The recent reductions-in-force at the Office of Special Education Programs (OSEP) within the U.S. Department of Education have left many educators, families, and administrators uncertain about the future of special education oversight. For the professionals who’ve dedicated their careers to supporting students with disabilities, this change isn’t just structural; it’s deeply personal.

At the same time, the FY 2026 budget request reshapes key programs under the Individuals with Disabilities Education Act (IDEA), signaling a fundamental shift in how and where special education funding decisions will be made. For vendors serving the state and local education (SLED) market, the challenge now is to understand what these changes mean on the ground and how to support schools and agencies working to maintain services for students who need them most.

The End of Big, Predictable Federal Grants

For years, large federal special education grants provided a dependable backbone—visible, broadly predictable, and easy to track. That predictability is eroding.

The administration’s FY 2026 request proposes $14.891 billion for IDEA Grants to States (ages 3–21) and holds $540 million for infants and toddlers (Part C), while consolidating Preschool Grants and several “National Activities” into the same bucket (Department of Education Budget Summary). The result: fewer standalone federal awards, less transparency around funding cycles, and more reliance on states and local education agencies (LEAs) to carry out the same critical work with limited resources.

The Shift to States and Districts

IDEA envisioned the federal government covering up to 40 percent of excess special education costs; in practice, the FY 2026 request implies a federal share closer to ~11 percent (ED FY 2026 Justification). As the federal role contracts, the fiscal and operational weight increasingly shifts to states and districts, and by extension, to the educators and administrators responsible for implementing these programs in classrooms every day.

For vendors, this means the opportunity now lives where those decisions are actually made: state agencies, regional service centers, and district business offices. However, it also means success depends on understanding the pressures these local teams face, and helping them navigate the uncertainty that comes with reduced federal support.

What This Means for Vendors

Adapting to this environment is about precision; seeing real spend, timing outreach to local cycles, and aligning to outcomes. Three realities stand out:

- Visibility matters. With fewer big federal signals, you need district-level purchase orders, contracts, and budget insight to spot demand early and understand who is being impacted.

- Compliance drives purchasing. Tools that help LEAs meet IDEA obligations—accessibility, reporting, and student support—will be essential as educators strive to do more with less.

- Relationships are local again. Procurement now hinges on state and district priorities, relationships, and community impact; not just compliance or cost.

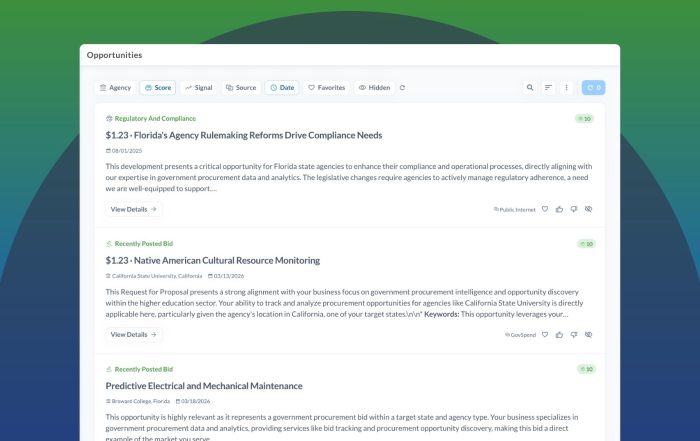

How GovSpend Helps Vendors Stay Ahead

When top-down guidance fades, bottom-up market intelligence becomes decisive. GovSpend gives vendors a window into what’s already happening on the ground — from special education funding discussions captured in school board meeting minutes to purchases and open bids for student support software, accessibility tools, and compliance services.

Across the GovSpend platform, you can already see districts debating how to allocate IDEA dollars, state agencies issuing new RFPs for special education services, and vendors winning contracts to fill emerging gaps. Examples include:

- Ware County Schools (GA) purchased an annual subscription for autism curriculum software on October 8th, for $5,516.50.

