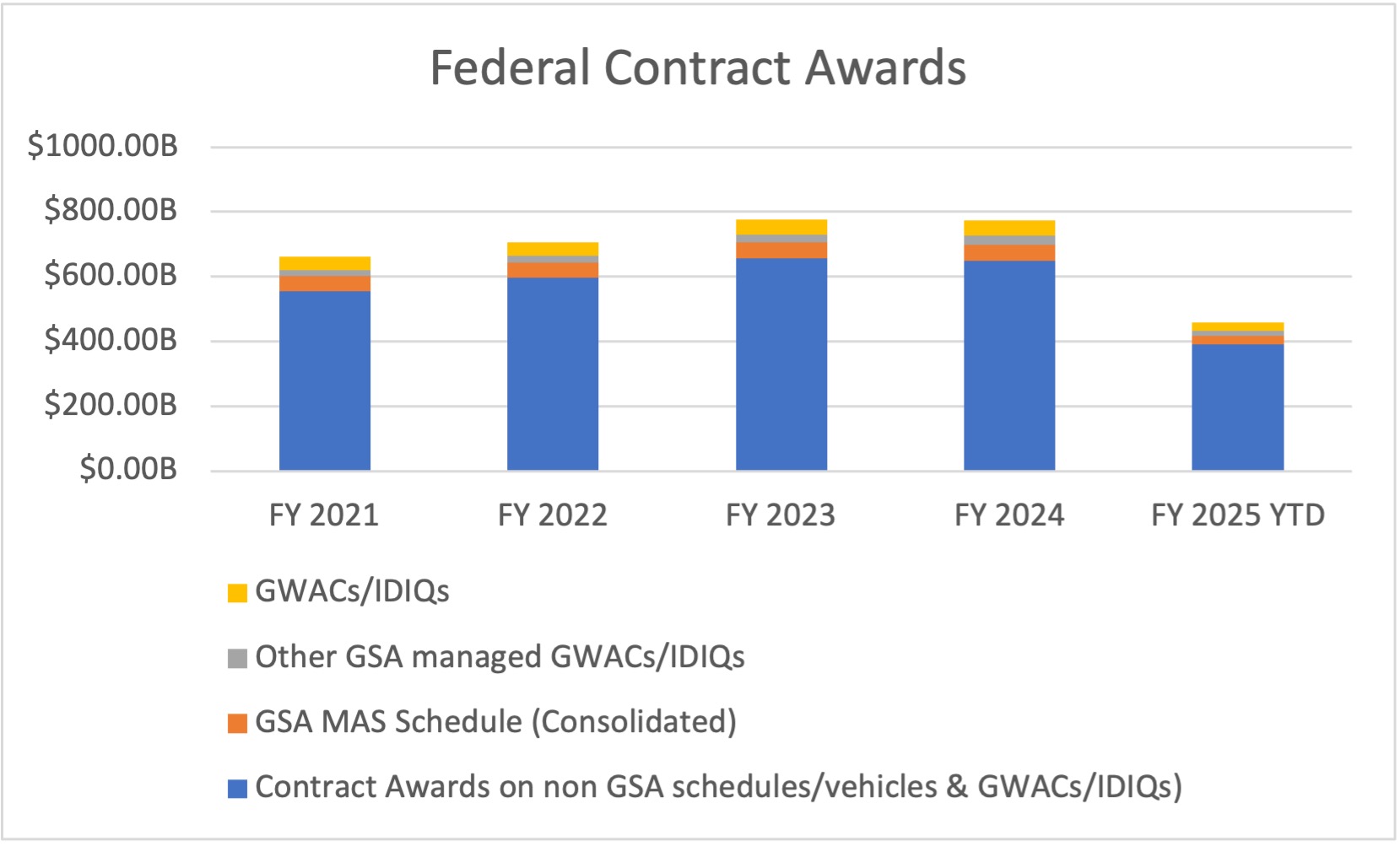

Year-to-Date (YTD), the federal government has awarded $457.9B in contracts, well on pace as compared to $774.9B for FY24. It is important to note that there’s typically a 90-day delay in the defense federal contracts being made public, so the actual YTD FY 25 obligation is much higher. With less than 2 months left before the end of fiscal year (FY) 25, it is worth examining the procurement trends across the various vehicles and schedules.

