As another federal government shutdown looms, the impact on states—and by extension the SLED market—remains a critical concern.

Here we are once again, slouching toward another federal government shutdown—potentially the fifth since 2010. This time, the Republican congressional majority has put forward routine continuing resolutions (CRs), which have stalled under the Senate’s 60-vote cloture requirement. The Democratic minority, for its part, is seeking redress for cuts made in H.R. 1, the “One Big Beautiful Bill Act (OBBBA).”

Adding to the uncertainty, the Office of Management and Budget (OMB) has withdrawn from public view all agency shutdown contingency plans, making it more difficult to assess federal preparedness.

Historical Precedents: Understanding the Federal Government Shutdown Impact on States

Recent history offers some perspective. The shutdowns of 2013 (16 days) and 2018–19 (34 days) highlighted the likely impacts on the state, local, and education (SLED) market.

The National Association of State Budget Officers (NASBO) is the most reliable source on this. In 2011, as a shutdown loomed but ultimately didn’t happen, NASBO downplayed the risks:

- A short-term shutdown of a couple of weeks would be inconvenient but not damaging.

- A multi-month shutdown, however, could cause major funding challenges for state-run programs dependent on federal dollars and for state employees whose salaries are partly federally funded.

By 2013, NASBO’s warnings were sharper. They raised concerns about states potentially furloughing workers, implementing hiring freezes, and facing cash flow crises as they covered federal welfare programs like TANF and WIC.

State Reserves as a Buffer

Historically, state “rainy day” fund balances have been the best indicator of resilience. Between 2000 and 2020, reserves averaged 5.4% of total general fund expenditures. But COVID-era savings and a strong economic rebound swelled reserves to an all-time high of 14.1% in 2024.

According to NASBO’s State Rainy Day Fund Balances Historical Dataset, reserves are expected to ease to 11.8% by 2026—still strong compared to historical norms.

NASBO’s most recent review of FY2026 enacted budgets reveals that:

“States based their enacted budgets on revenue forecasts that largely project slow growth in revenue for a fourth consecutive year. In a number of states, revenue forecasts were revised downward… as states were contending with economic and federal uncertainty.”

Political Pressure and Shutdown Odds

As of now, a shutdown on October 1 appears increasingly likely. The White House has warned of mass layoffs at agencies that furloughed workers during past shutdowns. Congressional Democrats are resisting those threats.

Interestingly, Senate Minority Leader Chuck Schumer (D-NY) strongly opposed “the chaos of a shutdown” earlier this year in March. Will he stick to that stance, or shift in the current standoff? And how will Republicans in swing districts react if a prolonged closure takes hold?

What SLED Vendors Should Expect

For SLED vendors, the near-term outlook is cautiously optimistic:

- Manageable shutdowns (weeks to a month or two): Most states have reserves strong enough to weather the disruption without major fallout.

- Prolonged shutdowns (multiple months): States could face furloughs, program delays, and pressure to cover critical federal programs.

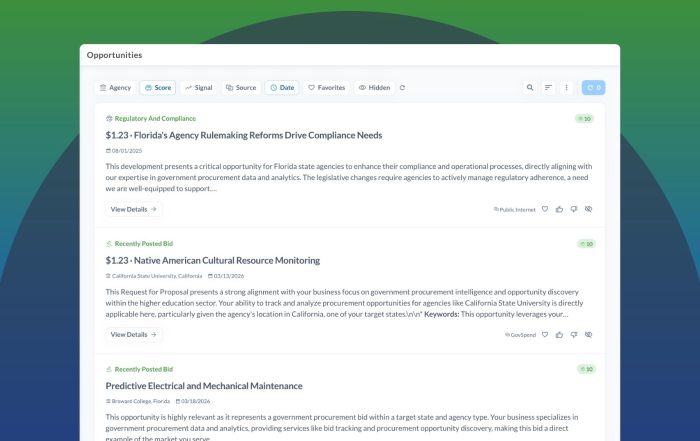

GovSpend will closely monitor leading indicators—particularly whether bids are being delayed or withdrawn. Meanwhile, Meeting Intelligence will deliver real-time insights into how shutdown impacts and contingency plans are shaping agency operations across the SLED landscape.

Stay Ahead of Shutdown Impacts

Uncertainty does not have to leave your organization guessing. GovSpend’s data delivers real-time visibility into procurement activity, agency responses, and contingency plans.

Request a demo today to see how GovSpend can help you stay ahead of shutdown impacts and maintain strong connections with your SLED customers.