With the passage of the “One Big Beautiful Bill” (H.R. 1) in July, the White House laid the groundwork for significant changes to the nation’s mass transit efforts. The American Public Transportation Association (APTA) called the President’s budget request a “historic investment in public transit and passenger rail.”1 However, it’s the new affordable housing tax incentives that are expected to spur organic mass transit development across the nation.

Overall, Federal Transit Administration (FTA) funding for the federal fiscal year (FFY) 2026 grows by $300 million to $21.25 billion. When it comes to the largest flexible funds, formula grants for urbanized ($7.0 billion) and rural ($960 million) areas remain in place, along with transit infrastructure grants ($2 billion). The administration also continues $3.8 billion worth of Capital Investment Grants (CIG) for 18 major projects starting or expected to start in FFY 2026.2

Where the administration looks to put a long-term stamp on urban mass transit is affordable housing. According to the U.S. Conference of Mayors, urban redevelopment (as has been seen with the Los Angeles Metro system) is a major driver of public transit upgrades and expansions.3 H.R. 1 provides significantly increased Low Income Housing Tax Credit (LIHTC) provisions that the Affordable Housing Tax Credit Coalition calls “historic and represent the biggest step forward in addressing our affordable housing crisis.”4

Previous administrations had focused on seeding a limited number of Transit-Oriented Development (TOD) projects. This administration is looking to spur organic development nationwide via tax incentives and streamlined permitting. Vendors should consider every urban rail transit (URT) and bus rapid transit (BRT) system to be in play as these incentives permeate the market.

The U.S. Department of Transportation (DOT) indicated its early priorities with nearly $500 billion in discretionary “BUILD” grants. Approximately 10% of that total was dedicated to transit projects, with DOT Secretary Duffy declaring this round of funding to be “just the beginning.”5

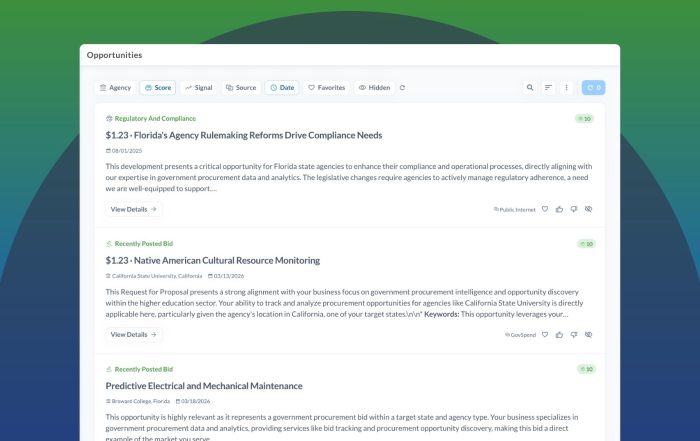

GovSpend’s Meeting Intelligence finds nearly 3,000 local government agencies that have been investing in TOD since the middle of 2004. Forward Pinellas (FL), the county planning organization, recently had an extensive discussion about the return on investment (ROI) for DOT. These discussions are the best lead indicators for future solicitations.

While it’s safe to assume that the federal government shutdown stymied bid activity in this area, spending should resume, potentially at an accelerated pace, as agencies attempt to make up for lost time or to get funds obligated before another shutdown looms.

Over the 12 months preceding the shutdown, 51 agencies issued 90 bids for mass transit-related planning and ongoing consulting support. These types of solicitations indicate imminent system upgrades and expansions. The City of Phoenix closed a bid for technical support to “assist City staff in carrying out tasks identified in the ReinventPHX and 19 North Policy Plans.”

Spending data over the same period finds more than 900,000 purchase orders from transit agencies totaling more than $20 billion. These include major facilities and infrastructure builds, outsourced transit services, and a wide range of day-to-day goods and services, such as vehicle maintenance and parts.

Since 2000, surface mass transit systems have grown extensively, but dipped in recent years. Vendors should be optimistic that recent policy changes will continue the rebound that began under the previous administration. GovSpend provides the data trail to help vendors find emerging transit projects and to capture the resulting bids and spending.

- https://www.apta.com/news-publications/press-releases/releases/apta-statement-on-president-trumps-fy-2026-budget-request-for-public-transit-and-passenger-rail/

- https://www.transportation.gov/mission/budget/fiscal-year-2026-budget-highlights

- https://localinfrastructure.org/resources/explainer-guide/how-the-one-big-beautiful-bill-act-could-affect-local-infrastructure-projects/

- https://www.housingfinance.com/policy-legislation/house-passes-sweeping-bill-with-lihtc-provisions/

- https://www.transportation.gov/briefing-room/president-trumps-transportation-secretary-sean-p-duffy-announces-nearly-500-million