In FY25, the federal government spent $833.83B —an increase of $50B or 7.47%—over FY24 when federal spending reached $774B. While the early trends suggested FY25 spending would track closely to FY24, and that DOGE-related cuts would not materially reduce overall spend, the final figure exceeded expectations, pushing the federal contracts awarded to a new peak of $833.8B! (This number includes Other Transaction awards)

While the overall number of contracts awarded increased, the number of companies winning work declined to 105,044 from 108,899 companies in FY24 – a trend that we continue to see over the years.

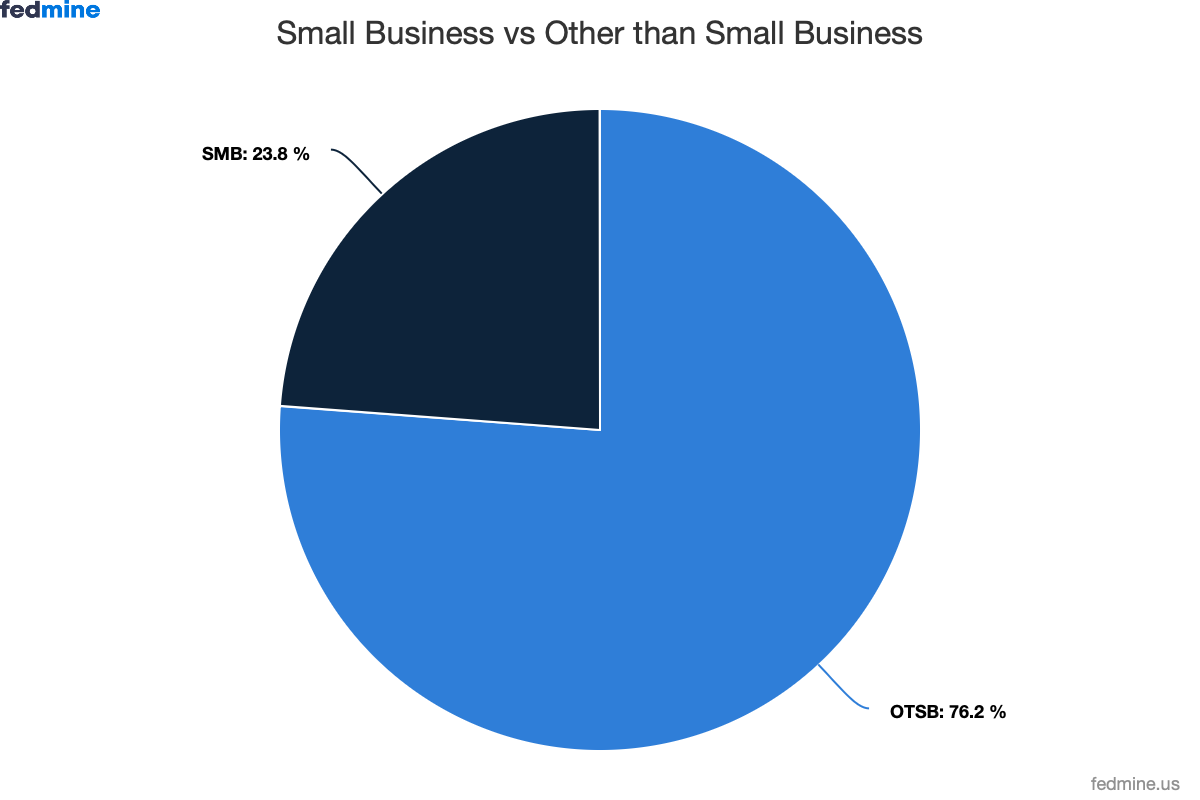

$194.13B, or 23.8%, of contracts were awarded as small business awards to 76,270 companies. Other than Small Business contracts accounted for $621.55B, which were awarded to 38,559 companies.

