Tracking federal contract cancellations is a key part of understanding how new administrations reshape government spending. As policy priorities shift, so do procurement strategies—often leading to increased contract terminations and stop work orders. This blog marks the second analysis in a recurring series where we will update and review federal contract cancellations every few weeks, comparing trends across administrations using data from Fedmine, GovSpend’s federal solution. By examining terminations for convenience and stop work orders, we aim to provide a clear, data-driven perspective on how each administration approaches federal contract management.

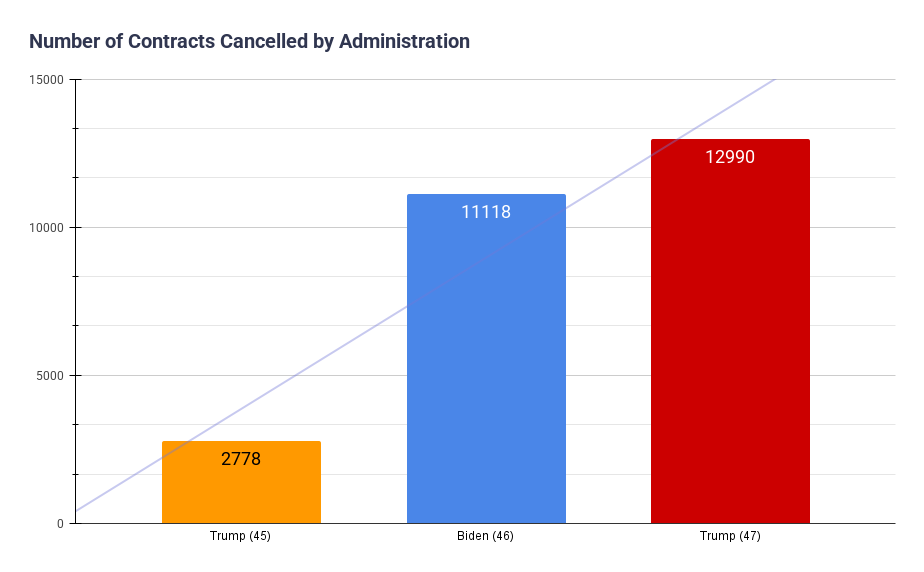

In part one of this blog series, we analyzed contract cancellations during the first seven weeks of the Trump (45), Biden (46), and Trump (47) administrations. Using publicly available federal procurement data via the Fedmine platform, we identified early trends in how each administration handled federal contract terminations during their first weeks in office. In this update, we check in after thirteen weeks to examine any changes in trends.

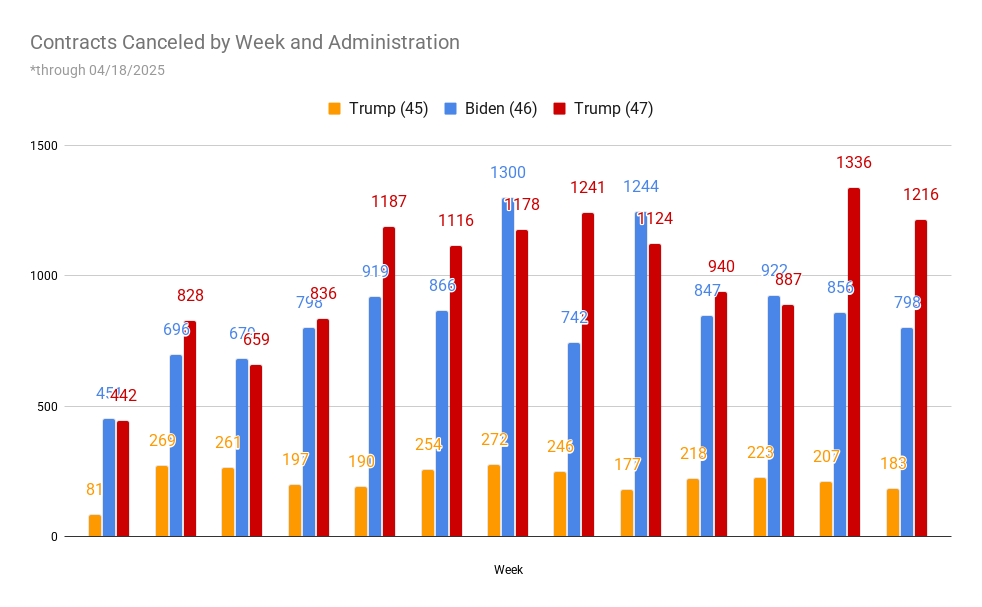

Weekly Trends: Trump (47) Surges Ahead

The contract cancellation patterns we observed in the initial weeks of each administration have largely held steady. However, while Biden (46) maintained a consistent rate of around 800 cancellations per week, Trump’s second administration (47) surged in weeks 12 and 13.

Total cancellation trends held steady, with the second Trump (47) administration increasing its slight lead over the Biden (46) administration, suggesting a sustained focus on contract review and termination during the early months of the Trump (47) administration.

A Deeper Look by NAICS Code

Analyzing cancellations by NAICS (North American Industry Classification System) code reveals that all three administrations canceled contracts in multiple manufacturing NAICS sectors. However, each administration’s top cancellation category came from a different sector: Trump (45) focused on Petroleum Refineries (324110), Biden (46) canceled the most contracts in the Hardware Stores sector (444130), and Trump (47) led with cancellations in Administrative Management and General Management Consulting Services (541611).

The charts below show the breakdown of cancellations in the top five NAICS sectors of each administration:

| Top 5 NAICS by Administration | Contracts Canceled |

| Trump (45) | 701 |

| 324110 – Petroleum Refineries | 337 |

| 336413 – Other Aircraft Parts and Auxiliary Equipment Manufacturing | 155 |

| 339113 – Surgical Appliance and Supplies Manufacturing | 99 |

| 339112 – Surgical and Medical Instrument Manufacturing | 62 |

| 334412 – Bare Printed Circuit Board Manufacturing | 48 |

| Biden (46) | 3,914 |

| 444130 – Hardware Stores | 1,692 |

| 332510 – Hardware Manufacturing | 735 |

| 325611 – Soap and Other Detergent Manufacturing | 567 |

| 339940 – Office Supplies (except Paper) Manufacturing | 480 |

| 337214 – Office Furniture (except Wood) Manufacturing | 440 |

| Trump (47) | 4,732 |

| 541611 – Administrative Management and General Management Consulting Services | 1,558 |

| 332216 – Saw Blade and Handtool Manufacturing | 1,281 |

| 444110 – Home Centers | 871 |

| 423710 – Hardware Merchant Wholesalers | 542 |

| 339940 – Office Supplies (except Paper) Manufacturing | 480 |

| Grand Total | 9,347 |

These differences reflect unique policy directions and agency focus areas under each administration, impacting both the types of businesses involved and the sectors at risk of de-obligation.

What This Means for Contractors

Contract terminations—particularly those involving set-asides, simplified acquisitions, and small businesses—can significantly reshape the competitive landscape. Understanding these trends isn’t just helpful for historical analysis—it’s critical for anticipating where future risks and opportunities lie.

By using GovSpend and Fedmine’s powerful search, classification, and tracking capabilities, contractors and suppliers can monitor terminations in real time, analyze patterns by NAICS, agency, or solicitation method, and pivot their business development strategies accordingly. Whether you’re watching how policy shifts are unfolding or identifying new entry points into the public sector, the GovSpend products offer the insight you need to stay informed and proactive.

In our next post, we’ll take a closer look at the top classification and sectors of each administration’s canceled contracts.

Stay tuned for updates every few weeks as we track these evolving trends across administrations using data from Fedmine.