Subcontracting is a foundational component of the federal acquisition ecosystem, yet it is often misunderstood or underutilized as a source of market intelligence. Beyond enabling contract performance, subcontracting activity leaves behind a rich data trail that can help companies better understand agency demand, prime contractor behavior, and competitive dynamics across the federal marketplace.

The FAR (44.101) defines a Subcontract as, “any contract as defined in subpart 2.1 entered into by a subcontractor to furnish supplies or services for performance of a prime contract or a subcontract. It includes but is not limited to purchase orders, and changes and modifications to purchase orders.”With more than $700B awarded as prime federal contracts in FY25, subcontracting is an effective strategy to not only enter the federal market, but also expand within the federal marketplace. For established companies, it is often used to meet socio-economic goals and expand capabilities. For new entrants, subcontracting offers a way to gain past performance, learn the nuances of federal procurement, and build agency relationships.

Understanding where this activity occurs—and how it is reported—provides valuable context for companies looking to make informed, data-driven decisions about where and how to compete.Companies that have a subcontract reporting requirement typically input the information into the Electronic Subcontracting Reporting System (eSRS.gov). Agencies then use this data for tracking and additional reporting. This site is expected to be transitioned into sam.gov in 2026. In addition, both prime contractors and subcontractors previously had to report their subcontract data into FSRA, or the FFATA Subaward Reporting System, which fed the data into USASpending.gov. This site has now transitioned to sam.gov.

Overview of Subcontracts Awarded

Because subcontracting data is self-reported, it should be interpreted with caution, and broad trends can be difficult to validate. Reported subcontract values have fluctuated significantly, ranging from approximately $348B in FY21 to $77.8B in FY25.

| Fiscal Year | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 |

| Grand Total | $348.58B | $186.00B | $127.38B | $39722.27B | $77.81B | $0.60B |

Note: GovSpend does not modify data it receives from its sources, even if there are discrepancies in the data reported. A possible error in a transaction reported by L3Harris Interstate Electronics Corp for a subcontract to CPI Satcom & Antenna Technologies Inc during FY24 has likely inflated the subcontracts reported for this period by a substantial amount.