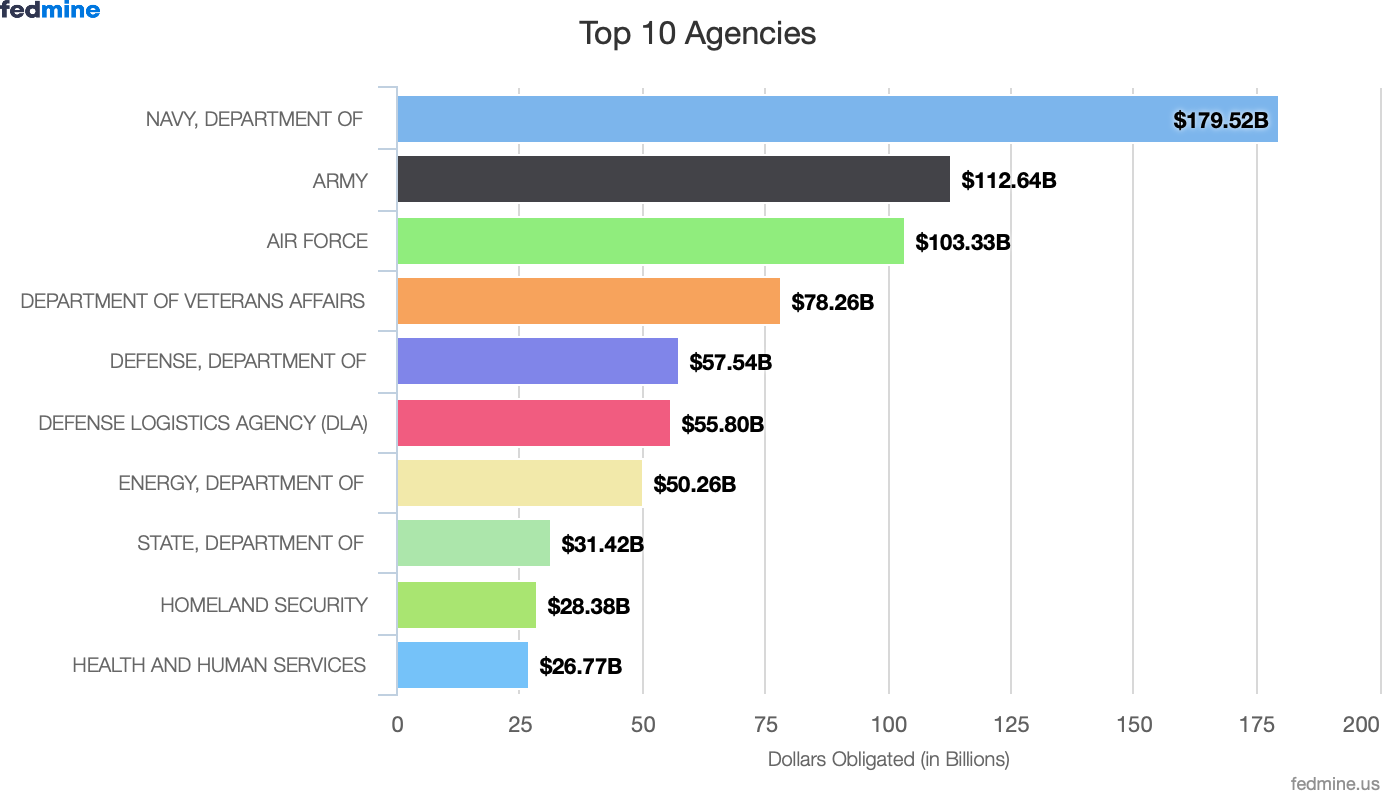

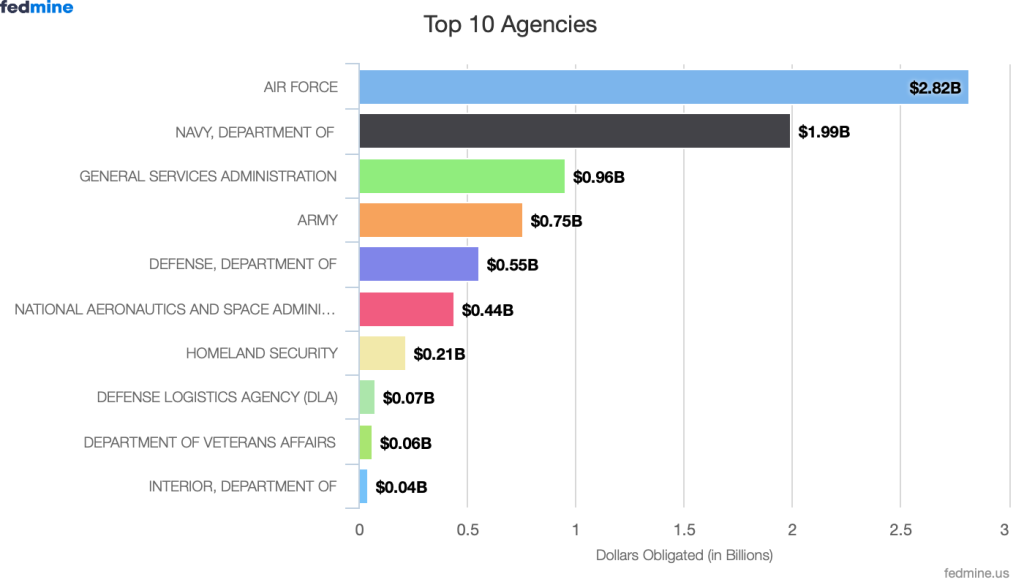

Agency Spend

The top awarding agencies reflect a good mix of agencies led by the Department of the Navy, the Army, and the Air Force. On the civilian and independent side, we also see the Department of Veterans Affairs, Department of Energy, Department of Homeland Security, and Department of Health and Human Services.