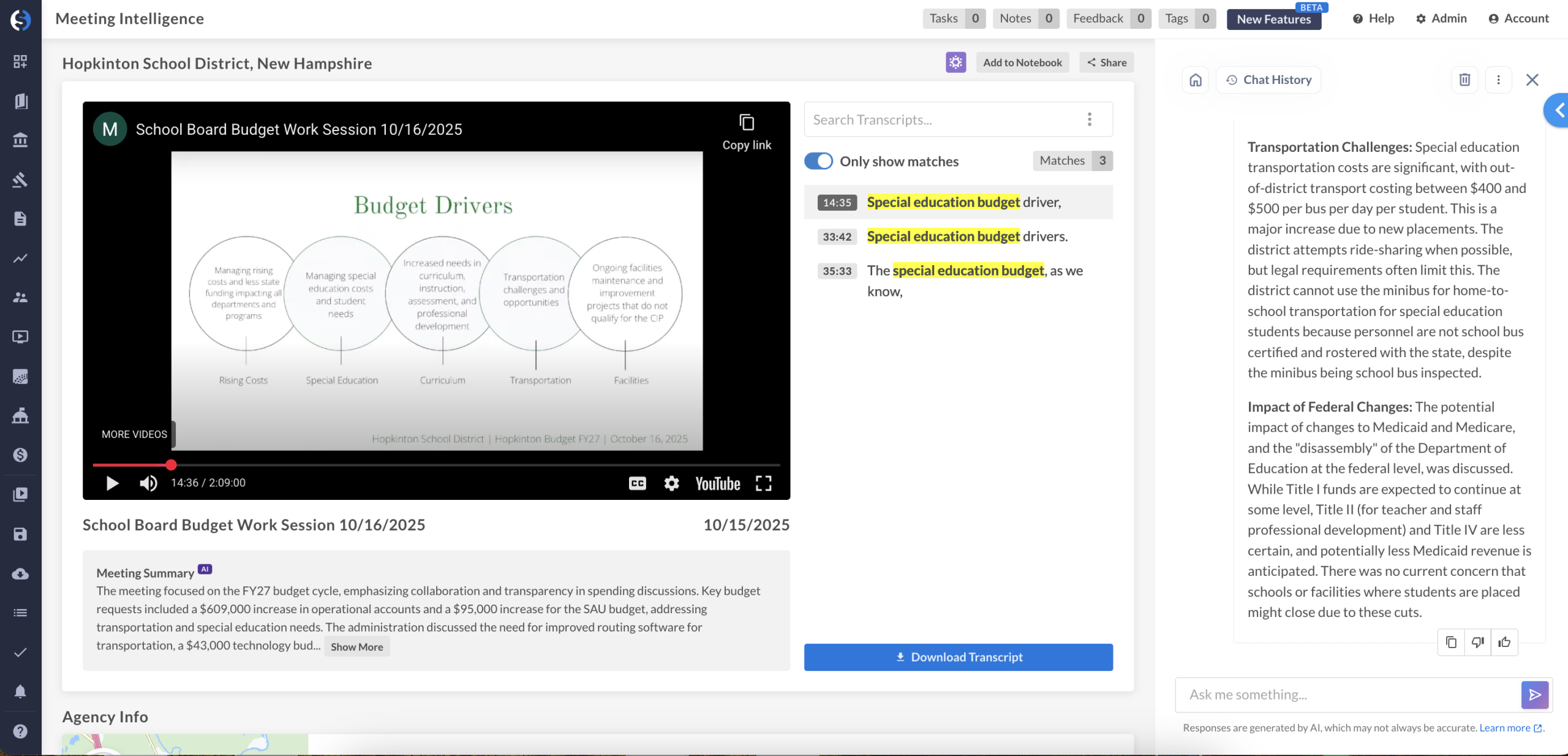

- Hopkinton School District (NH) met on October 15th to discuss the FY27 budget cycle, including a $95,000 increase for the SAU budget to address transportation and special education needs.

- Burbank Unified School District (CA) passed an amendment on October 19th that increased Special Education’s budgeted amount by $150,000.

- On October 21st, Middletown Public Schools (CT) discussed sourcing funding for special education to fill gaps caused by federal funding cuts.

