For many businesses in the federal marketplace, the GSA Schedule has long been a mystery—sometimes seen as a golden ticket, other times as a bureaucratic headache.

In a recent GovSpend webinar, GSA Schedules: The New Marketing Tool with More Muscle, Jennifer Schaus, a veteran consultant with more than twenty years of federal contracting experience, helped demystify what these schedules really mean and how companies can approach them strategically.

Why GSA Schedules Matter Now

While GSA Schedules have never represented the majority of federal spend, they carry real weight. In fiscal year 2024, they accounted for about seven percent of the government’s $774 billion in purchases. When you add in GSA-managed contract vehicles like Alliant II and OASIS, the share rises to roughly ten percent. Those numbers may sound small in percentage terms, but they represent tens of billions of dollars.

Recent executive orders are only increasing GSA’s influence. New policies are pushing agencies to consolidate contracts, simplify procurement, and rely more heavily on GSA as the government’s central buying hub. In other words, while the GSA slice of the pie may have looked thin in past years, it’s poised to grow.

The Truth About GSA Schedules

One of Schaus’s central messages was that a GSA Schedule is not a guaranteed source of revenue. It is, at its core, a marketing tool. Having a Schedule can make it easier for agencies to buy from you, but it doesn’t replace the need for relationships, business development, and competitive pricing. Companies that assume a Schedule will automatically lead to sales often end up disappointed.

Schaus compared the open marketplace of SAM.gov to Little League—anyone can play, but the competition varies widely. The GSA Schedule, by contrast, is the big leagues. Everyone on it has already been vetted, pricing is closely aligned, and competition is tougher. Without strong past performance, relationships inside agencies, and a clear pipeline of opportunities, a Schedule alone won’t get you far.

What It Takes to Get On

Applying for a GSA Schedule involves more than checking a few boxes. Contractors must prepare three core sections:

- Administrative: corporate documents, financial statements, and compliance records.

- Technical: past performance narratives, project examples, and quality control plans.

- Pricing: detailed rate proposals, supporting invoices, and a strategy for price escalation.

Pricing is often the toughest hurdle. GSA expects to be your lowest-priced customer, and once you’re on the Schedule, you may be asked to discount further in order to win task orders.

The process also involves navigating regular “refreshes” to the solicitation, which update requirements and forms. Staying compliant means keeping pace with those changes, even after being awarded. In addition, contractors must meet minimum sales thresholds—$100,000 in the first five years and $125,000 in each five-year period thereafter—to keep their contract active.

The Rise of TDR

Another shift underway is the move toward Transactional Data Reporting (TDR). Instead of requiring vendors to identify their “most favored customer,” GSA now asks for detailed sales data across 16 categories. While TDR removes some administrative burdens, it also increases oversight and transparency. Nearly all Special Item Numbers (SINs) now fall under this system.

Should You Pursue a GSA Schedule?

Not every business should. Before investing time and resources, Schaus urged companies to start with market research by answering a few critical questions:

- Do your target agencies actually buy your product or service through the Schedule?

- Are your competitors there, and if so, how do their prices compare to yours?

- Do you already have relationships and a pipeline of opportunities that could flow through a Schedule?

If the answer to any of these is “no,” it makes sense to wait. Without data to support the investment, a Schedule can become a costly distraction.

For those not ready to manage the demands of holding a Schedule themselves, subcontracting to larger firms that already have one is a practical way to enter the market. GSA eLibrary makes it easy to identify potential partners and even compare their pricing.

A Strategic Decision

The webinar’s key takeaway was that a GSA Schedule is not a starting point, but a tool to accelerate a well-prepared strategy. It works best for companies with healthy financials, competitive pricing, established relationships, and a plan for compliance.

“You wouldn’t jump into a swimming pool without knowing there’s water in it,” Schaus reminded attendees. The same is true here: before you leap, make sure there’s enough opportunity waiting for you.

Ready to Take the Next Step?

If you’re considering whether a GSA Schedule is right for your business—or if you want expert guidance on how to leverage it more effectively—connect directly with our webinar experts.

- Contact Jennifer Schaus for consulting, training, and resources on federal contracting at JenniferSchaus.com.

- Reach out to Archisha Mehan at FedConsult if you’d like to continue the conversation from a data perspective or explore market intelligence strategies.

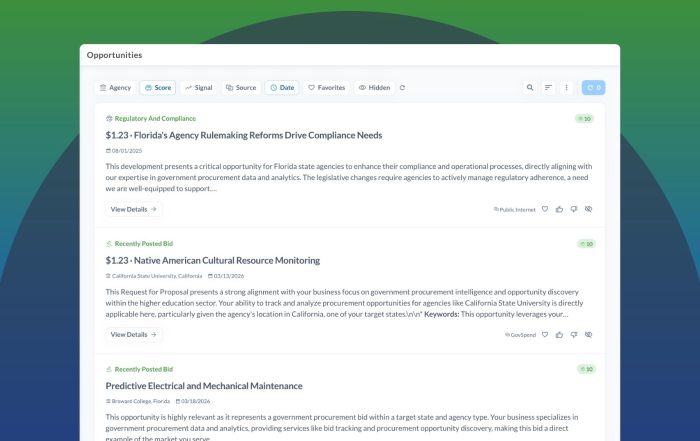

And if you’re serious about using data to guide your contracting strategy, don’t guess—see the numbers for yourself. Request a personalized GovSpend demo to explore how agencies are buying, who your competitors are, and where the best opportunities lie.