As expected, defense agencies accounted for $508.8B, or 61%, of the total contracts awarded— a 9.6% increase over defense spend in FY24.

By looking at agency-level spending, we can understand where growth occurred, which organizations were driving the increase, and how these shifts affected federal procurement.

Agencies with Increased Spending:

In FY25, 22 agencies had higher contract obligations – an increase of $90.8B in overall federal contracts.

- The Department of the Navy saw the biggest increase in contract awards of $41.2B

- The Dept of State showed an increase of $19B in FY25; however, there are deobligations in FY26, which likely relate to FY25 numbers

- The Department of Veterans Affairs saw a 17% increase over FY24, with total spend reaching $78.2B

- Homeland Security saw a 20% increase with FY25 spend reaching $28.3B—$4.7B over FY24 spend

Note: It is important to note that there are de-obligations at the Dept of State totalling $20.8B that occurred in FY26, and could be related to FY25 awards. However, to preserve data integrity and reflect the information available at the time of this analysis, no adjustments have been made to the data presented here.

| Agency (Funding) | FY 2024 | FY 2025 | Increase/Decrease ($) | %age increase/decrease |

| 1700 – NAVY, DEPARTMENT OF | $138,314,641,785 | $179,521,683,759 | $41,207,041,974 | 29.79% |

| 1900 – STATE, DEPARTMENT OF | $11,867,843,474 | $31,419,775,043 | $19,551,931,569 | 164.75% |

| 3600 – DEPARTMENT OF VETERANS AFFAIRS | $66,900,651,908 | $78,256,329,941 | $11,355,678,032 | 16.97% |

| 2100 – ARMY | $102,170,609,709 | $108,490,137,986 | $6,319,528,277 | 6.19% |

| 7000 – HOMELAND SECURITY | $23,654,206,251 | $28,377,610,304 | $4,723,404,053 | 19.97% |

| 97AS – DEFENSE LOGISTICS AGENCY (DLA) | $53,141,611,058 | $55,798,932,944 | $2,657,321,886 | 5.00% |

| 8900 – ENERGY, DEPARTMENT OF | $47,671,100,922 | $50,261,963,253 | $2,590,862,330 | 5.43% |

| 8000 – NATIONAL AERONAUTICS AND SPACE ADMINISTRATION | $21,351,597,334 | $22,776,489,539 | $1,424,892,205 | 6.67% |

| 6900 – TRANSPORTATION | $9,284,260,336 | $9,890,807,326 | $606,546,990 | 6.53% |

| 9700 – DEFENSE, DEPARTMENT OF | $57,170,636,522 | $57,534,923,808 | $364,287,286 | 0.64% |

| 8300 – Export-Import Bank of the U.S. | $42,250,362 | $52,150,530 | $9,900,168 | 23.43% |

| 6000 – Railroad Retirement Board | $35,628,632 | $43,006,157 | $7,377,525 | 20.71% |

| 9508 – National Transportation Safety Board | $22,449,913 | $29,684,092 | $7,234,179 | 32.22% |

| 9000 – Selective Service System | $1,549,945 | $4,415,190 | $2,865,245 | 184.86% |

| 5300 – The Institute of Museum and Library Services | $9,514,999 | $11,858,491 | $2,343,492 | 24.63% |

| 9511 – The Council of the Inspectors General On Integrity and Efficiency | $2,175,916 | $4,373,104 | $2,197,188 | 100.98% |

| 9516 – Defense Nuclear Facilities Safety Board | $4,504,542 | $5,948,545 | $1,444,003 | 32.06% |

| 3400 – International Trade Commission | $16,332,509 | $17,764,893 | $1,432,384 | 8.77% |

| 7400 – American Battle Monuments Commission | $0 | $278,000 | $278,000 | ! |

| 6300 – National Labor Relations Board | $25,714,994 | $25,930,487 | $215,493 | 0.84% |

| 4340 – National Endowment for the Humanities | $1,734,163 | $1,944,433 | $210,270 | 12.13% |

| 5400 – Federal Labor Relations Authority | $1,480,852 | $1,616,656 | $135,804 | 9.17% |

Agencies with a Decrease in Spending:

- 49 Agencies saw their spending decrease by $32.8B in FY25, with the Department of Health & Human Services seeing the largest dollar cut of almost $10B, or 27% of the total spend.