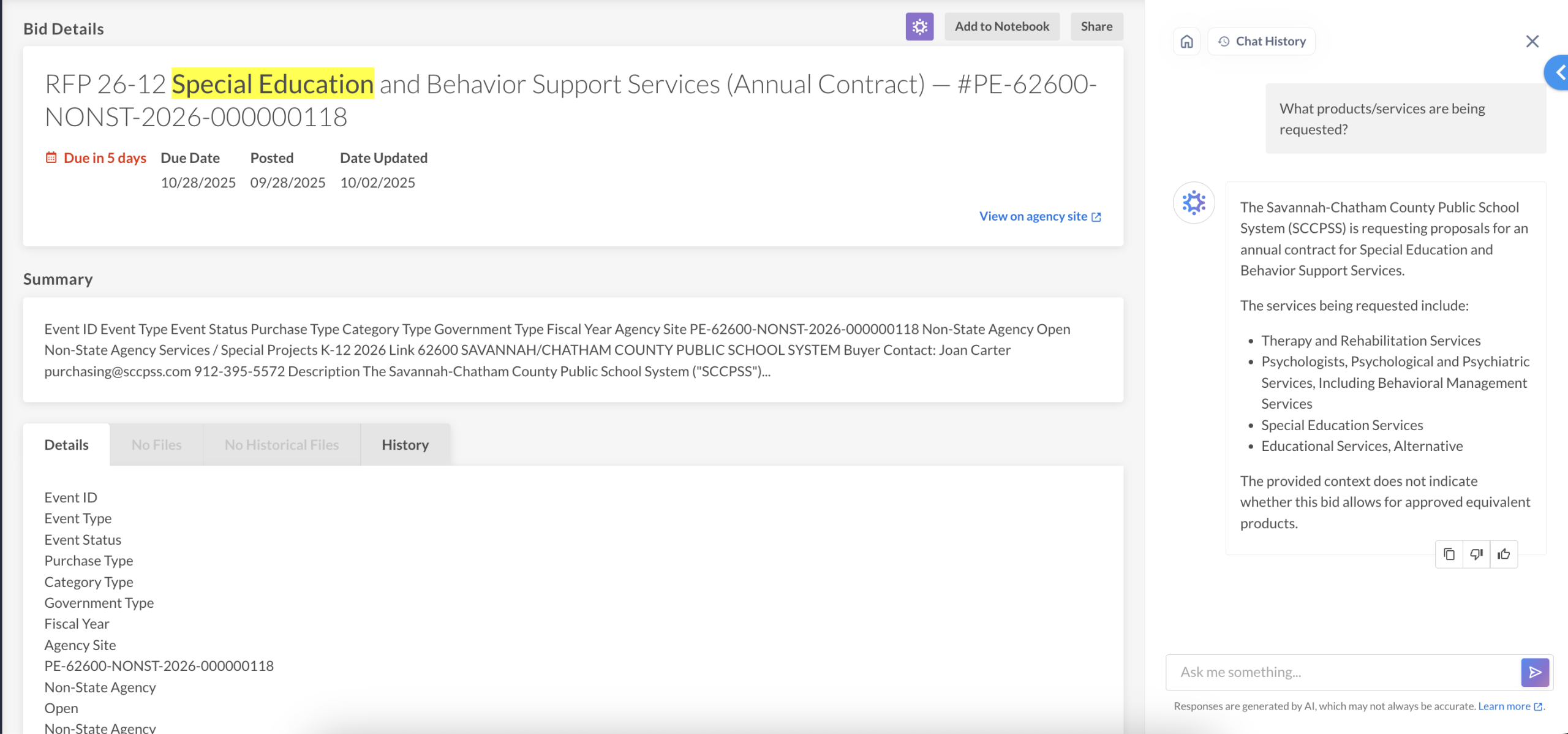

- The Savannah-Chatham County Public School System (GA) is requesting proposals for an annual contract for Special Education and Behavior Support Services, due on October 28th.

- The Kentucky School for the Deaf (KY) is seeking qualified individuals or companies to provide Occupational Therapy services to deaf and hard-of-hearing students with Individual Education Plans (IEP), due on November 12th.

- The Education Service Center (ESC) Region 10 (TX) has an open bid for special education software to enhance the educational experience for students with disabilities, due on November 14th.

- Baltimore City Public Schools (MD) has a contract for remote interpreting services that is expiring on December 13th and is not up for renewal.

