On January 25th, FEV Tutor, a prominent online tutoring platform, announced its cessation of operations. This unexpected move, which has been linked to the expiration of ARPA funds, leaves a void in the online tutoring market, presenting a unique opportunity for other educational service providers to step up and fill the gap. With the right B2G intelligence, competitors can capitalize on this changed competitive landscape and position themselves as the go-to solution for schools and districts in need of quality virtual tutoring.

Understanding the Impact of FEV Tutor’s Exit

FEV Tutor was a major player in the online tutoring space, providing services to schools and districts, as well as government-funded educational programs. Their closure creates an immediate demand for alternative tutoring solutions to ensure students continue to receive academic support.

Schools and districts are now tasked with quickly finding reliable partners to replace FEV Tutor, and they’re likely to prioritize companies that can demonstrate quality, scalability, and an understanding of their specific needs. Timing is critical here: being proactive can make the difference between seizing new business opportunities and missing out.

Utilizing GovSpend Data to Gain an Edge

GovSpend is a powerful platform that provides access to purchasing data from government entities, including school districts and public education programs. By analyzing this data, online tutoring companies can gain valuable insight by uncovering existing contracts and purchases, and identifying incumbent vendors, painting a clear picture of the market and competitive landcape.. Here are a few examples of how vendors are using GovSpend to capitalize on FEV Tutor’s shutdown:

1. Identify Districts Previously Partnered with FEV Tutor

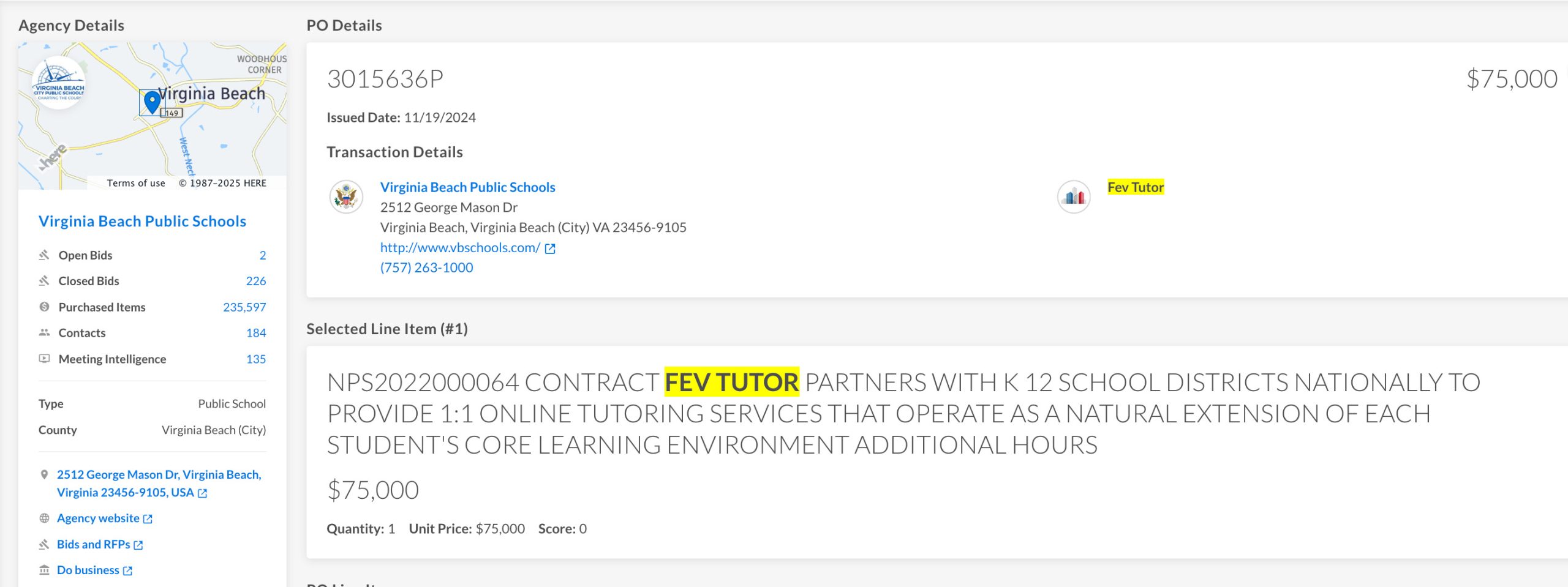

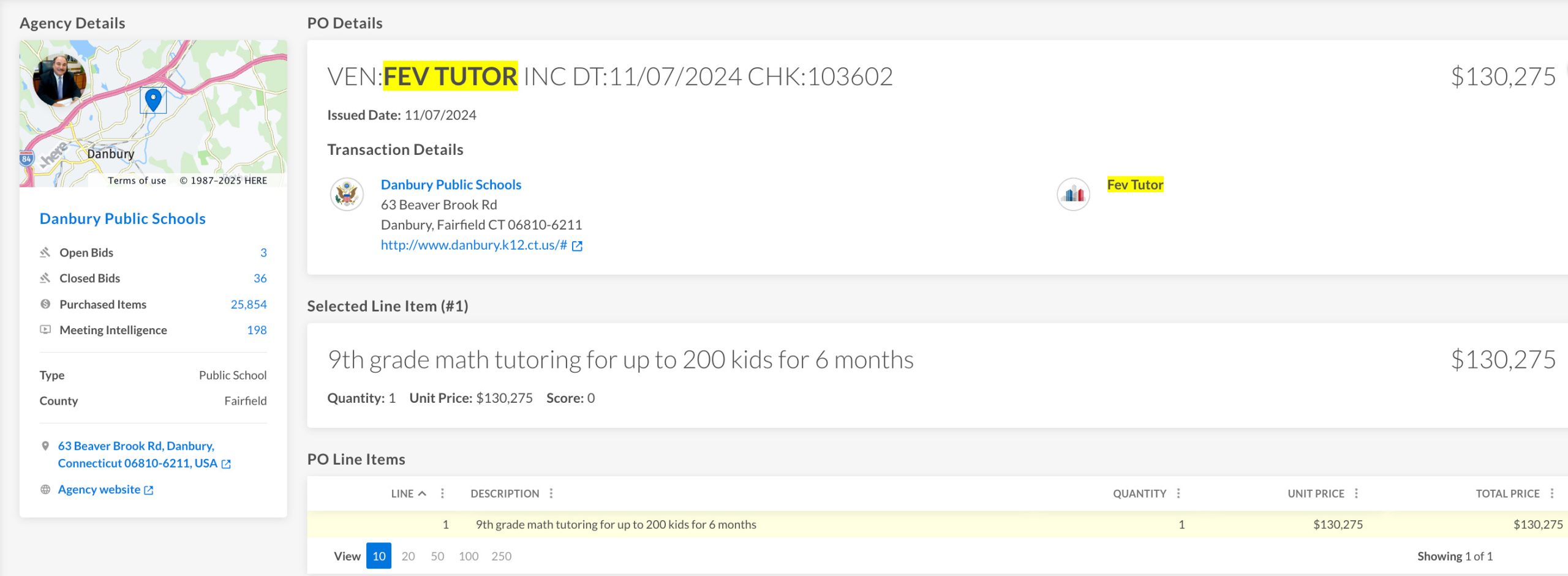

GovSpend’s Purchase Order and Contracts database can reveal which districts had contracts with FEV Tutor, their budgets for tutoring services, and the scope of previous agreements. According to GovSpend data, 68 government agencies spent over $27m with FEV Tutor over the last 36 months. Some of the most recent purchases include:

-

- Virginia Beach Public Schools (VA) signed a $75,000 contract with FEV Tutor on November 19, 2024

- On November 7, 2024, Longview Independent School District (TX) signed a contract for FEV tutoring services for $85,000.

- Danbury Public Schools (CT) entered into a 6 month, $130,000+ contract with FEV Tutoring on November 7, 2024

- On October 11, 2024, Redfordord Union Schools (MI) purchased an FEV Tutor subscription for $171,000+.

These insights allow companies to target outreach efforts to districts already accustomed to allocating funds for virtual tutoring, giving them a head start in offering tailored solutions.