- Interestingly, a few defense agencies saw their spending decrease. USACE’s spending (by funding agency) was reduced by almost $4B compared to FY24

- USAID saw a decrease of $4.3B, a 44% decrease compared to FY24

- The Department of Housing & Urban Development saw a decrease of $2.8B, namely on deobligations to companies that were master sub servicers

Below are the 20 agencies that saw the largest decreases.

| Agency (Funding) | FY 2024 | FY 2025 | Increase/Decrease ($) | % Increase/Decrease |

| 7500 – HEALTH AND HUMAN SERVICES | $36,759,999,128 | $26,772,521,147 | ($9,987,477,980) | -27.17% |

| 96CE – US ARMY CORPS OF ENGINEERS – Civil programs | $8,116,875,420 | $4,139,334,423 | ($3,977,540,997) | -49.00% |

| 7200 – AGENCY FOR INTERNATIONAL DEVELOPMENT | $7,479,610,728 | $4,164,252,979 | ($3,315,357,749) | -44.33% |

| 8600 – HOUSING AND URBAN DEVELOPMENT | $1,522,570,566 | ($1,329,903,557) | ($2,852,474,122) | -187.35% |

| 4700 – GENERAL SERVICES ADMINISTRATION | $26,950,259,898 | $24,852,951,246 | ($2,097,308,652) | -7.78% |

| 1200 – AGRICULTURE, DEPARTMENT OF | $11,616,938,013 | $9,650,539,702 | ($1,966,398,311) | -16.93% |

| 5700 – AIR FORCE | $105,190,367,353 | $103,333,372,459 | ($1,856,994,894) | -1.77% |

| 1400 – INTERIOR, DEPARTMENT OF | $8,334,142,646 | $6,829,931,335 | ($1,504,211,311) | -18.05% |

| 1300 – COMMERCE, DEPARTMENT OF | $5,187,855,167 | $4,159,277,069 | ($1,028,578,098) | -19.83% |

| 1500 – JUSTICE, DEPARTMENT OF | $9,568,513,017 | $8,712,157,709 | ($856,355,308) | -8.95% |

| 2000 – TREASURY, DEPARTMENT OF | $9,263,547,618 | $8,521,079,804 | ($742,467,813) | -8.01% |

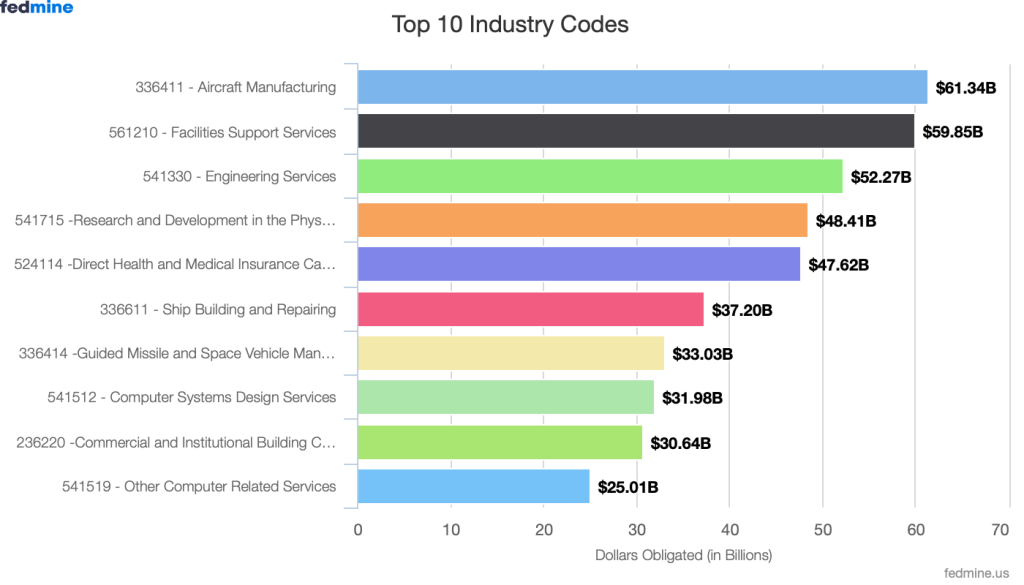

Top Industries:

The top five industry categories account for more than 65% of total spending. Facilities & Construction represent the largest share, at 18% of the total contracts awarded. This is followed by Professional Services and Aircrafts, Ships/Submarines & Land Vehicles. Contracts awarded as small business awards vary by category. 39% of contracts were awarded as small business contracts in the Facilities & Construction category, 36% in the IT category, and 28% in the Professional Services category.

Aircraft Manufacturing, Facilities Support Services, and Engineering Services are in the top 10 NAICS codes, which align closely to the top categories.

Use of GSA Schedules and GWACs/IDIQs

Various initiatives within the federal government, specifically around the consolidation of federal procurement activities, are expected to contribute to an increased use of GSA vehicles and the various GWACs/IDIQs already in place. This change is also likely to result in the consolidation of some of these agency-specific vehicles to GSA schedules/GWACs.

GSA Schedule: The use of GSA schedules continues to grow, with more than $38B in contract awards on the GSA MAS schedules in FY25 across a broad range of industry codes.