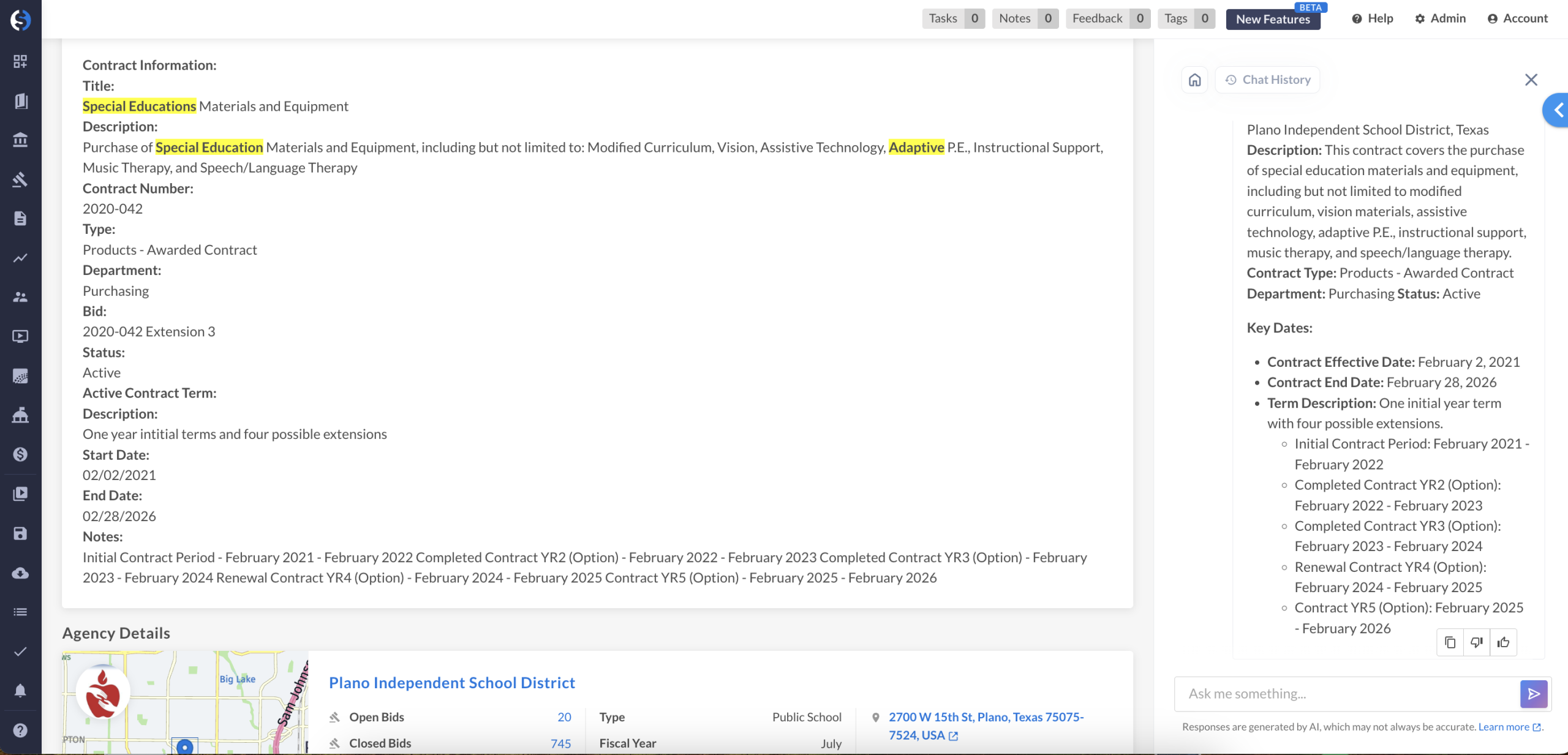

- Plano ISD (TX) has a contract for special education materials and equipment, including but not limited to modified curriculum, vision materials, assistive technology, adaptive P.E., instructional support, music therapy, and speech/language therapy, that expires on February 28, 2026, and is not up for renewal.

By tracking these data points over time, from initial discussions to final purchase orders, vendors gain a real-time understanding of how priorities and funding flows are shifting.

The Bottom Line

The shake-up at OSEP and the restructuring of IDEA funding are more than bureaucratic developments; they affect the people and programs at the heart of special education. Federal programs may be consolidating, but the need for specialized tools, services, and support remains as urgent as ever.

For SLED vendors, the moment calls for both strategy and awareness: the ability to follow the data while understanding the realities educators face on the ground. GovSpend connects the dots between board agendas, open bids, purchase orders, and vendor activity, turning fragmented public information into actionable insight. With this visibility, SLED vendors can identify where opportunities are forming, anticipate demand, and engage with the right agencies at the right moment, helping local education leaders stay focused on what matters most: serving students.

Explore how GovSpend helps vendors uncover special education opportunities across state and local markets. Request a demo today.