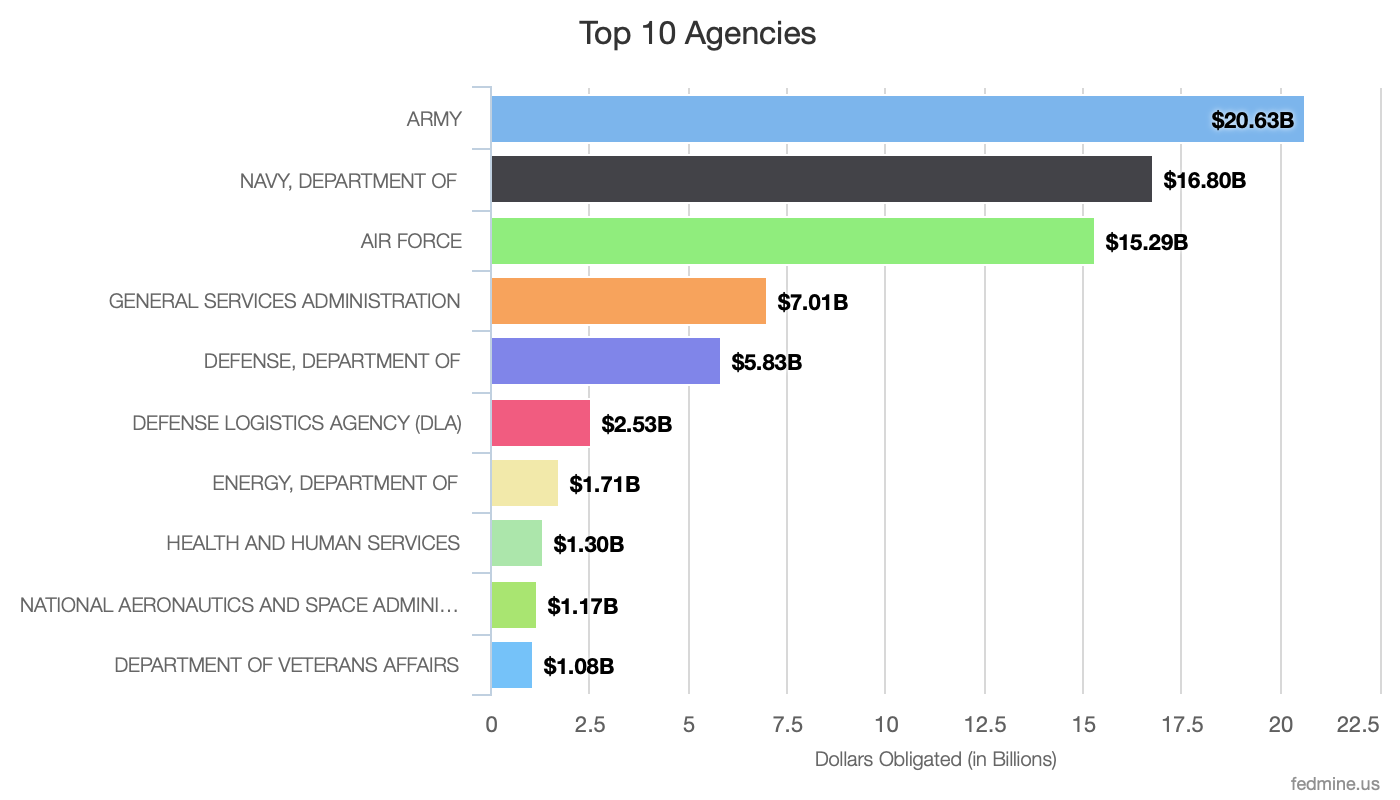

In FY25, $77.8B was awarded by 1,466 primes to 20,376 subcontractors. The Department of the Army led all agencies in subcontracting activity, followed by the Navy, Air Force, and the General Services Administration.