GWACs/IDIQs: In FY25, $72.4B, or 8.6% of the total federal contracts, were awarded on various GWACs/IDIQs. The top vehicle used is the NASA SEWP V, which accounts for 15.4%, or $11.16B, of the total awards on vehicles. Other consistently used vehicles include Alliant 2, Seaport NXG, OASIS, CIO-SP3, and T4NG. Collectively, the top five vehicles accounted for 52% of the total awards on the various GWACs/IDIQs, highlighting a strong concentration of spending within this small set of vehicles.

| Top GWACs/IDIQs | FY 2024 | % | FY 2025 | % |

| NASA SEWP V | $10,724,428,117 | 14.09% | $11,156,981,800 | 15.41% |

| Alliant 2 | $10,236,083,074 | 13.44% | $10,255,485,576 | 14.17% |

| Seaport-NXG | $7,376,587,659 | 9.69% | $8,453,708,924 | 11.68% |

| OASIS Unrestricted POOL 1 | $5,894,282,541 | 7.74% | $4,315,821,540 | 5.96% |

| IAC MAC Pool 1 | $3,565,410,048 | 4.68% | $3,465,935,785 | 4.79% |

| DLA SOE TLSP | $3,168,855,841 | 4.16% | $3,335,057,300 | 4.61% |

| CIO-SP3 | $3,122,035,649 | 4.10% | $2,700,527,628 | 3.73% |

| NASA SEWP | $1,835,687,971 | 2.41% | $2,000,031,970 | 2.76% |

| T4NG | $2,644,799,193 | 3.47% | $1,699,498,930 | 2.35% |

| OASIS SB POOL 6 | $1,399,206,867 | 1.84% | $1,593,707,462 | 2.20% |

| OASIS SB POOL 1 | $1,989,624,021 | 2.61% | $1,446,682,432 | 2.00% |

| ATSP4 | $1,193,620,262 | 1.57% | $1,091,448,063 | 1.51% |

| OASIS Unrestricted POOL 3 | $1,443,726,237 | 1.90% | $1,067,166,519 | 1.47% |

| RS3-SB | $791,444,701 | 1.04% | $984,821,241 | 1.36% |

| ITES-3S | $953,384,983 | 1.25% | $947,168,553 | 1.31% |

| CIO-SP3 SB | $1,116,591,778 | 1.47% | $937,768,067 | 1.30% |

| OASIS SB POOL 5B | $839,034,777 | 1.10% | $863,666,691 | 1.19% |

| ASTRO – DEVSI | $374,598,451 | 0.49% | $828,033,881 | 1.14% |

| DHA MQS | $790,698,749 | 1.04% | $736,091,777 | 1.02% |

| 8(a) Stars III | $735,821,379 | 0.97% | $726,661,048 | 1.00% |

| GRAND TOTAL | $76,140,663,814 | $72,395,588,798 |

Other Transaction Authority (OTA)

We continue to see the use of OTAs, specifically by the defense agencies. In FY 25, OTAs accounted for $18.2B of awards, compared to $18.5B in FY24.

1,347 companies were awarded OTA contracts, with Advanced Technology International winning the most at $3.95B in awards. National Security Technology Accelerator, the Consortium Management Group, Northrop Grumman, and Anduril Industries round out the top 5 companies winning OTAs and account for $7.28B in OTA awards, or 39.5% of the OTA awards made in FY25.

| Company Name | OTA Awards |

| ADVANCED TECHNOLOGY INTERNATIONAL | $3.95B |

| NATIONAL SECURITY TECHNOLOGY ACCELERATOR | $1.50B |

| CONSORTIUM MANAGEMENT GROUP, INC. | $758.64M |

| NORTHROP GRUMMAN SYSTEMS CORPORATION | $711.78M |

| ANDURIL INDUSTRIES, INC. | $364.13M |

| L3HARRIS TECHNOLOGIES, INC. | $318.62M |

| YORK SPACE SYSTEMS LLC | $279.56M |

| MILLENNIUM SPACE SYSTEMS, INC. | $265.89M |

| LOCKHEED MARTIN CORP | $250.87M |

| SARONIC TECHNOLOGIES, INC | $229.94M |

| SHELTERED WINGS, INC. | $227.36M |

Advanced Technology International, National Security Technology Accelerator, and the Consortium Management Group are all consortia. Consortia typically function as a partnership between the federal government and technology providers within a defined mission or capability area.