GSA Schedules & GWACs/IDIQs: Growing Share of Federal Spend

In FY24, GSA Schedules and other major contract vehicles accounted for $126.5 billion—or 16.3%—of total federal contract awards. That’s up from $106.2 billion in FY21.

| FY 2021 | FY 2022 | FY 2023 | FY 2024 | FY 2025 YTD | |

| Contract Awards on non-GSA schedules/vehicles & GWACs/IDIQs) | $555.40B | $596.96B | $655.83B | $648.35B | $390.26B |

| GSA MAS Schedule (Consolidated) | $46.56B | $46.07B | $49.92B | $51.12B | $27.52B |

| Other GSA-managed GWACs/IDIQs | $18.93B | $21.75B | $24.80B | $26.52B | $14.29B |

| GWACs/IDIQs | $40.80B | $41.88B | $46.46B | $48.91B | $25.91B |

| Total Federal Contract Awards | $661.68B | $706.66B | $777.01B | $774.91B | $457.98B |

The use of GSA Schedules, consolidated under Multiple Award Schedule (MAS), reached $51.12B in FY24, up from $46.56B in FY21, and averages at 6.6% of total federal contract awards. We have also seen an increase in the use of both GSA-managed, as well as other agency GWACs, and IDIQs over the years.

An analysis of the awards on the top 20 Schedules/GWACs/IDIQs provides a better insight into the use of these vehicles.

| GSA Schedule/GWAC/IDIQ | FY 2021 | FY 2022 | FY 2023 | FY 2024 | FY 2025 |

| GSA MAS Schedule (Consolidated) | $46.56B | $46.07B | $49.92B | $51.12B | $27.52B |

| NASA SEWP V | $8.73B | $9.22B | $10.61B | $10.71B | $5.94B |

| Alliant 2 | $4.09B | $6.06B | $7.91B | $10.22B | $6.45B |

| OASIS | $5.78B | $6.64B | $7.91B | $8.67B | $3.83B |

| Seaport-NXG | $2.39B | $3.99B | $5.57B | $7.38B | $3.85B |

| OASIS SB | $4.08B | $4.70B | $5.06B | $5.12B | $2.80B |

| IAC MAC Pool 1 | $1.52B | $2.21B | $3.01B | $3.56B | $1.61B |

| DLA SOE TLSP | $1.26B | $2.04B | $2.82B | $3.17B | $1.20B |

| CIO-SP3 | $3.51B | $3.53B | $3.11B | $3.12B | $1.80B |

| T4NG | $2.62B | $2.60B | $2.80B | $2.64B | $1.11B |

| NASA SEWP | $1.80B | $1.83B | $1.89B | $1.84B | $1.53B |

| ATSP4 | $0.86B | $0.71B | $1.08B | $1.19B | $0.24B |

| CIO-SP3 SB | $1.43B | $1.38B | $1.28B | $1.12B | $0.64B |

| ITES-3S | $0.56B | $0.69B | $0.77B | $0.95B | $0.52B |

| RS3-SB | $0.71B | $0.77B | $0.77B | $0.79B | $0.40B |

| DHA MQS | $0.91B | $0.86B | $0.95B | $0.79B | $0.54B |

| SPARC | $0.79B | $0.74B | $0.79B | $0.74B | $0.60B |

| DLA JETS | $0.53B | $0.62B | $0.68B | $0.74B | $0.47B |

| 8ASTARS3 | $0.06B | $0.32B | $0.54B | $0.74B | $0.52B |

| OASIS 8A | $0.13B | $0.35B | $0.54B | $0.65B | $0.40B |

| Awards on GSA & GWACs | $106.29B | $109.70B | $121.17B | $126.55B | $67.72B |

Key Observations:

- In FY 24, the top 10 vehicles, including the MAS schedules, accounted for $105B, or 83.5%, of the awards on Schedules/GWACs/IDIQs.

- GSA’s MAS schedule remains the most used vehicle, comprising 18% of the total awards on Schedules & GWACs/IDIQs

- NASA SEWP V is the second most used vehicle, at $10.7B, or 8.4%, of the awards

- Alliant 2, managed by GSA, continues its growth trajectory, increasing from $4B in FY 21 to $10.7B in FY 24, where it accounted for 8% of the total awards

- GSA’s OASIS vehicles are also popular within the federal agencies. OASIS unrestricted, small business, and 8a pools accounted for $14.4B in FY 24, up from $13.5B in FY 23

So, how did the Small Business and 8A vehicles do?