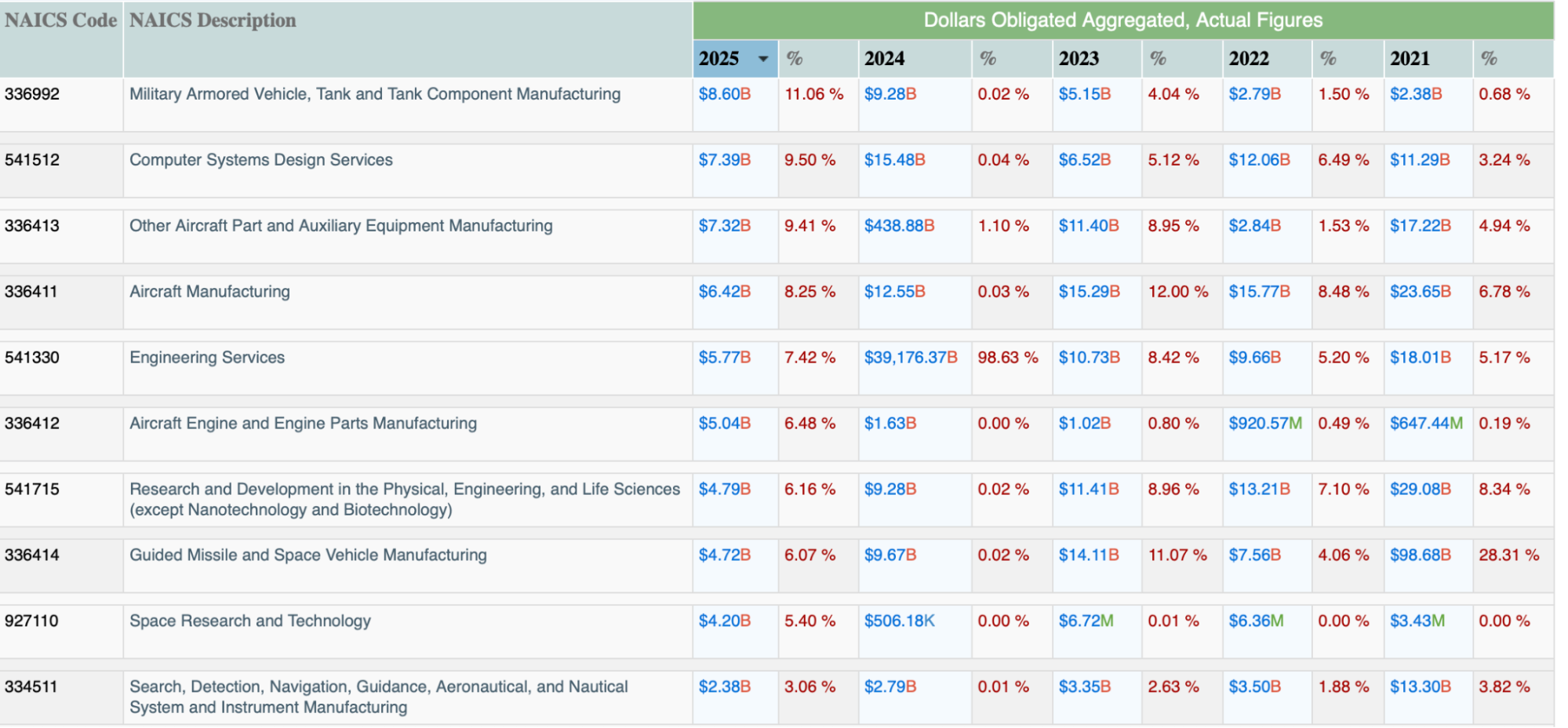

From an industry perspective, the top prime NAICS codes for which subcontracts were awarded include Military Armored Vehicle Manufacturing, accounting for 11% of the reported subcontracts, followed by Computer Systems Design and related services. Aircraft manufacturing NAICS codes also appear within the top ten industries.