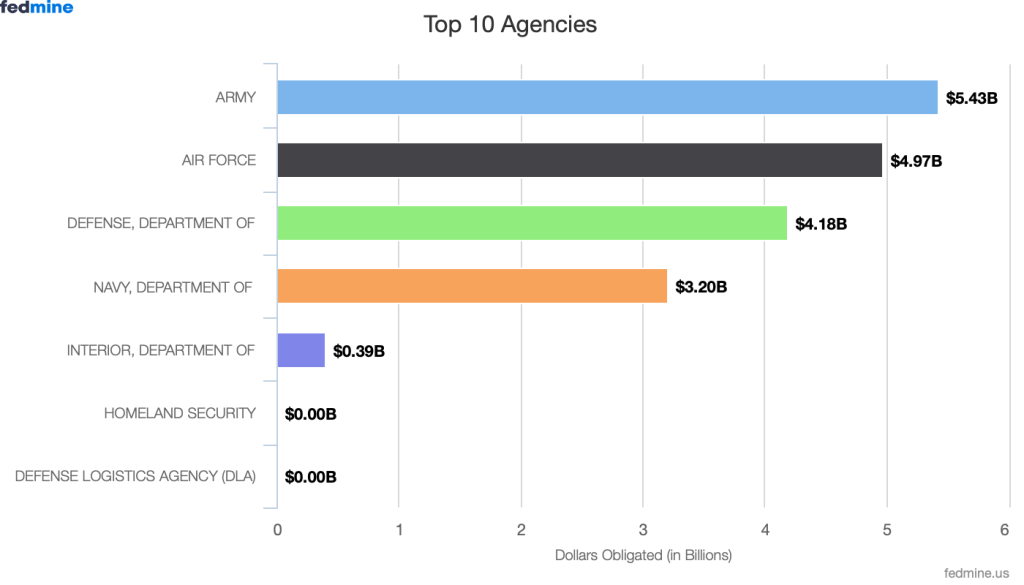

Small Business Innovation Research (SBIR) & Small Business Technology Transfer (STTR)

SBIR & STTRs are programs that help fund early-stage technology development, typically for small businesses. Over the years, we have seen the use of these programs increase, with SBIR/STTR contracts reaching $8.06B in FY25, compared to $7.4B in FY24. Consistently used by defense and non-defense agencies, the program has currently lapsed as of October 1, 2025.

In addition to the Department of the Air Force, the Department of the Navy, and the Army, we also see non-defense agencies, such as the GSA, NASA, Department of Homeland Security, and the Department of Veterans Affairs, in the top 10 agencies awarding SBIR/STTR contracts.

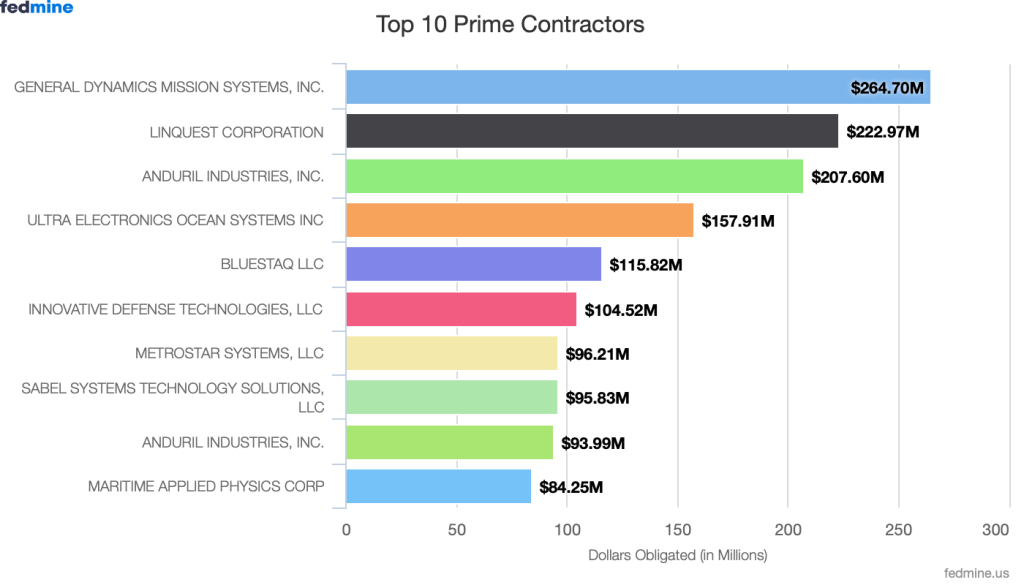

Top companies winning these awards include General Dynamics, Linquest, and Anduril Industries (which is also on the list of top 10 companies winning OTAs).