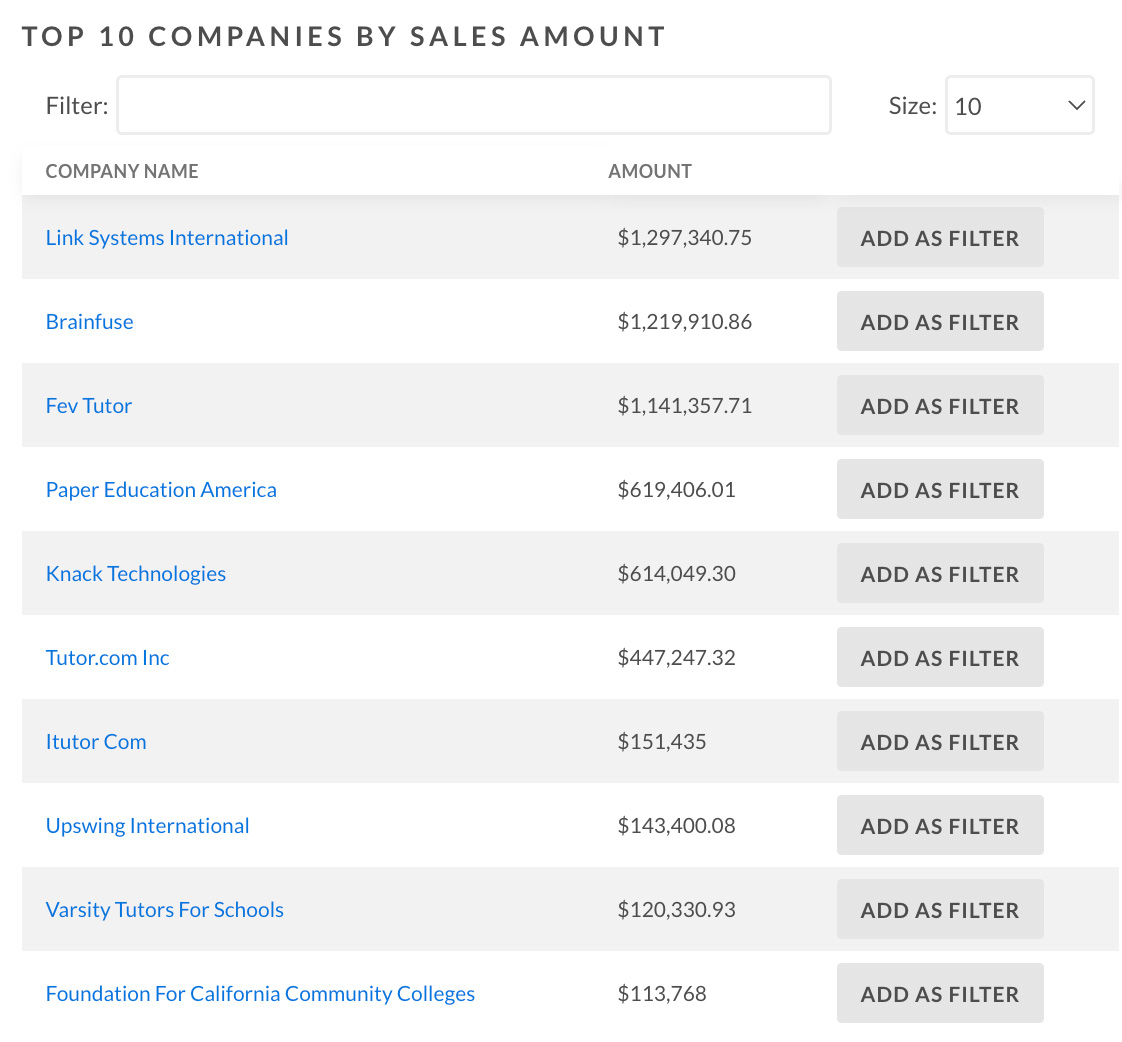

2. Understand Competitor Activity

By reviewing public procurement data, tutoring companies can analyze the competitive landscape, understand which other companies may be competing for FEV Tutor’s business, and identify gaps where their own services could be positioned as a better fit. For example, according to GovSpend data, the top 5 companies who sold the most in online tutoring services to government agencies in 2024 were Link Systems International ($1.29M+), Brainfuse ($1.19M+), FEV Tutor ($1.14M+), Paper Education ($619K+), and Knack Technologies ($589K+).

Diving further into the data, Link Systems International and Knack Technologies primarily did business with colleges and universities, whereas Brainfuse, FEV Tutor, and Paper Education primarily sold to K-12 schools and districts. While Link Systems International and Knack Technologies are major players in the online tutoring space, their primary market is not the same as FEV Tutor’s, and therefore they may not be as big of a competitor for their prior business as Brainfuse or Paper Education may be.

3. Tailor Proposals and Pricing

GovSpend’s insights into past purchasing decisions allow companies to craft proposals that align with district budgets and needs. Whether it’s a competitive pricing strategy or emphasizing unique features like adaptive learning tools or multilingual support, data-driven pitches can make all the difference. POs in GovSpend show that Charles County Public Schools (MD) and Killeen ISD (TX) had both signed large contracts with FEV Tutor in 2024 at $27/session. Companies that are able to meet or beat this pricing can position themselves to seamlessly step in to fill the gap left by FEV Tutor, ensuring minimal disruption to students’ learning.

Conclusion

The closure of FEV Tutor is a pivotal moment for the online tutoring industry, leaving many school districts and universities surprised and scrambling to find replacements in the middle of the school year. For companies willing to act quickly and strategically, there’s an opportunity to capture market share and build lasting relationships with schools and districts. By leveraging tools like GovSpend to guide their approach, online tutoring companies can position themselves as indispensable partners in education, ensuring students get the support they need to succeed.

Interested in learning more about what competitive insights GovSpend can provide for your industry? Request a personalized demo to see our data in action.