The importance of establishing a schedule or securing a vehicle is well understood by small businesses, many of which invest valuable resources to secure the contract. The true challenge, however, is winning task orders for these vehicles. Below, we take a look at the use of small businesses and 8a vehicles.

| Schedule | FY 2021 | FY 2022 | FY 2023 | FY 2024 | FY 2025 |

| OASIS SB | $4,076.44M | $4,701.24M | $5,060.91M | $5,116.36M | $2,797.01M |

| 8ASTARS3 | $61.28M | $319.35M | $539.37M | $735.80M | $519.93M |

| OASIS 8A | $128.27M | $345.50M | $540.81M | $648.22M | $397.61M |

| HCATS SB | $77.02M | $104.51M | $260.99M | $206.49M | $105.77M |

| 8ASTARS2 | $1,392.87M | $872.89M | $492.24M | $128.47M | -$15.15M |

| HCATS 8A | $21.56M | $43.44M | $61.66M | $82.16M | $52.64M |

| ALLIANT SB | $388.25M | $208.55M | $130.23M | $12.54M | $3.40M |

| 8ASTAR | $0.19M | -$0.07M | -$0.01M | -$0.02M | $0.00M |

| Total Combined | $6,145.88M | $6,595.4M | $7,086.19M | $6,930.02M | $3,861.20M |

- OASIS SB is the most popular vehicle used for small business awards, out of all vehicles with specific small business and 8A pools

- We see an increased use of 8A STARS3 as it replaces 8ASTARS2

- OASIS 8A pool has also seen an increase from $128M in FY 21 to $648M in FY 24

- While these small business and 8A pools account for 6% of the total awards on GSA Schedules and GWACs, they account for less than 1% of the total federal contract awards

Oasis+

One Acquisition Solution for Integrated Services Plus, or OASIS+ contracts, are multiple award contracts created to “support federal agencies’ procurement requirements for services-based solutions.” This suite of contracts includes the scope of the OASIS contracts, HCaTS, Building Maintenance & Operations, and expands the range of services available for acquisition. Initial numbers indicate that we will see robust activity on this suite of contracts.

| GSA Schedule/GWAC/IDIQ | FY 2024 | FY 2025 – YTD |

| OASIS+ SDVOSB | $860,000.00 | $11,392,474.16 |

| OASIS+ WOSB | $770,000.00 | $939,172.98 |

| OASIS+ HUBZone | $282,500.00 | $0.00 |

| OASIS+ 8(a) | $0.00 | $5,137,532.79 |

| OASIS+ SB | $0.00 | $10,212,029.52 |

| OASIS+ Unrestricted | $0.00 | $15,558,121.09 |

GSA Awards: Small Business vs. Other than Small

The numbers are consistent with the data we’ve analyzed so far, with less than 50% of the awards on GSA schedules awarded as small business.

| Small Business | Other than Small Business | |

| FY 24 | 45.56% | 54.44% |

| FY 23 | 46.70% | 53.30% |

| FY 22 | 47.35% | 52.65% |

| FY 21 | 46.16% | 53.84% |

As we look to the future of procurement, category management and the use of Best in Class (BIC) vehicles (introduced in 2016), paired with the recent changes in policies, will only accelerate a shift that has been building quietly over the past several years — one that prioritizes the use of BIC vehicles and centralized buying power. So what does the future hold? In my opinion, we will see:

- Increased use of GSA Schedules

- Consolidation of agency-specific vehicles (like PACTs, FirstSource, and others) to GSA Schedules and other BIC vehicles

- Rise in the use of OASIS+ vehicles, with the sunset of OASIS, and increased flexibility of OASIS+ vehicles

- Greater difficulty for small businesses to compete without strategic partnerships

- Expanded teaming, subcontracting, and joint ventures as pathways to vehicle access and task order success

Final Thoughts

In today’s federal contracting environment, it’s not just about having the right product or service—it’s also about having the right contract vehicle strategy. Businesses, especially small and relatively new to federal contracting, must continually assess how they access the market — whether through direct contract awards or by aligning with primes on key schedules and GWACs.

Note: The data referenced in this piece is as of 8/5/25 and is sourced from GovSpend’s federal solution, Fedmine.

For more information about accessing GovSpend’s public sector market intelligence for your procurement strategies, click here.