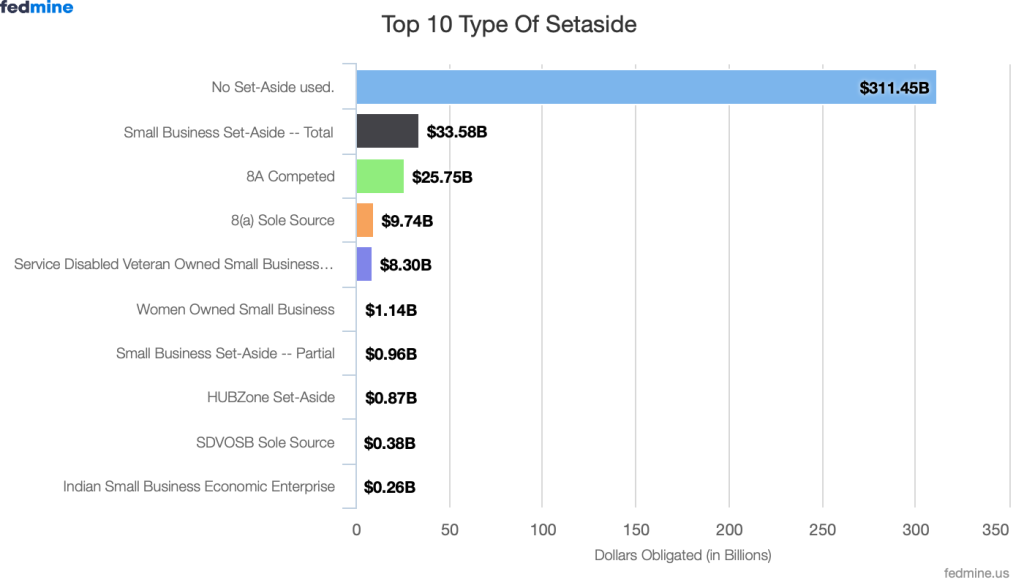

Use of Set-Asides

Set-asides are commonly used by agencies and contracting officers to ensure that a fair share of federal contract awards within each industry is directed to small businesses and to support agency-specific socioeconomic objectives. Awards to small businesses are not limited to set-aside procurements; agencies may and do award contracts to small businesses without the use of any set-asides.

In FY25, $33.58B was awarded as Small Business Set-Asides. The use of 8(a) Sole Source & Competitive set-asides totaled $35.49B, or 4.26%, of the total federal awards, and SDVOSB set-asides were at $8.68B, or 1.04%, of the total spend.

It will be important to be aware of changes in the use of set-asides in federal contracting, given the current environment and scrutiny of the 8(a) program.