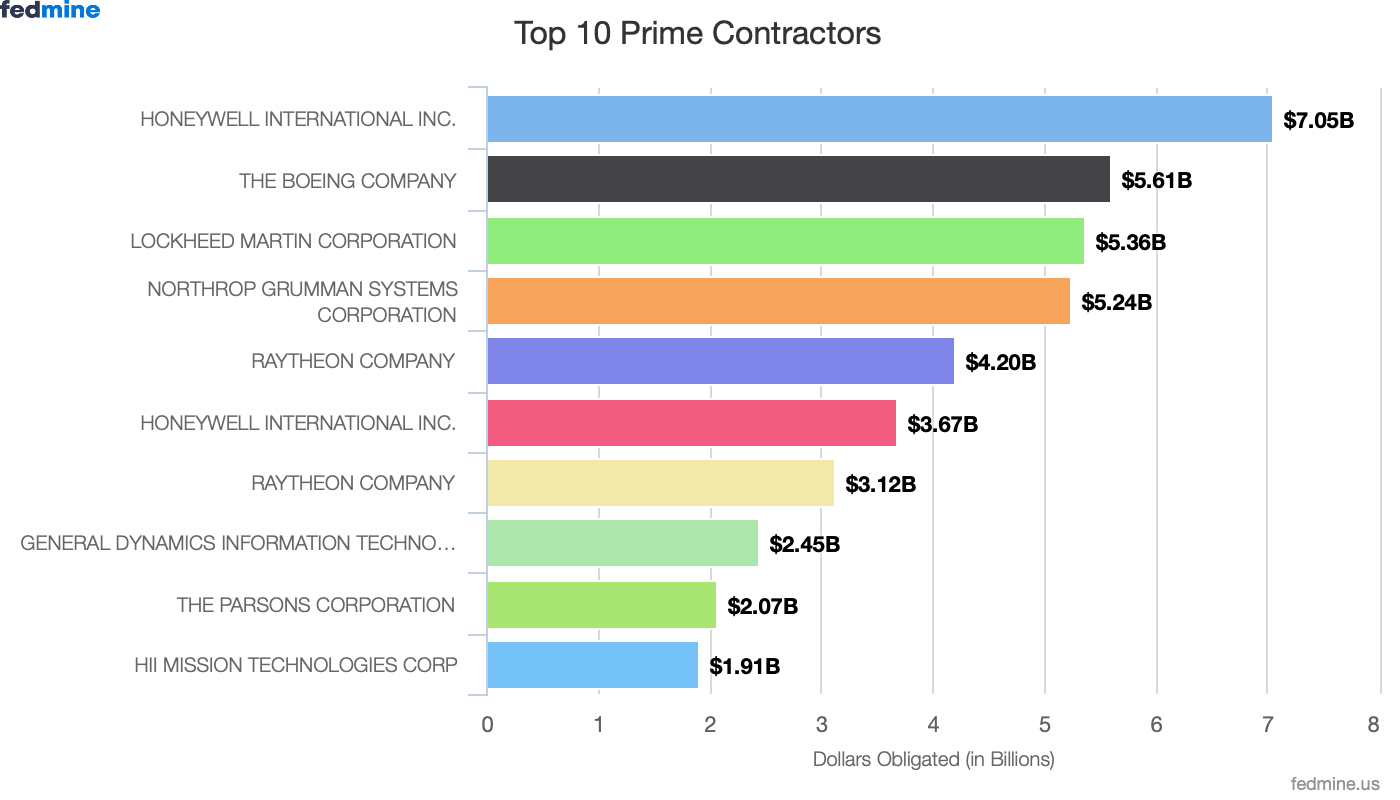

Among prime contractors, large defense and industrial firms dominate the subcontracting landscape, with companies such as Honeywell, Boeing, and Lockheed Martin consistently ranking within the top ten primes reporting subcontract awards.

Of course, the results will change as we add filters such as keywords, GWACs, or even place of performance. GovSpend’s federal solution, Fedmine, actually integrates the prime and subcontract data to provide an easy view of all the reported subcontracts on an award.

So, how do we strategically use the subcontract data that is available to either enter or expand into the federal marketplace?

- Identify the agency that you want to focus on and use the subcontract data available to understand the subcontracting activity and trends within that agency. This includes reviewing the prime contracts in your line of work that have a subcontracting requirement. The contract detail information from FPDS.gov provides details on whether a subcontract plan is required. This allows the company to create potential relationships with the prime contractor.

- Use the data to understand the prime contractors that might be a good fit for the products and services you want to provide to the agency. This includes not only understanding the prime contractor’s existing contracts at an agency, but also the various relationships it might have with other companies. Pay attention to the scope of the prime/sub work, pricing, expiration dates, socioeconomic categories, and contract vehicles used. Does the prime have any existing Joint Ventures or Mentor-Protege agreements in place?

- Analyze the subcontractors that are working at an agency. This includes understanding what products or services are provided to a prime contractor and the value of each subcontract. What other companies are they working with? Do they have any prime contracts in place, or are they focused on subcontracts?

When used strategically, subcontracting data can be a valuable source of federal market intelligence, despite its limitations. By looking beyond topline numbers to understand agencies, primes, vehicles, and pricing, companies can identify real opportunities and build smarter teaming strategies. No matter if firms are entering the market or expanding within it, those that treat subcontract data as an ongoing planning tool—rather than a static report—are better positioned for long-term success in the federal marketplace.

In Conclusion

Despite limitations with subcontract intelligence, it is an important data set that provides insights into subcontracting activity and, when integrated with prime contract data, vital information for companies. Used effectively, it helps identify potential agencies to work with, assess which prime contractors are the best strategic partners, and identify the existing prime-sub relationships. Additionally, the data provides insights into the competitive landscape, including contract values at the prime and subcontract levels, enabling informed and strategic decision-making. As federal data systems continue to evolve and become more integrated, companies that develop discipline around using subcontract intelligence today will be better prepared to adapt and compete tomorrow.