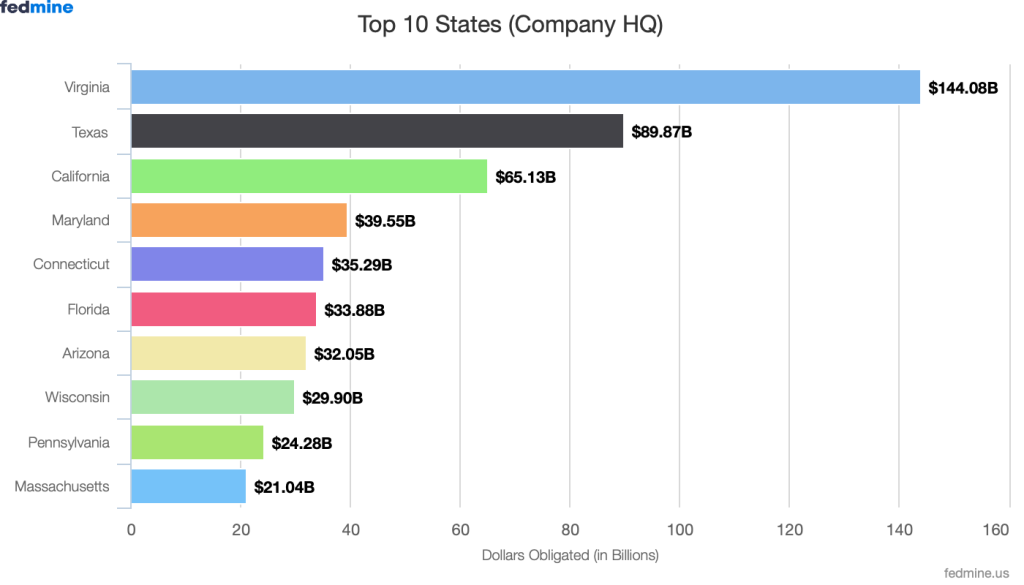

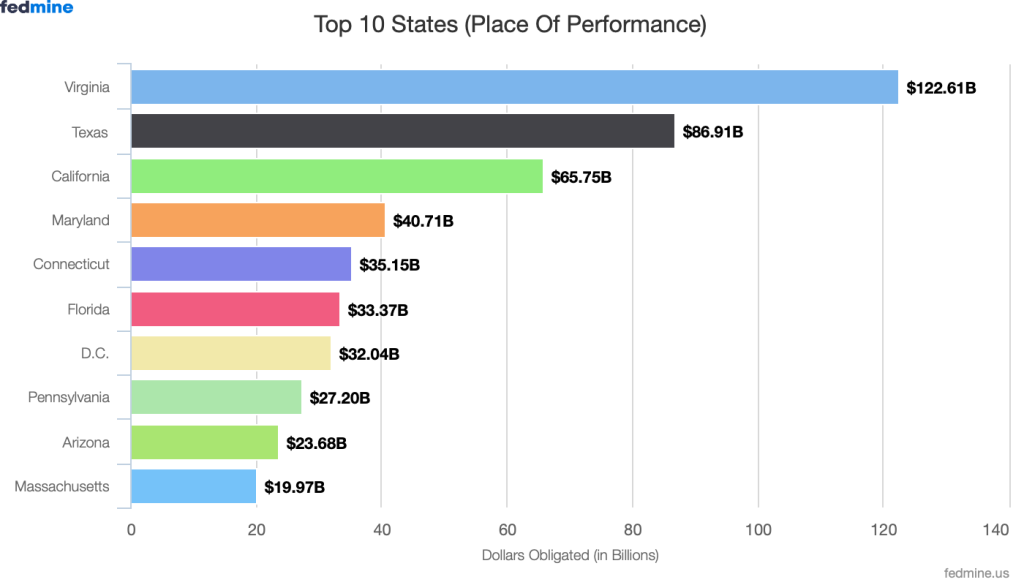

Top States

In terms of top states by Company HQ and Place of Performance, Virginia takes the top spot. Maryland, Texas, California, and Connecticut round out the top five.

Top Companies

Looking at the companies rolled up by the parent company, based on SAM UEI, it is no surprise to see Lockheed Martin, Raytheon, General Dynamics, Boeing, and Northrup Grumman in the top companies winning awards in FY25.

| UEI | Company Name | Obligated Amount |

| ZFN2JJXBLZT3 | LOCKHEED MARTIN CORPORATION | $73.67B |

| EGAVSJTA2D81 | RAYTHEON COMPANY | $33.96B |

| GVW2YMAK1AC1 | UNITEDHEALTH GROUP | $25.41B |

| VF58HFRNGEL8 | GENERAL DYNAMICS CORP | $23.43B |

| NU2UC8MX6NK1 | THE BOEING COMPANY | $23.11B |

| NKVZLJL93QT6 | NORTHROP GRUMMAN CORPORATION | $14.83B |

| J7M9HPTGJ1S9 | TRIWEST HEALTHCARE ALLIANCE CORPORATION | $13.37B |

| ZL41ERXMPAR3 | LEIDOS HOLDINGS, INC. | $12.64B |

| FAZSFFE6CST9 | GENERAL DYNAMICS – OTS INC. | $12.51B |

| JTAPCFM4NSL4 | MCKESSON CORPORATION | $11.94B |

| F9SDJAZFTLG6 | HUNTINGTON INGALLS INDUSTRIES, INC | $11.23B |

| SJULQDJ8NZU7 | L3HARRIS TECHNOLOGIES, INC | $8.72B |

| MBPHTU7Y9S65 | BOOZ ALLEN HAMILTON HOLDING CORPORATION | $7.84B |

| HPDLRXR4FYX5 | BAE SYSTEMS AUSTRALIA HOLDINGS LIMITED | $7.70B |

| GTXTRMLFL9U7 | AMERISOURCEBERGEN CORPORATION | $7.43B |

The top 15 companies accounted for almost 35%, or $287.7B, of the total federal contracts obligated in FY25.

It is also interesting to note that 78,039 companies had obligations of less than $1M; this includes $0 awards as well as de-obligations. In fact, 8,840 companies had net de-obligations, with Selene Finance LP and Carrington Mortgage Services seeing de-obligations totalling $1.1B and $743M, respectively.

First Timers

As we examine the pool of companies that work with federal agencies, it is also important to look at the companies that are winning contracts for the first time. These could include joint ventures or companies that are subsidiaries of other companies. In FY25, $11.78B was awarded to 10,340 first-timers.

| FY21 | FY22 | FY23 | FY24 | FY25 | |

| No. of Companies | 12,118 | 10,972 | 11,874 | 11,925 | 10,340 |

| $ obligated in Billions | $ 9.67 | $ 12.38 | $ 7.62 | $ 8.51 | $ 11.78 |

Over a five-year period, we have seen the number of first-timers decrease by 15%, from 12,118 in FY21 to 10,340 in FY25.

Summary

FY25 federal contracting reached a historic high of $833.8B, underscoring that overall federal spend remains resilient despite changes in policies, FAR rewrites, executive orders, and DOGE. Growth was driven primarily by defense agencies, continued concentration among a smaller pool of awardees, and sustained reliance on major contract vehicles, OTAs, and innovation programs such as SBIR/STTR. At the same time, the data also highlights important counter-trends: fewer companies winning contracts, notable declines across several civilian agencies, increasing concentration among the largest primes, and a shrinking pool of first-time entrants.

For the industry, success in FY26 and beyond will depend on understanding where agency growth is occurring, aligning to the right vehicles and acquisition strategies, and using data to focus resources on the most relevant customers, categories, and partners. In addition, companies will need to ensure that they remain aware of policy changes, and if defense agencies are a focus, that they have their CMMC certifications in place.

In FY26, the importance of data-driven planning cannot be understated, along with ongoing compliance, as companies position themselves to compete effectively in today’s marketplace.